Toronto-Dominion Bank (TD) just settled a money-laundering suit with the U.S. Department of Justice ('DOJ')...

Toronto-Dominion Bank (TD) just settled a money-laundering suit with the U.S. Department of Justice ('DOJ')...

The federal agency is ordering the bank to pay a $3.1 billion fine and placing a cap on its U.S. banking assets. That's a big blow to TD Bank's $400 billion domestic portfolio.

And it will surely affect its $14.6 billion stake in U.S.-based Charles Schwab (SCHW).

TD Bank acquired its position after Charles Schwab absorbed TD Ameritrade in 2020. And now, regulators are forcing TD Bank to walk away from it.

Some may see this as a defensive retreat, yet it's making the most of a bad situation. TD Bank is selling its Charles Schwab stock at $79.25 per share – the high end of valuations in recent years.

And TD Bank isn't just pocketing the cash. It's using that dry powder to buy back 100 million of its own shares, reducing the bank's outstanding stock by 6% and boosting profitability.

As we'll discuss today, this may be the best possible outcome from an otherwise painful move by regulators.

Regulators are forcing this penalty on TD at a great time...

Regulators are forcing this penalty on TD at a great time...

That's because Charles Schwab's stock is fairly valued and TD's stock is relatively cheap.

This matters because stock buybacks only create value when a stock is trading below its intrinsic worth... like TD Bank is doing right now.

Savvy investors know if a company repurchases shares when the price is too high, it risks wasting valuable cash.

We don't have to worry about that with TD Bank... It has found the sweet spot, and in doing so it's...

Building the case for long-term growth...

Building the case for long-term growth...

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

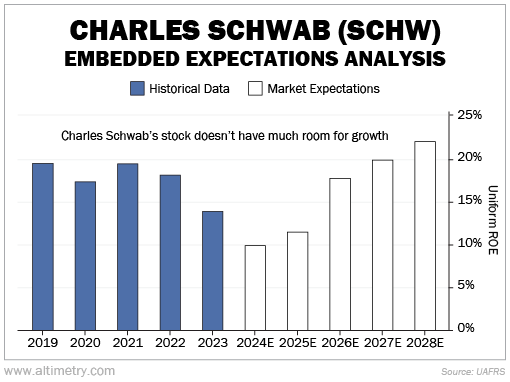

Charles Schwab's stock is fully valued, meaning it has limited upside. And investors expect its Uniform return on equity ("ROE") to gradually rise to 22% by 2028 – a level it hasn't reached in any of the past five years. Take a look...

In other words, the market is pricing in the best possible scenario for Charles Schwab.

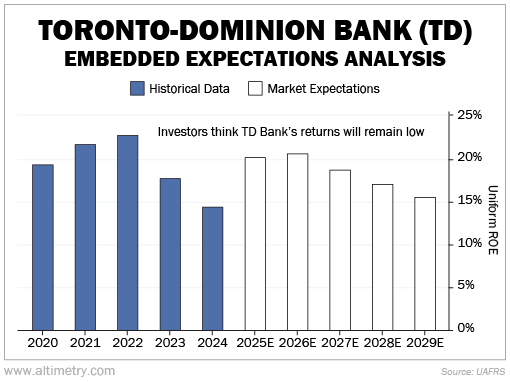

TD's stock, on the other hand, is undervalued. Its Uniform ROE peaked at 23% as recently as 2022. Yet, investors expect its Uniform ROE to fall to around 15%...

In other words, they're not able to see past the big DOJ penalty. But if TD can keep returns high, its share buybacks could actually boost profitability.

Ultimately, the DOJ's move is an opportunity for TD to create value...

Ultimately, the DOJ's move is an opportunity for TD to create value...

Although regulators are forcing TD to unwind its stake in Charles Schwab, TD is taking it all in stride...

The bank is selling its SCHW stock at a strong price and repurchasing shares at a discount, shifting capital into a higher-return opportunity.

This move will strengthen its balance sheet, increase earnings per share, and, ultimately, position it for long-term growth.

That should encourage investors, not dissuade them... TD is making the best of a tough situation, while setting the stage for more upside ahead.

Regards,

Joel Litman

March 19, 2025

Toronto-Dominion Bank (TD) just settled a money-laundering suit with the U.S. Department of Justice ('DOJ')...

Toronto-Dominion Bank (TD) just settled a money-laundering suit with the U.S. Department of Justice ('DOJ')...