The Federal Reserve finally blinked...

The Federal Reserve finally blinked...

At its September meeting, the central bank cut interest rates by 25 basis points ("bps"). Fed Chair Jerome Powell hinted we could see two more cuts before the end of the year.

The official rationale was clear enough... Employment data has been softening, and consumer spending is cooling. Policymakers want to protect the American household.

But as we've seen before, the effects of these cuts will stretch well beyond consumers. The bigger consequence is what they mean for corporate investment. To understand this, let's travel back to 1998...

That year, the Fed set a precedent that Powell may follow today...

That year, the Fed set a precedent that Powell may follow today...

When post-Cold War Russia defaulted on its government debt, the news sparked fears of a wider emerging market crisis that could bleed into losses for U.S. banks.

Soon after, Long-Term Capital Management – a highly leveraged U.S. hedge fund backed by Wall Street's biggest banks – collapsed. Volatility from the Russian default crushed its debt-laden strategy.

These two shocks threatened U.S. financial stability. So Alan Greenspan's Fed delivered three cuts in quick succession, totaling 75 bps.

While the cuts calmed financial markets, they also threw gasoline on the dot-com boom. Lower rates fueled even stronger investment for telecom and tech companies, along with U.S. corporations in general.

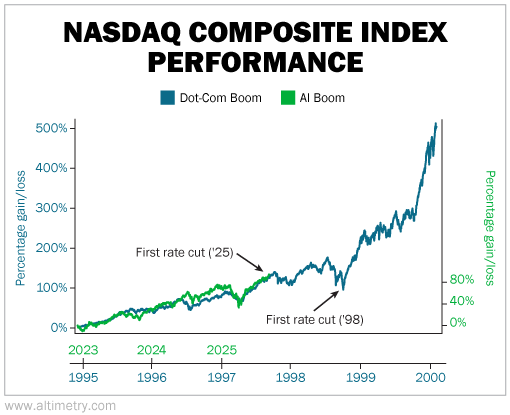

The tech-heavy Nasdaq Composite Index finished 1998 up almost 40%... then nearly doubled in 1999.

We're looking at a similar setup today. Powell's cut was aimed at stimulating employment. But the real fuel is headed straight into the technology cycle...

The Nasdaq has already been on a tear this year – thanks in large part to the artificial intelligence ("AI") boom. Now, with borrowing costs falling, AI stocks and the companies building the infrastructure to support them have even more incentive to accelerate spending.

That's why earnings expectations keep ratcheting higher...

That's why earnings expectations keep ratcheting higher...

Uniform profits grew 9% in 2024. Wall Street expects that number to climb another 9% this year... followed by 10% in each of the next two years.

And those expectations change how we view today's valuations. The market's Uniform price-to-earnings (P/E) ratio still sits at about 24 times. That's above the long-term average of 20 times.

But as earnings keep moving higher, those multiples look more reasonable. Higher earnings growth supports higher valuations... which is why tech stocks so frequently look "expensive" on a P/E basis.

We've seen this story play out before. Rate cuts intended as insurance for consumers end up supercharging tech investments. That's true even when tech investments are already considered "overvalued."

Of course, risks remain. Sentiment is elevated. And valuations will always matter if earnings stumble.

But for now, earnings are accelerating... credit conditions are steady... and it's getting cheaper to finance growth.

That's the kind of backdrop that can keep this AI-powered bull market running.

Regards,

Rob Spivey

October 6, 2025

The Federal Reserve finally blinked...

The Federal Reserve finally blinked...