Many investors focus on big-picture trends when thinking about investments...

Many investors focus on big-picture trends when thinking about investments...

It's a great way to make sure that the "wind is at your back" when investing. If you are investing in a big theme, where market opportunities are growing and cash is flowing, the idea is that your pick will be lifted, too.

As the saying goes, "A rising tide lifts all boats."

But there are times (in the business world) when a rising tide can't lift one of the boats. A rising tide can't lift a company higher when there are ethical issues.

For example, Enron’s market capitalization was around $60 billion in 2000. The firm was viewed as a blue-chip investment, perfect for folks looking to park their savings for retirement.

But in a single year, Enron’s systemic fraud was uncovered. The stock plummeted down to zero. One thing that can bring a huge company down to nothing is a rotten core of fraudulent activity.

To avoid the real portfolio torpedoes that sink rising ships, you need to watch for fraudulent behavior.

Recently, we thought we'd found a compelling microcap sitting in the middle of a big megatrend...

Recently, we thought we'd found a compelling microcap sitting in the middle of a big megatrend...

A cashless society is coming. Even before the coronavirus pandemic struck, estimates predicted the payment processing industry would grow from $1.9 trillion in 2017 to $3 trillion by 2022. That's a 57% increase.

People are abandoning cash for the convenience of credit cards and digital payments.

Half a century ago, you could just use specialty cards to pay for dinner or buy something at a specific store with a dedicated card. Today, you can pretty much pay for anything with a credit card or a few clicks on your phone.

When we spotted Priority Technology (PRTH) last month, we were excited.

With only a $500 million market cap, Priority is the fifth-largest nonbank payment processor in the U.S. The ambitious payment platform company processed $40.3 billion in payments in 2019.

As a late entrant to the industry, it has the advantage of not being tied down with legacy systems.

Priority built its payment processing platform with a cloud-based, automated approach, allowing it to work with fewer people and lower overhead. As a result, it isn't just a company in a great industry... It's also positioning itself to win.

