This self-fulfilling prophecy was built on unrealistic expectations...

This self-fulfilling prophecy was built on unrealistic expectations...

Tech has reigned over the markets for the past 15 years. Any company could get funding to build an asset-light software platform. Venture-capital ("VC") funds were flush with cash and looking to back the next Adobe (ADBE).

It was the era of Software as a Service ("SaaS") dominance. And like any good bubble, it started rationally... and then fed on itself.

VC funds pushed the SaaS companies they invested in to grow as fast as possible in a race to take market share. Investors love SaaS companies because they charge users a recurring fee to use their platforms. That makes them more reliable than the traditional one-time payment method.

The idea was that they didn't need to worry about profit. If you could become the biggest first, you'd dominate your niche. Then you could start raising prices to make money.

The easiest way for these companies to grow quickly was to focus only on what they did best – be it building customer relationship management ("CRM") software, billing software, or ad tech dashboards – and outsource the rest to someone else.

Then they could easily grow their businesses without investing a ton. They'd just pay others to rent their infrastructure, skills, and services. So as each of these SaaS startups grew, they would buy services from SaaS companies in other end markets.

Said another way, each of these companies spent VC money without a care... and much of it was going to all of the other VC-funded SaaS firms. It was an incestuous spending cycle.

VC money is getting tighter, though. Tech companies are cutting back. And not all of them will survive.

As I'll explain today, the "paradox of thrift" has come to Silicon Valley. When everyone starts saving at once – or in this case, cutting costs – it will lead to less revenue for everyone...

SaaS companies think they're saving themselves by cutting back...

SaaS companies think they're saving themselves by cutting back...

They're actually making the situation worse across the industry.

Many SaaS businesses are hemorrhaging cash. They have to decide between reducing or eliminating partnerships, doing more in-house work, or even going out of business.

Investors are still stuck in the SaaS-boom mentality. They're hoping these companies can once again help them rebuild their portfolios. They don't realize even the strongest SaaS businesses are facing headwinds... like Amazon Web Services ("AWS").

AWS, owned by e-commerce giant Amazon (AMZN), showed impressive 29% year over year growth in 2022. It has continued to sell its products worldwide.

That didn't stop Amazon CEO Andy Jassy from highlighting its struggles in his 2022 letter to shareholders. He said AWS is facing short-term headwinds because companies are cutting back on spending.

He doesn't just mean that mainline conglomerates like General Electric (GE) or retailers like Walmart (WMT) are rethinking their AWS spending. The tech darlings that fueled much of AWS's growth are facing a reckoning, too.

Many SaaS stocks have tanked since their peaks in late 2021...

Many SaaS stocks have tanked since their peaks in late 2021...

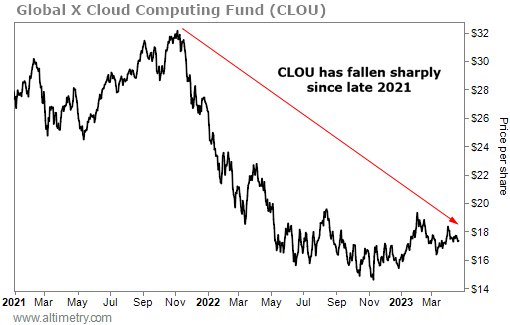

We can see this through the Global X Cloud Computing Fund (CLOU). It's a representative cloud-computing exchange-traded fund that tracks SaaS companies. And it's down 46% since its high in November 2021.

Take a look...

That might look like a buying opportunity. After all, everyone wants to believe there's light at the end of the tunnel... particularly for such a high-flying sector.

Here's the issue – that drop was just the market taking the air out of massively inflated valuations.

Investor expectations for SaaS stocks have been insanely high for years. Now, the market thinks these companies will maintain their historical growth levels.

We can see this using our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

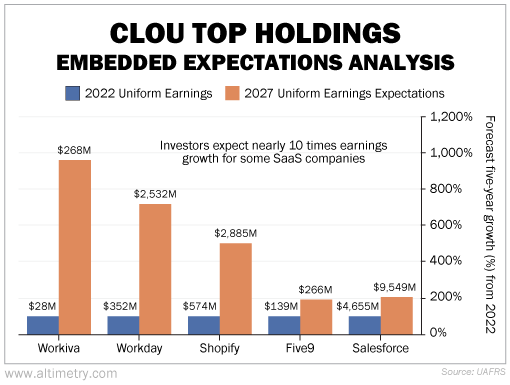

For this analysis, we looked at Uniform earnings for some of the largest positions in the CLOU basket... compliance platform Workiva (WK), financial-management system Workday (WDAY), e-commerce business Shopify (SHOP), cloud contact-center software Five9 (FIVN), and customer-relationship manager Salesforce (CRM).

The chart below shows the earnings growth expectations for each company, using 2022 earnings as a baseline. As you can see, investors are still pricing in massive growth for these companies. For example, they expect Workiva to achieve a staggering 961% earnings jump in five years.

Take a look...

These folks don't just have unrealistic expectations for Workiva. The market predicts earnings for almost all of these companies will at least double in the next five years. That's in line with their growth to this point.

Anticipating "business as usual" doesn't capture the problems with the SaaS revenue cycle. As these companies start cutting costs, SaaS vendors will lose money. And then those SaaS companies will cut costs for their vendors (who are also clients)... who will then have to cut back even more.

And so on, and so forth.

Investors are optimistic that SaaS companies will recover. They're expecting massive growth, even after stock prices in this industry have dropped by almost half.

So far, the industry has been hit by valuation headwinds. The next round of problems will be fundamental in nature. There will be a lot more room for SaaS to drop due to poor performance.

The incestuous SaaS cycle is unraveling. Investors are going to have to adjust their expectations... fast. Bad things are on the horizon for these stocks.

Regards,

Rob Spivey

April 25, 2023

This self-fulfilling prophecy was built on unrealistic expectations...

This self-fulfilling prophecy was built on unrealistic expectations...