Renters may finally get some relief from high prices...

Renters may finally get some relief from high prices...

And it's coming at the perfect time.

With interest rates hitting their highest levels in more than a decade, folks are looking to save where they can.

Mortgage rates climbed past 7% at the end of October. It's the first time that has happened since the Great Recession. And that's making it tough for people to buy homes right now.

That doesn't mean more people are renting, though. You see, rental prices also remain sky high... especially in major cities. And those steep prices are scaring people away.

In the third quarter of 2022, more apartment renters in the U.S. moved out of apartments than moved in. That hasn't happened for the past 30 years. That's a sign rent prices need to come down.

At the same time, competition is growing in the rental market. Countless new apartment buildings are cropping up in big cities.

Developers started all kinds of apartment projects back when interest rates were low. These folks locked in cheap financing – and left a lot of their developments unfinished. They wanted to keep demand higher than supply to make sure prices stayed elevated.

Now, that's finally starting to change.

Demand is falling, and debt isn't cheap anymore...

Demand is falling, and debt isn't cheap anymore...

High interest rates are preventing developers from taking on new projects. Instead, they're finishing the ones they had already started... bringing them to market as soon as possible.

This low-demand, high-supply setup means rental prices are starting to come down. While that's good for consumers, it's bad news for real estate investments. Asset classes like real estate investment trusts ("REITs") will take a big hit from falling rent prices.

REITs own or finance income-producing real estate across a range of property types, like office buildings, retail stores, and residential housing.

They offer a share of the earnings without the hassle of going out and buying, managing, or financing a property. So they can be a lucrative, low-effort opportunity for investors.

Their straightforward business model is also enticing. They lease space and collect rent on the properties. Then they distribute that income as dividends to shareholders.

If rent prices are falling, that means less income to distribute to investors. That could mean a bumpy road ahead for REITs.

The market understands the risk with REITs – sort of...

The market understands the risk with REITs – sort of...

The Dow Jones U.S. Residential REITs Index has fallen 26% since the beginning of the year. AvalonBay Communities (AVB), one of the largest U.S. residential REITs, has fallen even further. Its stock is down 33% in 2022.

There are two major reasons REIT prices are dropping...

The first is the risk of falling income, as we just mentioned. Residential REITs may need to lower their rents to attract tenants.

The second is that those lower rents will need to cover higher costs. As interest rates rise, debt gets more expensive. That hurts the profitability of REITs.

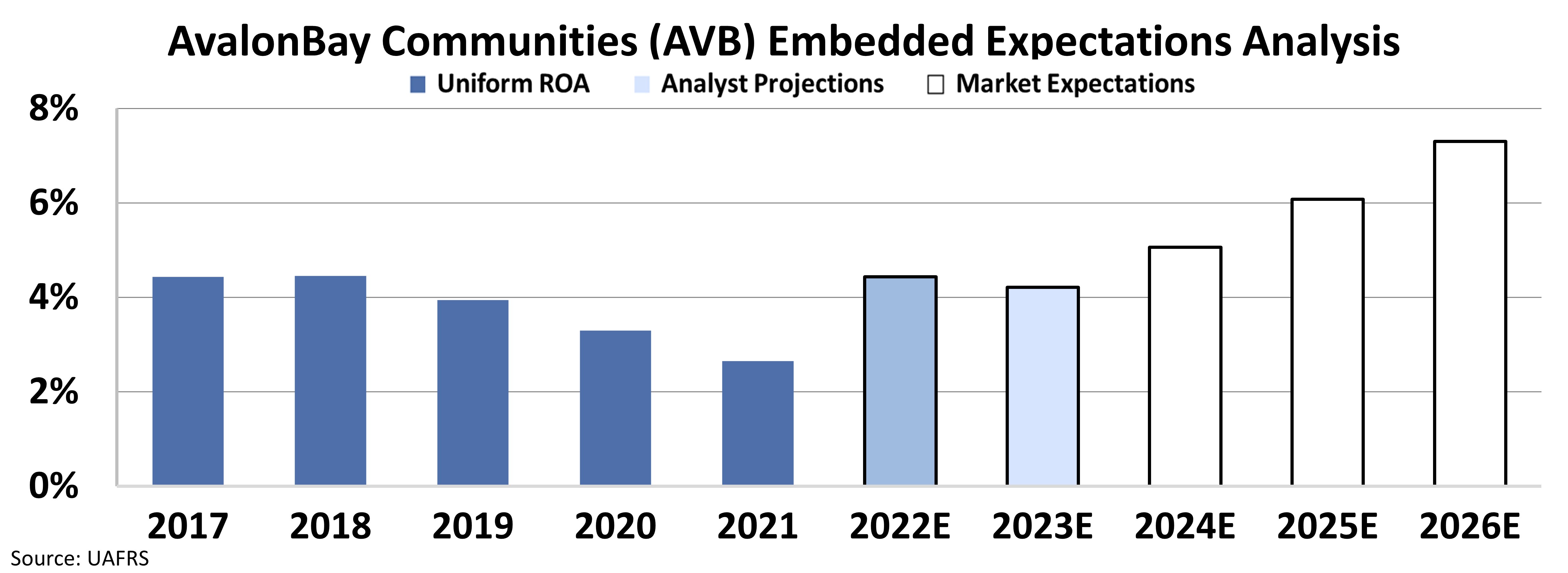

We can see this once again with AvalonBay. The company's Uniform return on assets ("ROA") was just 3% in 2021, well below the 6% cost of capital. That number has been decreasing since 2018.

That being said, investors haven't abandoned the stock. We can see this through our Embedded Expectations Analysis ("EEA") framework. It uses Uniform Accounting to tell us what the market expects from a company based on its current valuations.

At today's levels, investors think AvalonBay's Uniform ROA will reverse course and climb above 7%... something it hasn't done in the past 15 years.

Take a look...

This paints a clear picture of investor optimism. The market doesn't anticipate any demand slowdown for AvalonBay. It doesn't think higher interest rates will hurt the company's profitability, either.

Even after the stock has been crushed this year, investors still seem bullish on the business. We think they're missing the point.

We're still in the early stages of what could be a long overdue rent-price correction. That's good news for anybody who rents. For AvalonBay, though, it's about the worst possible environment... other than rising interest rates, which we're also seeing today.

Considering all these factors, AvalonBay has plenty of downside risk. This is probably not a good company to jump into right now.

Regards,

Joel Litman

November 17, 2022

Renters may finally get some relief from high prices...

Renters may finally get some relief from high prices...