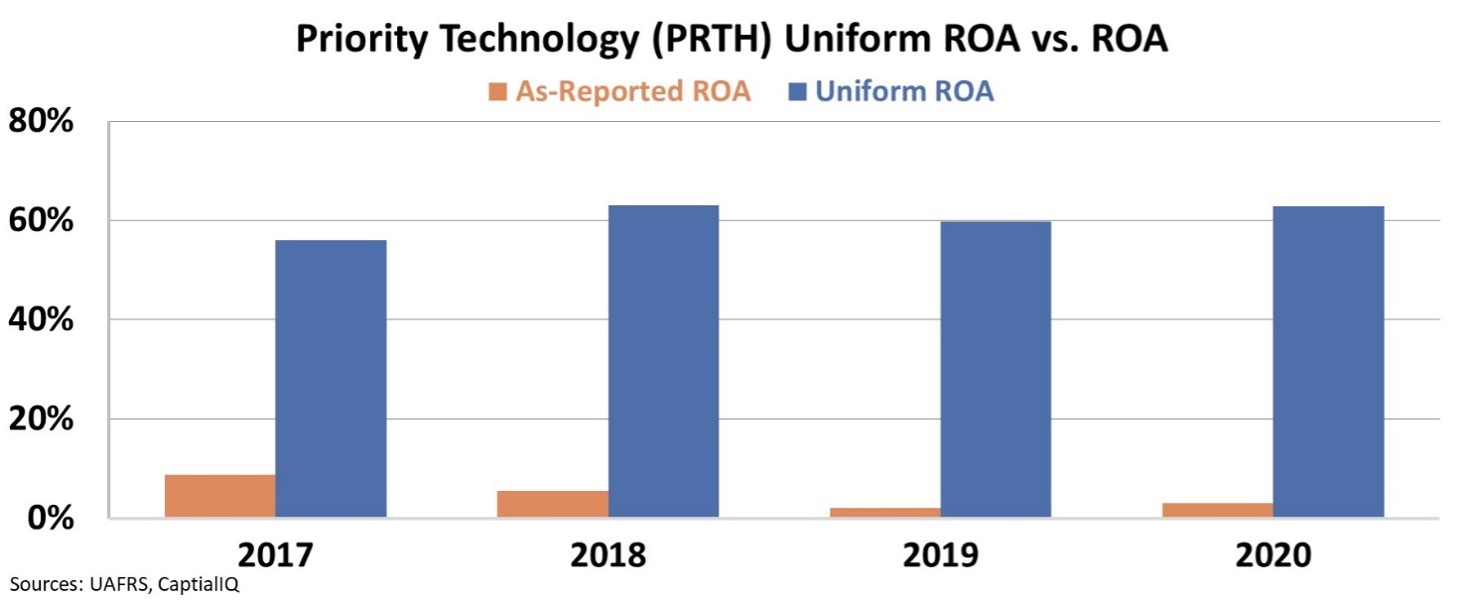

And as Uniform Accounting metrics show, its profitability is higher than investors realize. For example, as-reported metrics would lead you to think that Priority only had a 3% return on assets ("ROA") last year, when the company's Uniform ROA was far greater at 63%.

That's better than Visa (V), Mastercard (MA), PayPal (PYPL), or Square (SQ)! So, it looked like a no-brainer.

That was until we looked even deeper...

That was until we looked even deeper...

We perform deep due diligence in what we call "Fundamental Forensics." We don't just analyze the numbers... We start by analyzing the people.

That means looking at who the auditors are, management's background and history, how management is compensated, and analyzing management's communication.

Unethical management teams can destroy a company from the inside and land it in hot water with regulators. They can also siphon money off from the company, thereby stealing from shareholders.

And what we found when we looked at Fundamental Forensics for Priority sent us running.

Priority CEO Thomas Priore, who founded the company in 2005 and controls nearly 70% of the company's shares, has a checkered past.

Previously, he ran a hedge fund called ICP Asset Management and managed several multibillion-dollar collateralized debt obligations ("CDOs") known as the Triaxx CDOs.

As those CDOs failed, Priore transferred money fraudulently (and repeatedly) from other funds he was managing. He did that to keep Triaxx afloat, eventually transferring $40 million of funds inappropriately.

It was so egregious that the U.S. Securities and Exchange Commission ("SEC") barred Priore in 2010 from any association with a broker, dealer, investment advisor, or other financial intermediary for five years.

His questionable ethical decisions don't appear to end there... Priority paid a company he founded, PSD Partners, an aggregate of $2.7 million in management fees and other payments from 2016 to 2018. It looks like Priore used the company as his own checkbook.

Even worse, investors at Priority have no say in what he does either. As we mentioned, Priore owns nearly 70% of the company, his brother owns another 14%, and three other senior managers own another roughly 6% of the company's equity between them. So, management controls almost 90% of the company's equity.

It's difficult for investors to separate management from the business if it's unethical...

It's difficult for investors to separate management from the business if it's unethical...

And it's not like this is disclosed in Priore's management bio. Instead, his bio talks glowingly about his experience.

It's a reminder that you need to do your due diligence and research in the land of microcaps. No one else is doing it for you.

There is no other part of the market where you can find companies with upside as massive as microcaps do. If a name like Priority was clean, it could be a 1,000% upside opportunity.

It's worth $500 million. And peers like Global Payments (GPN) at a $57 billion market cap, Fiserv (FISV) at $72 billion, and Fidelity National Information Services (FIS) at $90 billion wouldn't even notice if Priority took market share. It would need to reach a $5 billion market cap.

But the reason for that opportunity is because this space is under-policed. And so, if you don't know what you're doing, there's a big risk with that massive potential reward.

That's why we do the deep Fundamental Forensics work for every stock pick in our Microcap Confidential newsletter. Our approach to forensic analysis has even been used by the FBI and Justice Department officials.

It's also the reason why our Uniform Accounting research is followed by nine of the top 10 global investment houses and more than half of the world's 300 biggest money managers.

Microcap Confidential details our favorite microcaps with massive upside. It helps steer you away from the Prioritys of the world.

In fact, each quarter, we publish a list of enticing microcap names to avoid...

Our first list was published in July 2020, where we recommended 10 stocks to avoid at all costs. Among the 10 names that we highlighted, seven are down, including four that are down 50% or more. Meanwhile, the Russell 2000 small-cap index is up 59% for the same period.

And because we see a massive moneymaking opportunity for 2021 in the microcap space, we're also giving away a free year of Microcap Confidential. We are confident that we're bringing you names that are potential 10-baggers without the risks of companies that could go to zero.

We've put all the details together in a brand-new presentation... Click here to watch it.

Regards,

Rob Spivey

June 23, 2021

Many investors focus on big-picture trends when thinking about investments...

Many investors focus on big-picture trends when thinking about investments...