Intel (INTC) is in the midst of a long-overdue shake-up...

Intel (INTC) is in the midst of a long-overdue shake-up...

Once the undisputed leader in semiconductors, Intel has spent the past decade watching competitors like Advanced Micro Devices (AMD) and Nvidia (NVDA) dominate high-growth markets – especially AI.

Meanwhile, its own Foundry business has burned through billions of dollars with little to show for it. Investors have grown increasingly impatient.

But now, a major shift may finally be underway...

Intel announced last month that it's in exclusive talks to sell a majority stake in Altera – the programmable chip unit it acquired for $17 billion in 2015 – to private-equity giant Silver Lake.

Shares surged 16% on the news... marking Intel's biggest single-day gain in nearly five years.

The Altera deal might just be the catalyst Intel needs for some action. So let's explore why this deal signals a possible breakup or restructuring of Intel... and why betting on a turnaround could be a smart move for investors.

Intel has been under pressure to streamline its bloated structure...

Intel has been under pressure to streamline its bloated structure...

It missed the boat on AI, lagged key chipmaking innovations, and failed to deliver on ambitious promises under former CEO Pat Gelsinger.

His departure last year signaled that the board was ready for a change in direction. Now, that change appears to be taking shape.

Selling part of Altera is more than just a cash-raising exercise. It's a sign that Intel is willing to shed noncore assets... and potentially unlock value through strategic partnerships or spinoffs.

There were already rumors that Broadcom (AVGO) and Taiwan Semiconductor Manufacturing (TSM) could be eyeing some parts of Intel for an acquisition. So investors are even more excited to hear concrete details about another potential deal.

The final valuation of the Altera deal hasn't been disclosed. But reports suggest some bidders valued the unit at just $9 billion... nearly half of what Intel paid a decade ago.

That's a steep markdown. But it could be a savvy step toward rebuilding investor confidence. Intel can focus on the parts of the business with real upside. And a deal would reduce its more than $50 billion in debt.

The market is treating this as the first step toward a turnaround...

The market is treating this as the first step toward a turnaround...

A 16% surge on a single announcement is rare for a mature tech giant. And it shows how much investors have already written off the company's prospects.

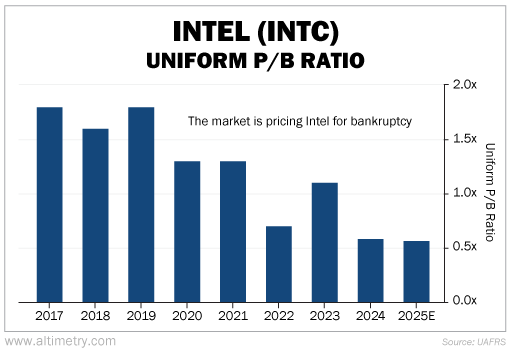

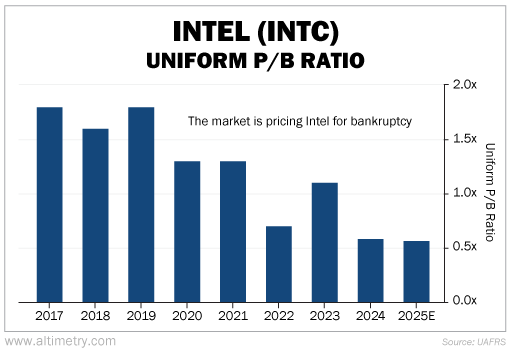

We can see this by looking at Intel's Uniform price-to-book (P/B) ratio...

The Uniform P/B ratio compares a company's total value with the value of the assets on its balance sheet (or "book"). The higher the P/B ratio, the more investors are willing to pay for those assets.

Said another way, it measures how valuable investors think Intel's assets are.

A company normally trades below a Uniform P/B ratio of 1 when the market is worried about bankruptcy risk. Intel's has been 0.6 times since 2024... its lowest level in 16 years.

Take a look...

Investors are punishing Intel for years of missed expectations... and its failure to keep up with megatrends such as AI.

When expectations are this low, even modest progress can create outsized gains...

Intel's fall from grace has been painful to watch...

Intel's fall from grace has been painful to watch...

But the company has a new management team. And it's showing signs of structural change. Intel may finally be righting the ship.

Expectations are so low that any strategic progress could lead to meaningful upside. This business needs to free up capital, reduce complexity, and reallocate resources toward growth markets like AI and advanced packaging.

If it can accomplish those goals, the market could change its mind fast.

Regular readers know we've been bearish on Intel for quite some time. We're still not convinced yet... but we might finally be seeing some signs of life.

A few more pieces of good news could turn this into an amazing comeback story.

Regards,

Joel Litman

April 1, 2025

Intel (INTC) is in the midst of a long-overdue shake-up...

Intel (INTC) is in the midst of a long-overdue shake-up...