5G can't be the future if it doesn't survive the present...

5G can't be the future if it doesn't survive the present...

This wireless technology is positioned to change the Internet for the better. It can deliver higher data speeds with super low latency, better reliability, improved network capacity, stronger availability, and a more uniform user experience.

But building out these systems nationwide isn't cheap.

Across the U.S., the biggest providers have already spent more than $120 billion on the 5G network. Verizon and AT&T are two of the biggest spenders. But they're not alone...

One of the next-biggest investors in the 5G blitz spent massively to keep up with the major players. Now, all that spending is coming home to roost.

Today, we'll look at how this TV provider poured billions of dollars into 5G... and totally lost the market's faith in the process.

No earnings... significant debt maturities... and a potential disaster...

No earnings... significant debt maturities... and a potential disaster...

Dish Network (DISH) has been on a massive 5G shopping spree for almost a decade. Since 2014, the satellite TV company has spent nearly $34 billion buying up 5G spectrum.

Its goal is to break into the wireless business to offset its shrinking TV business. And it needs a part of the 5G spectrum to be able to operate.

When T-Mobile announced its merger with Sprint back in 2019, Dish bought tons of its spectrum. Here's the issue, though... Buying spectrum doesn't magically turn into revenue and earnings.

The 5G rollout has been slow. Dish in particular is trying to pry customers away from established wireless providers. And that has investors spooked.

Dish has almost $15 billion in distressed debt. Investors are starting to get very concerned about it.

It doesn't help that the company's domineering chairman, Charlie Ergen, has been telling analysts that the markets are effectively closed to the business.

Dish's 2029 bonds have fallen to a fraction of their face value. They're trading at $0.42 on the dollar.

You can't save a company with no available credit...

You can't save a company with no available credit...

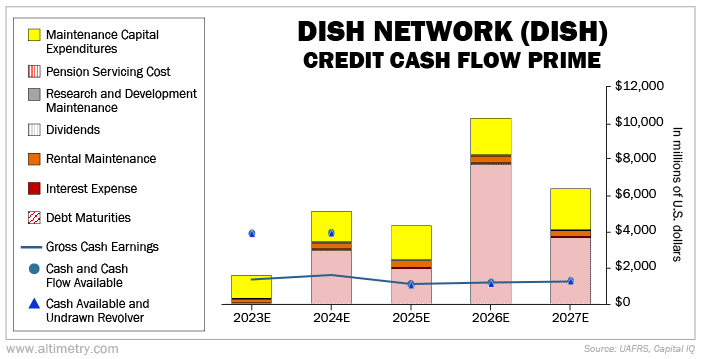

Without credit, it has no way to grow and sustain the business. So to check the status of Dish's upcoming maturities, we turn to our Credit Cash Flow Prime ("CCFP") analysis.

The CCFP compares companies' financial obligations against their cash positions and expected cash earnings. We can use it to model Dish's credit risk.

In the following chart, the stacked bars represent Dish's obligations through 2027. This is what it needs to pay in order to keep the lights on... to prevent the company from collapsing.

We compare these obligations with cash flow (the blue line) and the cash on hand at the beginning of each period (the blue dots).

Take a look...

A quick look at our CCFP analysis shows Dish has debt maturities coming due every year for the next five years... and not nearly enough cash flows to cover all its obligations unless it can refinance its debt.

While cash on hand should help it navigate 2023, that's just delaying the inevitable. It's still on the hook for all that debt...

In short, the picture looks bleak for Dish. But there's one factor that investors have failed to consider. It's Dish's saving grace.

That 5G spectrum is worth its weight in gold...

That 5G spectrum is worth its weight in gold...

Chairman Ergen thinks the only way the company will be able to get the necessary additional capital is to post new assets as collateral. And fortunately, Dish happens to own quite a collection...

As we mentioned, it has $34 billion in U.S. Federal Communications Commission ("FCC") licenses for 5G spectrum. It has another $3 billion in intangible assets from before the 5G kick.

Even though Dish has a ton of debt coming due, it might not be destined for bankruptcy. We need to consider the value of those 5G licenses.

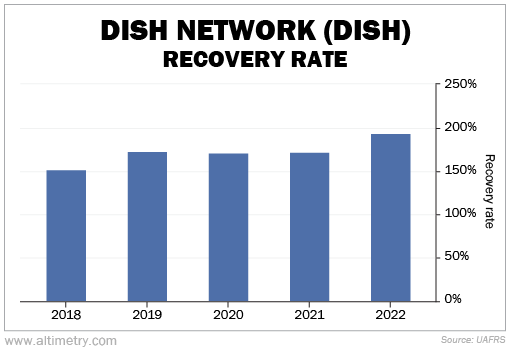

We can look at Dish's recovery rate for some clues. The recovery rate represents how much a company's assets – even distressed assets – back the credit. And it indicates the company's ability to pay back debt by liquidating those assets.

Thanks to the strong value of its assets, the recovery rate on Dish's credit is nearly 200%. Take a look...

There's very little risk that bondholders won't recover their principal if Dish defaults. Its assets are worth nearly twice as much as its debt obligations.

The company could post those assets as collateral for secured loans. This could buy it more time to work on its business. It could even allow Dish to refinance its near-term debt.

Dish's asset backing is strong. For credit investors, some of these bonds could be a good opportunity at a steep discount... even if things don't work out for the business.

Regards,

Rob Spivey

June 1, 2023

5G can't be the future if it doesn't survive the present...

5G can't be the future if it doesn't survive the present...