Bausch Health (BHC) is getting desperate to generate some cash...

Bausch Health (BHC) is getting desperate to generate some cash...

Shares of the health care giant are down more than 95% from their all-time high. Now a $3 billion company, it's buried under a $20 billion mountain of debt.

That's why last month, Bausch Health announced it might sell off its eyecare business – Bausch + Lomb (BLCO) – to shore up its financials.

A sale could give Bausch Health more than $10 billion in cash. That would easily pay off its $2.4 billion in debt coming due next year... and cover the majority of its debt coming due through 2027.

About two weeks ago, the Financial Times reported private-equity ("PE") giants TPG and Blackstone are preparing a joint bid for the business. Sources say the bid will be valued at $25 per share – a significant premium over the stock's pre-announcement trading price of about $15 per share.

Today, we'll take a closer look at the potential sale... and why TPG and Blackstone might be getting a steal.

If successful, this could be one of the largest PE deals of the year...

If successful, this could be one of the largest PE deals of the year...

TPG already owns another ophthalmology company called BVI Medical. The two businesses combined could create a behemoth in the space.

Plus, PE companies are struggling to find good buys this year... so this could be a rare big deal that will keep investors happy.

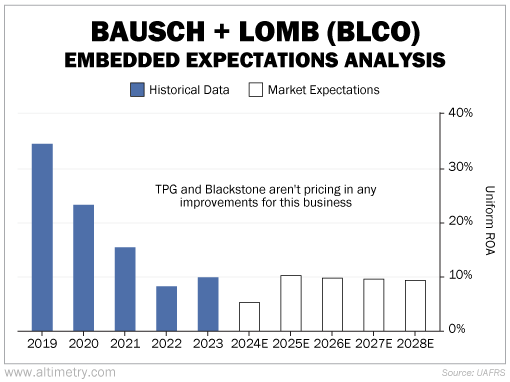

Even though $25 is a significant premium for Bausch + Lomb, it's still a bargain. We can see this by looking at our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what a prospective bidder is paying for it today.

Bausch + Lomb has had to use some of its earnings to pay down its parent company's interest expenses. So as Bausch Health has gotten more desperate, Bausch + Lomb's Uniform return on assets ("ROA") has gotten weaker. It used to be as high as 35% in 2019. In the past two years, it has been closer to 9%.

That said, at a $25 purchase price, TPG and Blackstone don't expect any improvement.

Just take a look...

TPG and Blackstone have a lot to gain if they can fix up the business.

Bausch + Lomb used to mint cash. It has struggled under the pressure of its parent company. But that doesn't mean eyecare is any less profitable than it used to be.

This could be a rare win-win for everyone involved...

This could be a rare win-win for everyone involved...

Bausch Health needs cash. And Bausch + Lomb is just about the best asset it has left. The subsidiary is under pressure to hold up a dying business.

Once it sheds that responsibility, returns should improve toward previous levels.

If Bausch Health can drum up enough cash for the next three years, it might have enough time to fix its business. And TPG and Blackstone could get ahold of one of the best businesses in the eye care industry.

Regards,

Rob Spivey

October 30, 2024

Bausch Health (BHC) is getting desperate to generate some cash...

Bausch Health (BHC) is getting desperate to generate some cash...