Going from isolation to independence...

Going from isolation to independence...

The U.S. workforce spent a lot of time in isolation during the pandemic. But 2022 seems to be the start of a new direction.

The return to "business as usual" seems in order. There are many reasons to be excited, from traveling across the world, going out more, and stressing less about our normal activities.

However, returning to some semblance of normality may come with a few complications.

It may create some issues for folks who can pick up extra work on the side while working remotely.

One of the biggest trends of the past two years has been the rampant acceleration of people embracing independent contractor work.

With increased flexibility coming about due to the pandemic, many pivoted to working as independent contractors rather than traditional full-time employees.

The 'return to the office' movement will affect some contractors...

The 'return to the office' movement will affect some contractors...

With increased flexibility comes more responsibility.

Freelancers who have adopted work as independent contractors have dived head-first into the space, leaving traditional employment.

And yet, many have taken advantage of the flexibility the world has found itself with to pick up independent contractor work as a side hustle to bring in extra income.

Many millennials have taken up contractor work and earned additional income to pay for student loans, among other obligations.

But as the world returns to the office en masse, these individuals working double-duties may finally be forced to decide on their type of employment.

A return to the office means managers and employers have better insight into their employees' workload. Managers will decipher which employees have a full plate of work and which workers use their downtime on a side hustle.

While contracting will stay strong, the platforms to support 'gig' work may struggle...

While contracting will stay strong, the platforms to support 'gig' work may struggle...

With people returning to the office, the side hustle industry will inevitably cause some havoc in offices.

Based on how people feel about work, it's clear that the contract work movement is here to stay. While the move to independent contracting began before the pandemic, 2020 has served to bring it into the forefront. Contracting continues to have strong tailwinds going forward due to how more work than ever is online and how millennials have embraced this new kind of work.

However, the platforms that freelancers are using may not thrive alongside them.

With so many contractors looking for side gigs, and companies worldwide looking to hire independent contractors, it's hard for platforms to build loyalty with their users.

Instead, freelancers and contractors on these platforms tend to float between their options, and these online marketplaces lose their pricing power.

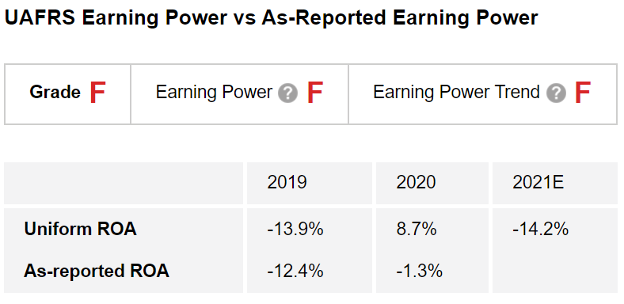

We can see this looking at The Altimeter grades for Fiverr International (FVRR).

On an as-reported basis, Fiverr had a negative Uniform return on assets ("ROA") before the pandemic. Even after strong pandemic-induced tailwinds, it mustered a poor negative 1% ROA.

While the story gets better as we turn to the Uniform numbers, we can see Fiverr is still under pressure. It had a similarly poor Uniform ROA in 2019 that improved to 9% in 2020, still less than corporate average returns. But as competitors continue to price out Fiverr, returns are expected to collapse to negative 14% through 2021.

When the numbers are put together, the company earns an "F" grade across the board. Put simply, The Altimeter thinks Fiverr is a poor-performing name in every aspect.

Fiverr has been folding under pressure. That said, other competing platforms may put up a better fight in the battle to win over freelancers and contractors.

While Fiverr may not be the best bet for 2022, there are scores of other Internet-reliant stocks with bright futures ahead...

While Fiverr may not be the best bet for 2022, there are scores of other Internet-reliant stocks with bright futures ahead...

Here at Altimetry, we comb through thousands of publicly traded stocks to identify "under-the-radar" stocks. And in one of our backtests, we found that 96% of Internet-related stocks that transitioned to a Software as a Service ("SaaS") model performed better... with an average gain of nearly 760%.

We recently put together a presentation on one of those opportunities... It's a little-known SaaS company whose stock could easily rise 10x from today's levels...

Watch it right here.

Regards,

Joel Litman

March 3, 2022

Going from isolation to independence...

Going from isolation to independence...