The Trump administration recently escalated the trade war...

The Trump administration recently escalated the trade war...

In late September, the White House added China's largest semiconductor manufacturer, Semiconductor Manufacturing International Corporation ("SMIC"), to a restricted list. U.S. suppliers will now need special permission to work with the firm – similar to the recent restrictions placed on Huawei Technologies.

The Trump administration claims that it's halting sales for these suppliers due to national security concerns. The U.S. Commerce Department notes that exporting products to SMIC poses a risk of diversion to military end use. And independent market analyst Richard Windsor notes one of SMIC's board members is from Datang Telecom Technology, which supplies technology to the People's Liberation Army of China.

Despite these concerns, it appears the broader issue revolves around the trade war itself. This is a way for the U.S. to gain additional leverage on China to ensure the U.S. can keep the country in check from a competitive perspective.

One outcome of this trade war is that China is now rushing to build up its own independent semiconductor "ecosystem." If the U.S. can so easily disrupt these massive corporations, China will need to diversify the supply chain.

Similarly, the U.S. chipmakers are also scrambling to ensure that they aren't dependent on Chinese fabricators or suppliers. If China retaliates by imposing similar restrictions, U.S. companies could feel the brunt of this supply disruption.

This means that the trade war could actually create a mini boom in the demand for semiconductor equipment sales.

For example, producer Micron Technology (MU) recently announced it was increasing capital expenditures ("capex") next year to $9 billion. Over the next few years, as Chinese and American companies build out their own supply chains, this may lead to stronger equipment sales.

However, in the long term, it may also mean U.S. suppliers will lose Chinese business to homegrown Chinese suppliers. We may see increased competition in the industry, as China seeks to become more independent and thus introduces more competitors into the fold.

One company that may benefit from this trend is a firm with a lot of recent activity in The Altimeter...

One company that may benefit from this trend is a firm with a lot of recent activity in The Altimeter...

Advanced Energy Industries (AEIS) is a U.S. company in the semiconductor equipment manufacturing industry. It provides power and control technologies for making semiconductors, as well as data storage products, flat panel displays, and medical devices.

Many different users have been looking at AEIS in The Altimeter database in recent weeks... so today in Altimetry Daily Authority, we'll dig into the name and highlight what we see in the context of Uniform Accounting and fundamental insights.

Advanced Energy is exposed to a lot of booming industries – including 5G, cloud computing, and innovative medical devices. 5G installation spending continues to increase and cloud computing demand has risen, particularly as more companies are shifting to the work-from-home model. Increased demand in both these segments should provide some tailwinds for the firm to continue its growth.

Additionally, Advanced Energy looks like the type of company that will benefit from the trade war disruptions. It's the dominant supplier of power supply modules, with roughly 45% market share of the nearly $1 billion total market. These are the engines that help power and create semiconductors.

Advanced Energy has already "rolled up" most of its competition through acquisitions, and the company possesses hundreds of patents to protect its market share as new firms enter the space.

As we said, the U.S. and China are both seeking to bring production and supply of semiconductors within their borders. The trade war has caused huge disruptions in production for both countries as increased retaliations and restrictions limit collaboration between companies.

And if U.S. semiconductor firms increase their capex spending, American equipment manufacturers like Advanced Energy are set to benefit.

