Luxury brands can be a major cash cow...

Luxury brands can be a major cash cow...

No company makes that clearer than LVMH. In the May 14 Altimetry Daily Authority, we discussed how successful the luxury conglomerate model can be.

While LVMH was formed from a merger between Louis Vuitton and Moët Hennessy, it has since expanded its portfolio to include many of the world's premier alcohol and fashion brands. The company has also expanded to other luxury markets like jewelry – it's in the process of acquiring Tiffany (TIF) – and perfume.

It should go without saying that LVMH mints money, which is why companies like Tapestry (TPR) are trying to emulate its business model.

Though Tapestry has stayed within its legacy fashion business, acquiring brands like Coach and Kate Spade, it failed to enter one of the most profitable slices of LVMH's strategy – alcohol. As we said last month, Tapestry's board fired its CEO in the midst of implementing the strategy to emulate LVMH... potentially missing an opportunity to build an American response to the Paris-based conglomerate.

You see, LVMH doesn't just consist of Moët Hennessy's namesake assets... It also owns a number of other alcohol powerhouses like Krug, Belvedere, Chopin, Ardbeg, and Glenmorangie.

Outside of beer, LVMH's alcohol portfolio is both diverse and highly desirable. The company dominates the high-end wine, champagne, and spirit market... and this has led to great returns.

Today, let's take a look at a company that's building a similarly diverse alcohol portfolio... but it's not focused on the high-end market.

Instead, Constellation Brands (STZ) has built a collection of popular, high-performance brands across beer, wine, and spirits.

Constellation started out as a bulk wine distributor until it decided to follow the LVMH strategy beginning around the turn of this century.

Since then, it has acquired a number of low- and mid-end brands – including Corona, Modelo, and craft giant Ballast Point within beer... Kim Crawford, Ruffino, and Ravenswood wines... and Svedka, High West, and Nelson's Green Brier spirit brands.

If you're familiar with the brands, you'll notice Constellation's portfolio targets a much wider audience than the likes of LVMH. Between Corona and Ballast Point alone, Constellation's portfolio appeals to the vast majority of beer drinkers.

However, it doesn't look like the company's massive investments into affordable brands have paid off...

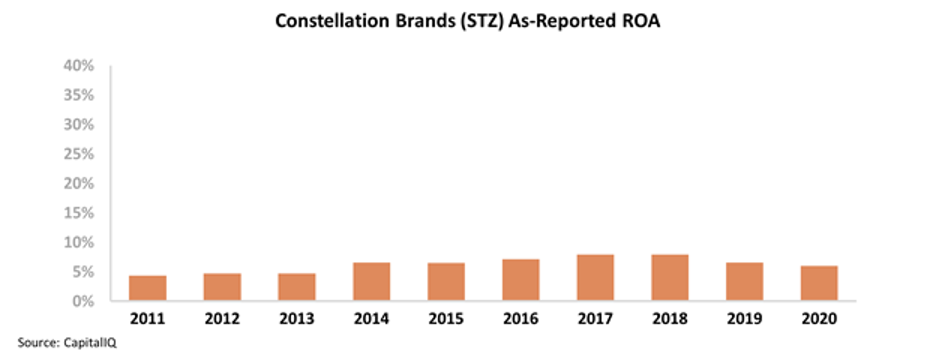

In 2013, Constellation made a massive bet buying U.S. distribution rights to the Corona and Modelo brands. Since then, the company's as-reported return on assets ("ROA") has been underwhelming and largely stagnant.

Constellation's ROA peaked at 8% in 2018, and it has fallen back to long-term average 6% levels this year.

Unlike Tapestry, Constellation has maintained its management team despite these weak returns. The company is still part-owned by the founding Sands family, who support management's long-term strategy.

With returns like this, it appears that selling affordable products – even to a much larger audience of consumers – isn't the same as dominating the high-end space like LVMH.

That said, Constellation's as-reported profitability tells you more about arbitrary accounting rules than it does about the company's actual returns...

In reality, Constellation has followed LVMH's playbook to a tee... and it's evident in the company's returns in recent years.

