More work is shifting online... and that means cybersecurity is a growing concern.

More work is shifting online... and that means cybersecurity is a growing concern.

For people working at home, the threat is becoming harder to control. When employees were in the same place, hacking was easier to defend against. Now, workers are using personal laptops on unsecured networks. This means hackers have more points of attack to target.

The FBI has reported a 400% spike in cyberattacks in 2020, which the Bureau attributes to more work than ever moving online.

And it's not just companies at risk... Individuals' information is also under threat due to website data breaches. Millions of people can be affected by these attacks, and for years afterwards.

Recently, even the Kardashian empire suffered a consumer site hack. As Fox Business explains, Kylie Cosmetics is a victim... Kylie Jenner's operation was one of 100 businesses that had data stolen by two employees of Shopify (SHOP).

All it took was two rogue employees to steal names, addresses, and the last four digits of credit cards.

Even when shopping online for something as commonplace as cosmetics, customers need to stay vigilant and ensure they treat their data carefully.

Hackers have a plethora of strategies for stealing information...

Hackers have a plethora of strategies for stealing information...

Two of their favorite ways to target sites are through distributed denial-of-service attacks ("DDoS") and bot attacks.

A DDoS attack occurs when a hacker floods a website or host with traffic and overwhelms it. Eventually the site can't respond to all the fake users, which results in the site crashing.

Bot attacks are when a hacker uses Internet "robots" to enter a network, wreak havoc, and obtain classified information. These attacks can be dangerous because of "botnets" – huge collections of bots that allow hackers to deploy DDoS attacks and take control of a network.

Both attacks can take down websites and cripple online sales. As such, businesses need effective technology to defend their digital walls.

Radware (RDWR) is one company focused on protecting enterprises from these attacks... and it's been a popular stock in recent weeks among institutional clients of Valens Research – the firm that powers Altimetry.

Radware is at the forefront of protecting clients from DDoS and bot attacks. Its software uses machine learning to stay one step ahead of hackers... This artificial intelligence ("AI") approach has minimal human involvement and can be changed to suit specific client needs.

Investors might assume that such a vital offering means Radware could charge whatever it wants for its products.

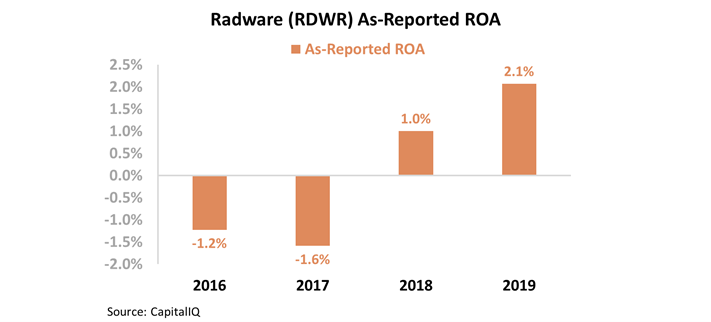

And yet, based on GAAP metrics, it looks like the company is barely profitable. Radware's as-reported return on assets ("ROA") over the past four years has ranged from negative 2% to positive 2% – well below corporate averages.

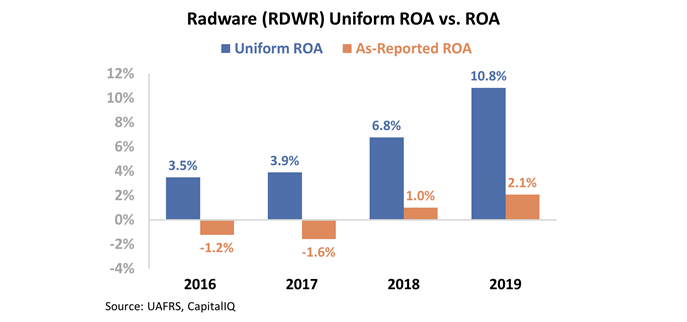

But GAAP's treatment of long-term investments, stock option expenses, and other line items is distorting Radware's profitability. In reality, the company has seen a steady ROA improvement over the past four years. In 2019, Radware's Uniform ROA reached 11%. Take a look...

Uniform Accounting shows that Radware has taken advantage of the widespread need for increased cybersecurity. However, just looking at the company's past returns doesn't tell us if this stock is a buy...

We need to consider what investors are expecting Radware to do in the future. If they see through the accounting "noise," know that returns are improving, and expect the trend to continue, then upside is likely already priced in.

We can use Uniform Accounting, a discounted cash flow model, and Radware's current stock price to figure out what the market is pricing in.

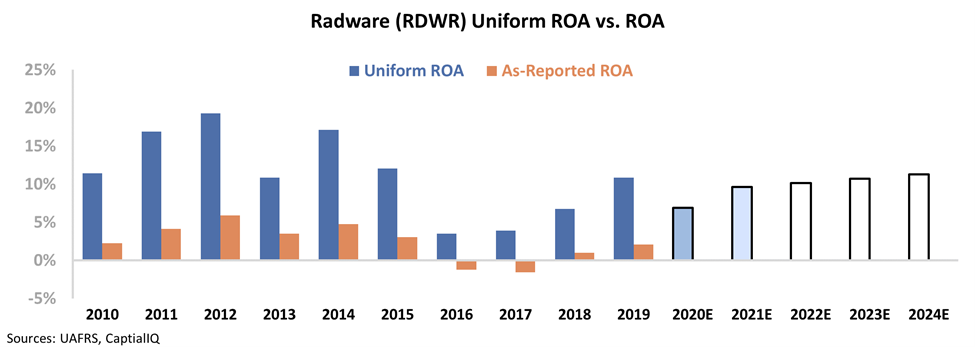

The chart below shows the company's historical performance, in terms of ROA (dark blue bars) versus what Wall Street analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at the current stock price (white bars).

Right now, Wall Street is projecting Radware's returns to stay near current levels. The market also has similar expectations, pricing in Uniform ROA to remain at 11% through 2024. This means that despite the surge in demand for Radware's services, the market isn't expecting returns to improve going forward.

More companies are relying on e-commerce sales, and more people are working remotely. That means more risks to defend against... and more customers using services like those from Radware.

But by thinking that Radware's profitability isn't shooting higher, investors aren't pricing in continued tailwinds for the business. Uniform Accounting shows the company was improving before the pandemic and could be set up to continue this trend. The market may be too pessimistic on Radware today... and that means the company's stock could see upside ahead.

Regards,

Rob Spivey

October 20, 2020

More work is shifting online... and that means cybersecurity is a growing concern.

More work is shifting online... and that means cybersecurity is a growing concern.