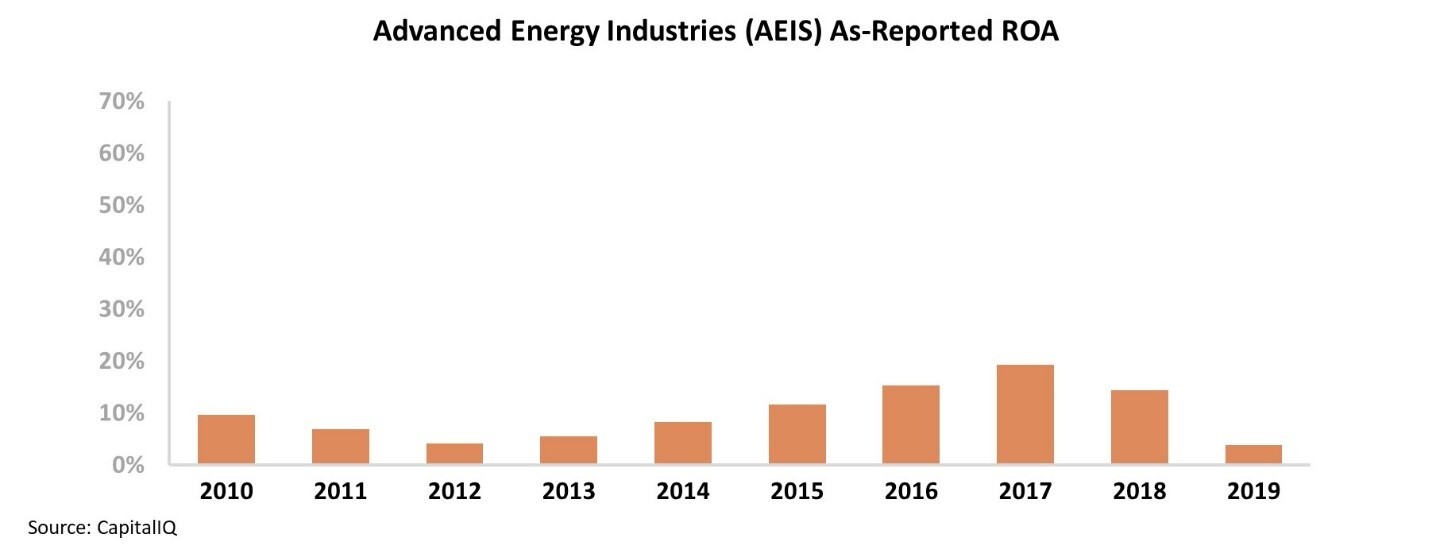

However, looking at its as-reported return on assets ("ROA"), Advanced Energy appears to have low and declining returns... meaning that even if it grows, investors likely won't be excited. As you can see in the chart below, the company's as-reported ROA fell from a peak of 19% in 2017 all the way to 4% in 2019...

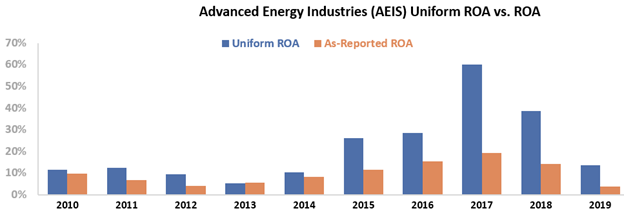

However, due to distortions in as-reported accounting – including the treatment of goodwill – this picture of Advanced Energy's performance isn't accurate. The market is completely mistaken about the strength of the company's returns.

Since 2015, Advanced Energy's ROA has been at least twice as high as the as-reported metrics would have you believe. Last year, the company's Uniform ROA was 14%.

However, returns did fall for the year due to a collapse in demand for cyclical semiconductor equipment orders from their 2017 peak. Despite this decline, Advanced Energy's Uniform ROA was still significantly stronger than as-reported metrics implied. The company's leading market position and aggressive acquisition strategy have allowed it to generate above-average returns.

However, simply understanding the strength of historical returns doesn't tell us whether the stock is undervalued or overvalued on its own...

To find out if Advanced Energy can continue to create value for shareholders, we can use the Embedded Expectations Framework to easily understand market valuations.

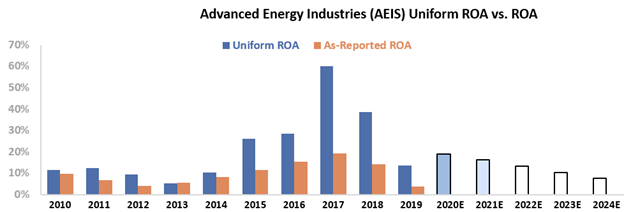

The chart below explains the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Analysts forecast Advanced Energy's returns to rise to 16% from 14% last year. But the market appears to be missing this trend and is pricing in returns to fall all the way to 8%. This would be the lowest ROA for Advanced Energy since 2013.

If the company is able to continue growing its leading market position and acquire smaller competitors struggling to stay afloat during this economic downturn, these profitability expectations may be too pessimistic.

Additionally, the trade war could drive increased capex for U.S. semiconductor firms, as both countries distance themselves from the other's production... so American firms would need to add capacity.

The majority of Advanced Energy's sales are from U.S. companies – thus leaving the firm well-positioned to take advantage.

Without Uniform Accounting, investors wouldn't see the company's strong returns. They might instead think that Advanced Energy has below-average, declining returns instead of robust profitability.

And right now, the market is pricing in the company's returns to collapse to lows not seen since 2013. If Advanced Energy continues to execute on its acquisition strategy and take advantage of trade war tailwinds, these expectations may be far too low... and that would mean upside ahead for AEIS shares.

Regards,

Joel Litman

October 13, 2020

The Trump administration recently escalated the trade war...

The Trump administration recently escalated the trade war...