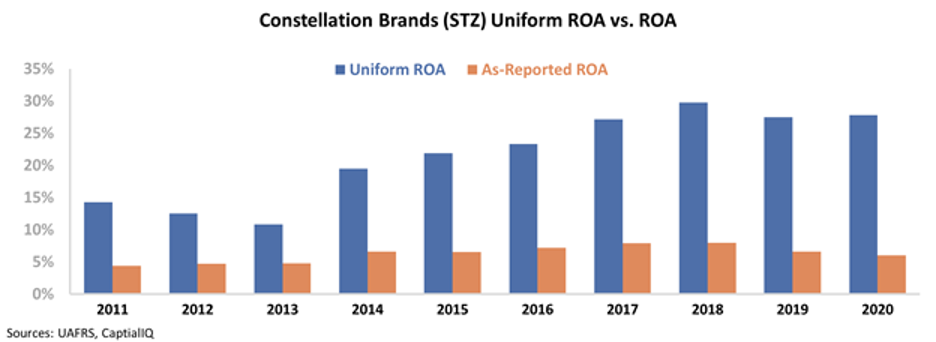

Once we apply our Uniform Accounting metrics – which adjust for misleading and arbitrary accounting standards like the effect of goodwill, non-operating investments, and one-time special items – the power of selling affordable products is clear.

Since 2013, Constellation's Uniform ROA has consistently expanded on the back of its U.S. distribution rights deal for its Mexican beer assets. After bottoming out at 11% in 2013, the company's Uniform ROA reached a peak of 30% in 2018 and has remained around 27% to 28%.

Clearly, Constellation's board and the Sands family are doing the right thing by letting the management team continue down this path.

Though Constellation targets a completely different end market than LVMH, the same strategy has led to similar profitability. Looking at as-reported metrics alone, you might get the wrong idea... and completely miss out on a massively profitable company.

Citigroup's (C) CEO may be having a 'Marissa Mayer moment'... and it sounds even more tone deaf this time around.

Citigroup's (C) CEO may be having a 'Marissa Mayer moment'... and it sounds even more tone deaf this time around.

As we've highlighted repeatedly here at Altimetry Daily Authority, the "At-Home Revolution" is accelerating due to the coronavirus pandemic.

More and more people are working from home... playing at home... supplying themselves at home... and are spending more to protect their homes.

The pandemic has let the proverbial "toothpaste out of the tube," especially when it comes to companies allowing employees to work remotely. People were finding they could be just as productive at home... and sometimes preferred working from home to travelling into the office each day.

Businesses can no longer point to risks of working from home – such as reduced collaboration and productivity – because workers have proved that these aren't an issue. As a result, it's going to be hard for employers to "put the toothpaste back in the tube" and take away working from home as an option for their employees.

Many businesses have come to understand this, and have even supported it. In the world of finance, big names such as JPMorgan Chase (JPM), Morgan Stanley (MS), Bank of New York Mellon (BK), and Synchrony Financial (SYF) have announced that they'll have employees working from home for a longer period of time... and for some, this change will be permanent.

But Citigroup CEO Michael Corbat has been doing his best to resist the inevitable. As Bloomberg reported last week, Citi's Hong Kong and Taiwan offices are already operating at 50% and 75% of capacity, respectively... and Corbat has expressed his goal for getting everyone back into the office.

This is reminiscent of Marissa Mayer's stance once she took over at Yahoo in 2013, insisting that employees come back to the office. It didn't eventually make any difference for Yahoo's returns, employee collaboration, or productivity... and the business was much the same by the time it was pulled apart a few years later.

And Corbat's goal is unlikely to revolutionize Citi's competitive positioning, either. If anything, it will hold back the company's ability to reduce costs and improve its return on equity towards peer levels. Citi will have to continue spending on the office space its staff is using, while other competitors will be able to grow more lean and boost returns.

Every revolution always has reactionary responses from those who want to hold onto the status quo, and it looks like the At-Home Revolution is no exception.

But the companies that adapt and take advantage of these big societal shifts will be major winners in the months and years ahead.

In our Altimetry's Hidden Alpha newsletter, we've identified these businesses poised for big gains in the wake of the coronavirus pandemic. We already have twelve new ideas targeted at profiting from this massive change the world is seeing. Some of these are names you're unlikely to hear about anywhere else.

To learn more about our analysis on the At-Home Revolution and Hidden Alpha – and gain access to the full list of recommendations – click here.

Regards,

Rob Spivey

June 4, 2020

Luxury brands can be a major cash cow...

Luxury brands can be a major cash cow...