Billionaire hedge-fund manager Ray Dalio is sounding the alarm...

Billionaire hedge-fund manager Ray Dalio is sounding the alarm...

The founder of Bridgewater Associates has gone through a lot of market cycles. And he has made huge profits along the way, even during the 2008 financial crisis.

So when Dalio warns that the U.S. is three years away from a "debt crisis heart attack," investors tend to listen.

In a recent Odd Lots podcast episode, Dalio laid out a grim scenario for the Bloomberg analysts... The rising national debt and soaring borrowing costs signal a tipping point.

He believes the U.S. is entering the final stages of a debt supercycle – where deficits spiral and reform becomes nearly impossible.

If the government doesn't act now, Dalio argues the U.S. could face a funding crisis and lose its financial dominance.

It's a provocative message. But when you look at the numbers more closely, the story isn't quite so one-sided...

Today, we'll explain why the U.S. debt burden is less dangerous than it appears... and why the key to economic stability is smart public investment – not austerity.

The national debt may be growing, but so is the economy...

The national debt may be growing, but so is the economy...

There's no question that the U.S. has a huge deficit... Last year, the shortfall topped $1.8 trillion.

Interest rates are rising, and the 10-year U.S. Treasury yield is hovering around 4% to 4.75%. But even these numbers don't justify the market panic.

Think of it this way... Each $1 trillion in new borrowing costs the U.S. government about $42 billion to $50 billion per year in interest. That's less than 1% of the amount collected in federal tax revenue each year (nearly $5 trillion).

More importantly, the U.S. isn't borrowing just to pay the bills. It's directing much of the spending toward long-term investments...

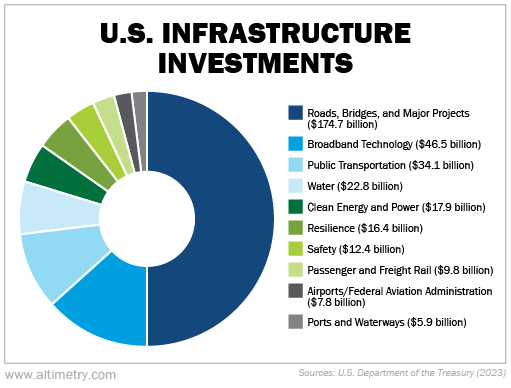

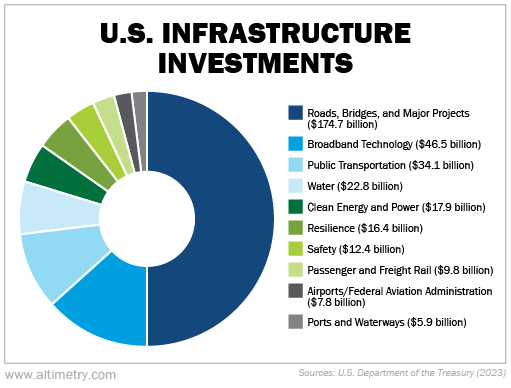

It's building chip manufacturing sites (via the CHIPS and Science Act) and repairing roads, bridges, and rail (via the Infrastructure Investment and Jobs Act). Take a look at this breakdown...

These initiatives will improve U.S. competitiveness, productivity, and resilience... and boost profits across industries.

So, if the government spends wisely, debt won't drain the economy. It will actually fuel growth. And that's because...

Public investment is more effective than most people think...

Public investment is more effective than most people think...

The International Monetary Fund ("IMF") has studied the benefits of public investment for years... specifically the multipliers. They measure the change in output based on adjustments in government spending or tax revenue.

The IMF's research shows that, in most environments, government spending on industrial policy, including infrastructure, produces solid returns.

When interest rates are in a normal range, the multiplier averages around 1.1 to 1.2. That means every dollar spent generates more than one dollar in GDP.

When interest rates are extremely low, that number can rise to 1.5 or higher. Today's rates are pretty close to the long-term average. That means public investments are likely generating multipliers around 1.1 to 1.2.

Simply put, public investment creates additional value even after the interest is paid off.

Yet folks like Dalio aren't convinced... He fears that borrowed money will go to waste – or worse, crowd out private investment. But many public projects are already attracting private capital, with moderate borrowing costs.

If public money accelerates growth and brings in higher tax revenue, the long-term debt picture looks far less alarming.

That's why investors should focus on growth rather than fear...

That's why investors should focus on growth rather than fear...

Dalio's concerns about the U.S. deficit deserve serious attention.

But slamming the brakes on public investment isn't the solution. If anything, long-term stability requires improved spending – not less spending.

Of course, there are a few conditions... Borrowing costs need to be low – a manageable slice of federal tax revenue. And new spending must be productive, by targeting public projects.

With all the technology and infrastructure initiatives on deck, the U.S. is far from a fiscal heart attack.

So don't let doomsday headlines cloud the bigger picture. The U.S. is still betting on growth... and that should give investors plenty more room to run.

Regards,

Joel Litman

April 9, 2025

Billionaire hedge-fund manager Ray Dalio is sounding the alarm...

Billionaire hedge-fund manager Ray Dalio is sounding the alarm...