Investors have been waiting all year for this moment...

Investors have been waiting all year for this moment...

The Federal Reserve enters its September 16 meeting under growing pressure to cut interest rates. And that pressure isn't just coming from the White House... but from Wall Street itself.

Folks are losing patience with high rates, which can stifle economic growth. And some believe the Fed's slow-and-steady approach has been too slow.

The central bank last cut rates in December 2024. Since then, both employment and inflation have held steadier than most expected... two key metrics to support rate cuts.

At the same time, wage growth is softening slightly. Job creation is slowing. Consumer sentiment continues to weaken. All these numbers could get a boost if the Fed slashed rates.

The central bank has every reason to pull the trigger on a rate cut. Today, we'll take a closer look at the data... and why, for the Fed, ignoring the market could be a big mistake.

July's consumer price index ('CPI') data triggered more concern than it should have...

July's consumer price index ('CPI') data triggered more concern than it should have...

Yes, headline inflation rose 0.2% month over month. And yes, core inflation rose 0.3%. But those numbers don't tell the full story.

Much of the increase came from just a few categories. Airfare jumped 4%, while used-car prices climbed 0.5%.

In contrast, prices for many consumer staples and tariff-exposed goods were flat or even down for the month.

Apparel – much of which comes from abroad – rose just 0.1%. Meats, poultry, fish, and eggs were 0.2% more expensive. Cereals and baked goods were 0.2% cheaper.

Financial-data provider ING says this data shows corporations are absorbing most of the tariff costs, rather than passing them on to consumers.

They may be playing the long game to keep inflation low... and benefit from potential lower rates in the coming months.

At the same time, the July jobs report missed expectations...

At the same time, the July jobs report missed expectations...

Longtime readers know employment data is the second half of the Fed's dual mandate. The central bank wants to see unemployment between 4% and 5%.

So when that number rose to 4.2% in July, investors expected that to be a signal Fed Chair Jerome Powell couldn't ignore.

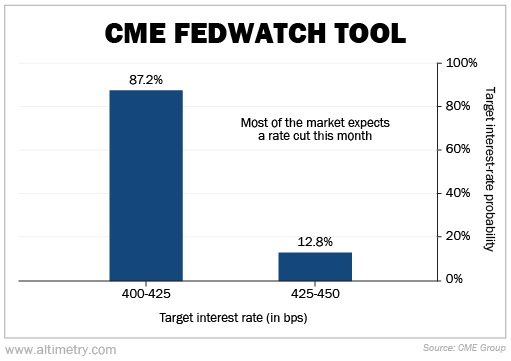

To understand market interest-rate expectations, we look at the CME FedWatch Tool. It tracks sentiment in the futures market... and right now, it's showing an 87% chance of a rate cut at the September meeting.

Take a look...

Almost the entire market is now pricing in a rate cut.

If the Fed holds steady instead, that disappointment could do more harm than good... even if Powell believes it's the right thing to do.

The Fed risks rattling the markets by doing nothing...

The Fed risks rattling the markets by doing nothing...

If the central bank doesn't act, it sends a conflicting message. Either inflation risk is higher than the market believes... or the Fed is content to let economic momentum erode further.

Either option introduces uncertainty. And uncertainty is what markets hate most of all.

Powell has spent the past two years trying to engineer a "soft landing." While inflation isn't right at the 2% target, it's not far off. Meanwhile, employment data is clearly slipping... further backing up the rate-cut narrative.

We still have one more month's worth of job and inflation data to go. The next jobs report comes out this Friday. Inflation data comes out on September 11, less than a week before the Fed's meeting.

Barring particularly good news on the jobs front or bad news for inflation, the Fed's decision should be clear.

Regards,

Joel Litman

September 2, 2025

Investors have been waiting all year for this moment...

Investors have been waiting all year for this moment...