Intel (INTC) is selling pieces of itself just to keep the lights on...

Intel (INTC) is selling pieces of itself just to keep the lights on...

The company remains one of the largest and most respected U.S. chipmakers. But behind that reputation lies a series of costly missteps over the past several years...

Chipmakers like Nvidia (NVDA) and Advanced Micro Devices (AMD) have specialized in high-demand areas like graphics processing units ("GPUs"). Intel has struggled to decide whether it wants to focus on designing chips or making them.

The company poured billions of dollars – and years of effort – into this dilemma, all without a clear direction.

The U.S. government even promised to loan Intel billions of dollars to build fabs to make chips. But after delays to its projects and Intel lagging industry peers, it's unclear if those plants will ever be profitable.

Today, we'll take a closer look at what's going on with Intel... and why investors should be worried about the company.

Intel's financial troubles run deep...

Intel's financial troubles run deep...

The company sold off a portion of its stake in autonomous-driving technology provider Mobileye last year, after acquiring the business for $15.3 billion in 2017. Reports from Bloomberg state it could consider a similar sale to raise more cash.

Intel has also considered selling its underperforming Network and Edge division. Revenue for this segment dropped nearly 30% in 2023.

These struggles aren't unique to the Network and Edge division, either. Intel's total revenue was down 14% in 2023 and 31% from its 2021 highs.

Mobileye was once seen as Intel's foothold in the future of autonomous driving – a space that promised growth and innovation. So it's concerning that it's being considered as a source of much-needed liquidity.

Healthy companies don't pick apart their crown jewels... unless they're desperate for cash.

Intel has been disappointing investors for some time. The company reported a $1.6 billion net loss in the second quarter. And it suspended its dividend... while slashing its workforce by 15% in an attempt to get back on track.

But those efforts aren't yet bearing fruit. The problems must be severe if it feels the best option is to sell parts of its business.

The numbers tell a grim story for Intel, too...

The numbers tell a grim story for Intel, too...

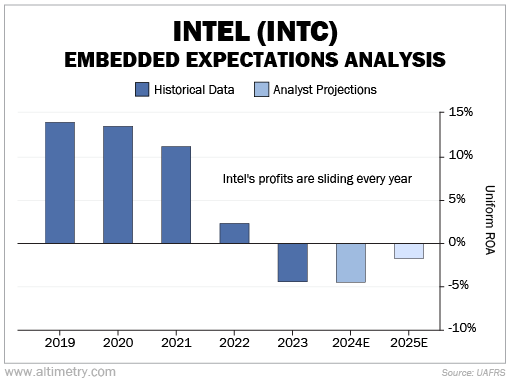

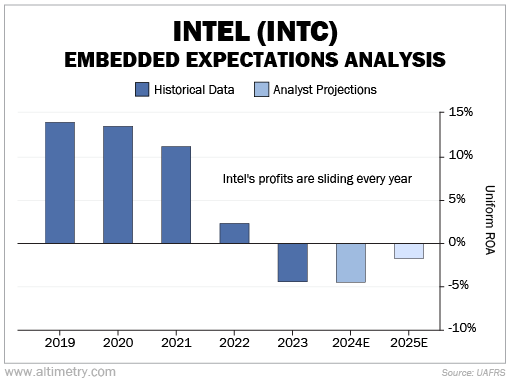

The chipmaker hasn't posted any significant profits since 2021. Uniform return on assets ("ROA") even flipped negative last year...

And as we mentioned earlier, 2024 hasn't been any better for Intel. It's projected to lose money this year, too.

This is a company struggling to regain its footing while burning through cash.

And even though the stock is down significantly – about 55% year to date – we wouldn't call it "cheap." After all, no valuation is low enough for a company that's generating negative returns.

Investors betting on a rebound are paying for hope... not performance.

Many folks expect Intel to eventually right the ship...

Many folks expect Intel to eventually right the ship...

But this chipmaker is deep in a period of transition. There's no clear end in sight.

The company's strategy has been reactive, not proactive. It's selling off assets and cutting costs just to keep up. It should be making moves to drive growth.

Even the U.S. government's substantial support for chipmaking plants isn't enough. Until Intel can regain profitability and start generating positive cash flow, the risks far outweigh the potential rewards.

Regards,

Rob Spivey

October 8, 2024

Intel (INTC) is selling pieces of itself just to keep the lights on...

Intel (INTC) is selling pieces of itself just to keep the lights on...