The 'Big Bath' is coming... and no one is talking about it.

The 'Big Bath' is coming... and no one is talking about it.

A few weeks ago, we shared an essay Joel wrote in Forbes that warns of a coming earnings apocalypse: the "Big Bath."

This isn't a new phenomenon. When management teams are going to disappoint on earnings, the smart ones don't just give bad news... they give really bad news.

To make earnings worse, these management teams find every piece of bad information, goodwill write-off, and restructuring charge they can, and then take those charges when they know their results are going to be weak.

It's something of a "fundamental capitulation."

As the bad news emerges – especially when it's widespread, like it'll be in the second quarter this year in the wake of the coronavirus – it can cause investors to panic.

But as Joel said, investors should be patient, and tactically use it as a buying opportunity. In essence, it's the management teams tacitly acknowledging that things have gotten to their worst.

Right now, we're not even in earnings season... but we're already starting to see the Big Bath show up.

Just last week, oil major BP (BP) announced $17.5 billion in impairment charges and write-offs for the second quarter. The company will be marking down its assets and building cookie-jar reserves to use to reduce expenses in the future... And it won't be the only corporation to do so.

This is a clear sign of the Big Bath. Stay tuned to future issues of Altimetry Daily Authority... We'll keep you updated as we see more companies join in on the trend as we head into the second-quarter reporting season.

Two companies 'own' the digital advertising market...

Two companies 'own' the digital advertising market...

For as long as most people can remember, two giant tech firms have dominated the digital ad space: social media giant Facebook (FB) and Google's parent company Alphabet (GOOGL).

Alphabet is an obvious one... its flagship Google website singlehandedly controls more than 16% of all web traffic. Not only that, Google owns more than 90% of the total search market – meaning those ad dollars have a high chance of connecting to users.

Facebook is no slouch, either... Its namesake web platform accounts for another 6.5% of all web traffic.

Neither of these figures factor in mobile app usage, nor do they include all the ways Facebook and Alphabet control digital advertising.

Both firms have employed a similar technique to maintain their spots at the top – it's called "acqui-hiring."

This is simply a portmanteau of "acquisition" and "hiring," and it means Facebook and Google acquire companies to bring highly talented developers and engineers onto their platform so that they can't compete with the mothership.

It's a strategy to preserve market share – any time one of the two giants finds a viable competitor, it buys that company out and brings on the employees.

Alphabet notably did this with firms like DoubleClick and YouTube, while Facebook acquired the likes of Instagram and WhatsApp.

When you start considering the advertising power of platforms like YouTube and Instagram, it's easy to see how the two giants have maintained their power.

That said, after years of massive success, regulators finally began catching on to the strategy.

While acqui-hiring isn't illegal, you've probably heard arguments that these large tech firms may be violating antitrust laws with their market dominance. In recent years, both companies have had to become more careful about this strategy – at this point, any more significant acquisitions could be the final straw in an antitrust case.

If it weren't for regulators breaking up the fun, it's hard to believe Alphabet wouldn't have been targeting The Trade Desk (TTD) in recent years.

Much like Google's full suite of advertising products and tools, The Trade Desk offers customers a cloud-based, self-driven solution to create data-powered ad campaigns.

And if there's a company with plenty of user data, it's Alphabet.

The overlaps don't end there... The Trade Desk's programmatic buying software works the same way YouTube and Instagram know which ads to show users.

The Trade Desk is a direct competitor to the "Big Two"... and the company knows it.

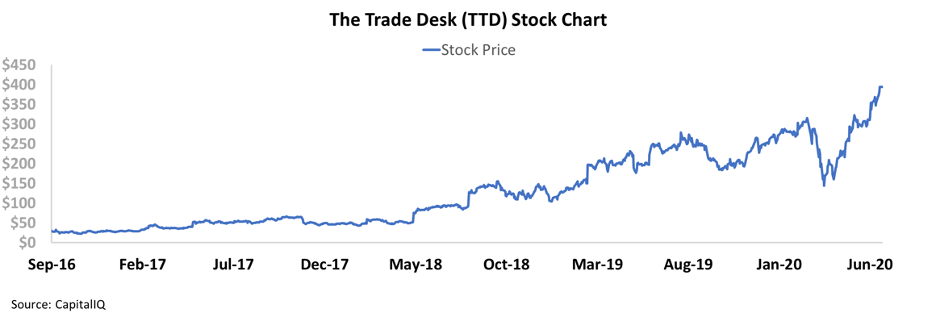

Since going public in 2016, The Trade Desk has been one of the fastest-growing companies in the country... and its stock has been on a tear. In just shy of five years, TTD shares have jumped from $30 to roughly $400. That's a more than 1,200% return.

But despite The Trade Desk's growth and stock success, perhaps Alphabet made the right call by leaving the company alone...

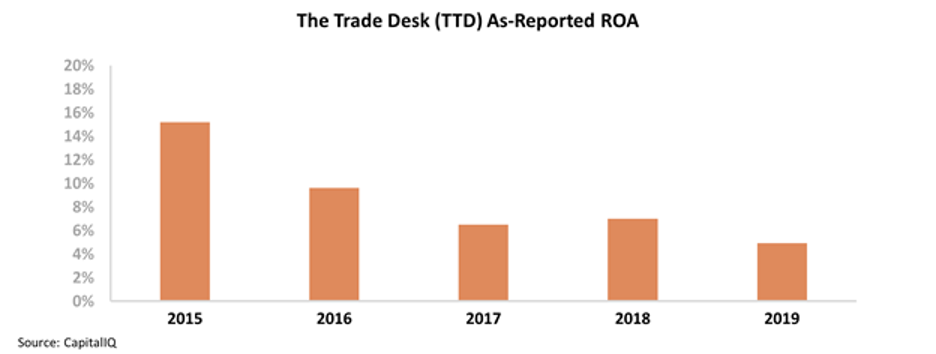

Over the past five years, The Trade Desk's profitability has taken a massive hit. The company had a 15% return on assets ("ROA") in 2015, and this has declined in each year since to just 5% in 2019 – less than long-term corporate averages.

At these levels, it looks like Alphabet and Facebook might not need to acqui-hire to prevent competition – their scale might be enough to take out any competition naturally.

That said, the Big Two might have more to worry about than the as-reported metrics suggest...

Once we apply our Uniform Accounting metrics – which adjust for items like non-cash stock option expenses, research and development (R&D) spending, and excess cash – we can see that The Trade Desk is much more profitable than it looks.

And these discrepancies can make a huge difference for young tech companies.

Looking at Uniform returns and asset growth, The Trade Desk's Uniform ROA improved from a low of 23% in 2015 to peak 40% levels in 2018, before fading slightly to 31% last year. Meanwhile, the company has grown by an average of 96% over the past five years.

A company growing that fast with such strong returns is a clear threat to the Big Two digital advertisers. Uniform Accounting shows the reality... and Alphabet probably regrets not buying The Trade Desk before it grew to a $18 billion valuation.

Looking at the as-reported metrics alone, it might be tough to understand why The Trade Desk is one of the best-performing stocks of the past five years... But when using Uniform Accounting metrics, we can see the real story.

Regards,

Rob Spivey

June 23, 2020

The 'Big Bath' is coming... and no one is talking about it.

The 'Big Bath' is coming... and no one is talking about it.