The hotel industry is seeing a recovery...

The hotel industry is seeing a recovery...

After many false starts, it looks like the world is close to making an important vocabulary change when talking about the coronavirus pandemic.

The world is quickly shifting from a life-altering pandemic to an endemic. For many, thanks to COVID-19 vaccines and treatments, it is now not a high enough risk to alter the way we live our lives completely.

Restrictions are being eased. People are looking forward to traveling and seeing the world again.

Over the last two years, people have been forced to adjust travel expectations regarding where they could go and how often. Concerns about the virus and the hassle of closed borders as well as other issues meant many people didn't even bother to travel.

As the world reopens, excited travelers plan to use their savings to explore. Travel agencies and businesses report a significant jump in bookings for the upcoming spring and summer seasons.

Some analysts expect U.S. tourism and travel spending to reach pre-pandemic levels in 2022. This is a remarkable victory for anyone who watched the omicron variant of the virus sweep across the world in late 2021. At the time, with the most contagious strain yet, it appeared the world was headed back to square one.

With all the data pointing to a strong recovery, you might be thinking it's time to buy up all the travel stocks to ride the recovery wave. But is that a good move?

Smart investors check if the market is already pricing in the news…

Smart investors check if the market is already pricing in the news…

Fortunately, using Uniform Accounting, we can easily look at an entire subindustry to see how it has performed historically and what the market is pricing it to do.

In this case, we can look at the top players in the hotel industry. These include Marriott International (MAR), Hilton Hotels (HLT), Hyatt Hotels (H), Choice Hotels International (CHH), Wyndham Hotels & Resorts (WH), and Playa Hotels & Resorts (PLYA).

