Amazon (AMZN) CEO Andy Jassy is getting worried...

Amazon (AMZN) CEO Andy Jassy is getting worried...

And his comments in the company's annual letter to shareholders reveal why.

In recent years, Software as a Service ("SaaS") has been one of the hottest areas of the tech sector. SaaS businesses sell their software on a subscription basis, which makes revenue more predictable than the traditional one-time payment scheme.

The SaaS model exploded in the past few years... driven by increased demand for remote-work solutions and the need for businesses to digitize their operations.

But as we highlighted a few weeks ago, SaaS industry growth seems to be slowing. Jassy acknowledged in his letter that the growth is decelerating for Amazon's SaaS arm, Amazon Web Services ("AWS"). Revenue growth in AWS dropped from north of 40% last year to only 16% in the first quarter of 2023.

SaaS companies rely on web-hosting services like AWS to grow. So if AWS is slowing down, so will the rest of the SaaS world. But that doesn't mean you should paint all companies in SaaS and web services with the same brush...

Not every SaaS business will be impacted equally by this deceleration. Some companies will be hit harder than others. So today, we'll take a closer look at the competition in the web services industry... and evaluate who could lead the race.

The market knows there will be a winner...

The market knows there will be a winner...

There are three major players when it comes to public cloud web services. These are AWS, software giant Microsoft's (MSFT) Azure, and Google parent Alphabet's (GOOGL) Google Cloud.

Google Cloud is a relative newcomer to the public-cloud space. It's doing its best to break through, but for now it seems like a two-horse race.

What sets AWS apart – and what led it to become the dominant force in the SaaS industry – is its early adoption of a consumption-based pricing model. This let startups and small businesses access cloud resources on a budget.

AWS has also built a massive ecosystem of partners and third-party vendors. They offer a wide range of tools and services that can be easily integrated into AWS applications. This has helped AWS to become one of the most popular businesses for SaaS customers.

But as the web-services market matures, businesses are looking for more features. They want a cloud platform that can offer reliability, security, and support for mission-critical workloads.

This is where Azure comes in... Microsoft's cloud platform offers a comprehensive suite of services that address these business needs.

Azure's hybrid cloud service lets businesses leverage their existing on-premises servers while expanding their capabilities in the cloud. This flexibility has helped Azure become a preferred option for large businesses.

Plus, Azure is considered the go-to option for large Fortune 500 companies. They perceive it as a reliable and secure cloud service. Microsoft's reputation is going a long way.

And the market has made its preference known.

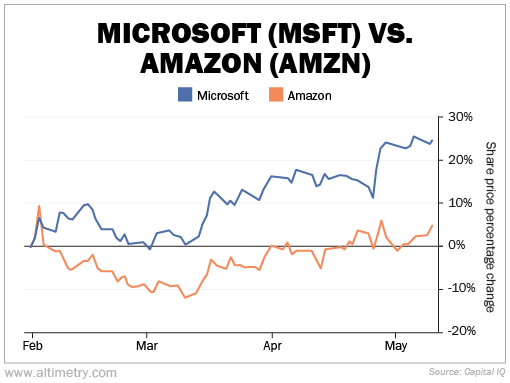

The entire tech sector rallied in January... but only one of the two tech giants have kept running since then. Take a look at how much better Microsoft has performed in the past three months...

Microsoft stock is up more than 23% since the end of January. Amazon is basically flat.

The market seems to understand that we're entering a new age of web services – one that's more mature. Customers aren't just looking to grow cheaply. They want more options and more security.

As we said, AWS is highly dependent on startups and small businesses to grow. That helped it gain a leg up early in the race. But it also means AWS can be sensitive to a slowdown in the economy. These small companies are having a difficult time in an environment with high inflation and recessionary concerns.

Microsoft's Azure has a customer base composed of large corporations. It might be less sensitive to possible shocks in the economy.

We're seeing a significant difference in the share prices of these companies. It's all about the cards in their hands... and the market has caught on. Expect this dislocation to keep growing.

Regards,

Rob Spivey

May 11, 2023

P.S. Last night, my colleague and Altimetry founder Joel Litman shared a brand-new urgent warning with investors... about a critical market event that's set to move $10 trillion worth of stocks in a single day next month.

It's not the start of the next recession... or anything to do with the Federal Reserve or the recent bank runs. But Joel says this key catalyst could be just short of life or death for dozens of stocks. If you act fast, there's still time to prepare your portfolio. Watch the free replay here.

Amazon (AMZN) CEO Andy Jassy is getting worried...

Amazon (AMZN) CEO Andy Jassy is getting worried...