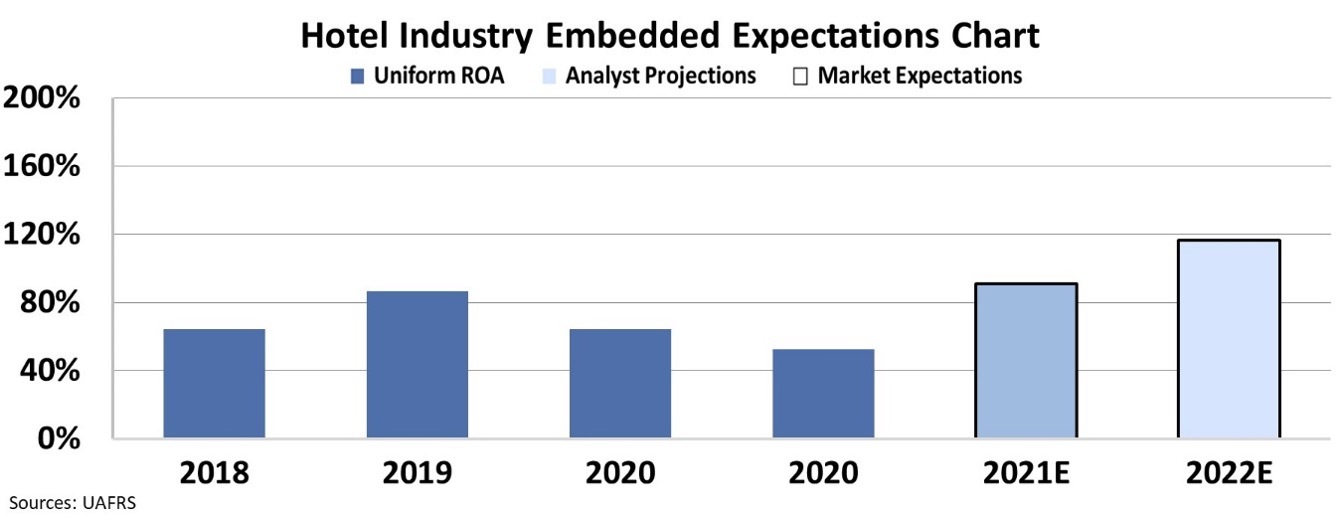

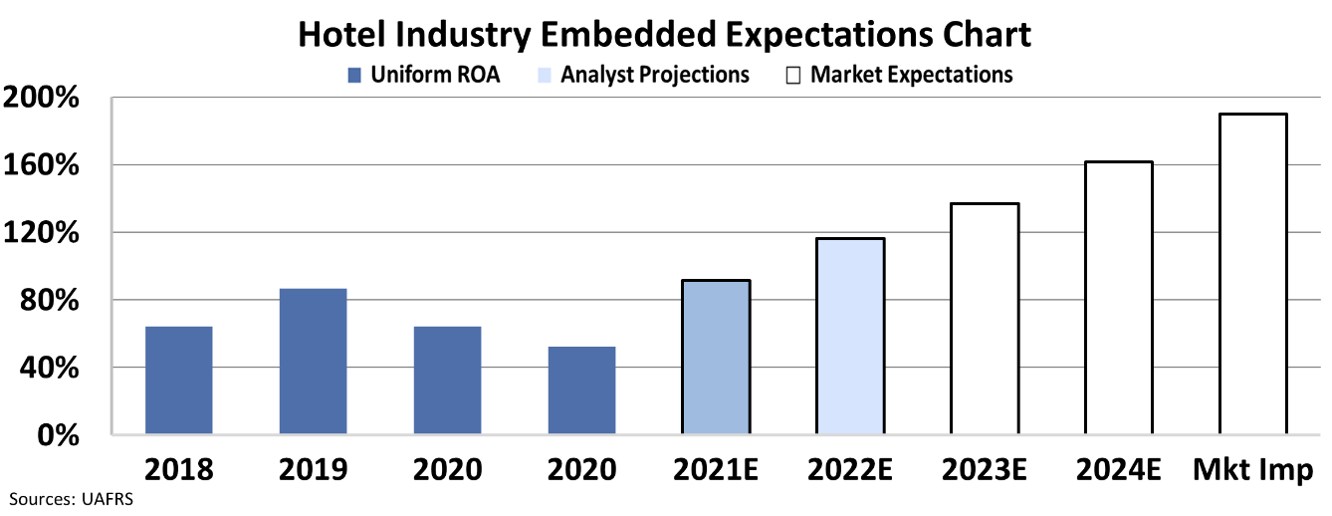

When looking at the aggregate return on assets ("ROA") for these six companies, we can see that 2020 was an incredibly tough year. People practically stopped traveling when the pandemic overtook the world, and these companies' ROA dropped from 87% to 53%.

As people return to traveling and start using hotels more, Wall Street analysts forecast record high returns over the next two years. ROA is projected to jump back to higher than we saw pre-pandemic, reaching 116% in 2022.

So what does the future hold for hotels?

So what does the future hold for hotels?

As travel picks up again, the future looks strong for hotels.

But the market has already priced this recovery and more into the stock prices. The market is so bullish on hotels that it expects returns to continue rising to record highs.

By 2025, the market expects these top hotels to have an ROA of 190% on average, more than double previous highs in 2019.

Considering that this industry collapsed just about a year ago, these expectations are pie-in-the-sky optimistic.

Gone are the days when hotels were forced to get creative through promotions like "staycations" and daily bookings for rooms to be used as makeshift offices.

But as the world opens back up, companies like the six profiled here are expected to transform their businesses to be even better than they were before the pandemic.

The bad times are behind the industry. But it looks like the market has overreacted to the recovery, making them too expensive to be good stock purchases.

While the hotel industry might be overpriced, there are plenty of other recovery stocks with upside...

While the hotel industry might be overpriced, there are plenty of other recovery stocks with upside...

Here at Altimetry, we use Uniform Accounting to understand financial distortions. Our method allows us to pinpoint recovery stocks that are poised for big upside...

In our Hidden Alpha service, the "Survive and Thrive" stocks that we predicted would rebound are already up nearly 40%... but that's just the tip of the iceberg.

Every month in our Hidden Alpha newsletter, we use our proprietary method to recommend hidden gems that the market hasn't priced in yet.

You can learn more by clicking here.

Regards,

Rob Spivey

March 2, 2022

The hotel industry is seeing a recovery...

The hotel industry is seeing a recovery...