Something has changed in the past few months...

Something has changed in the past few months...

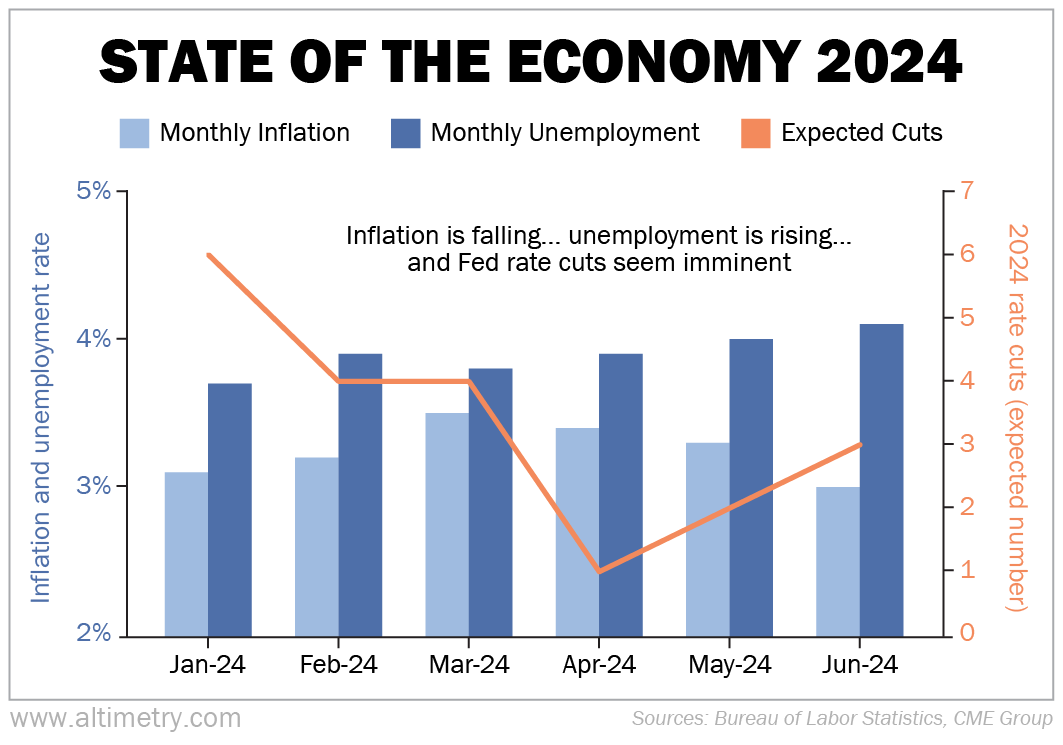

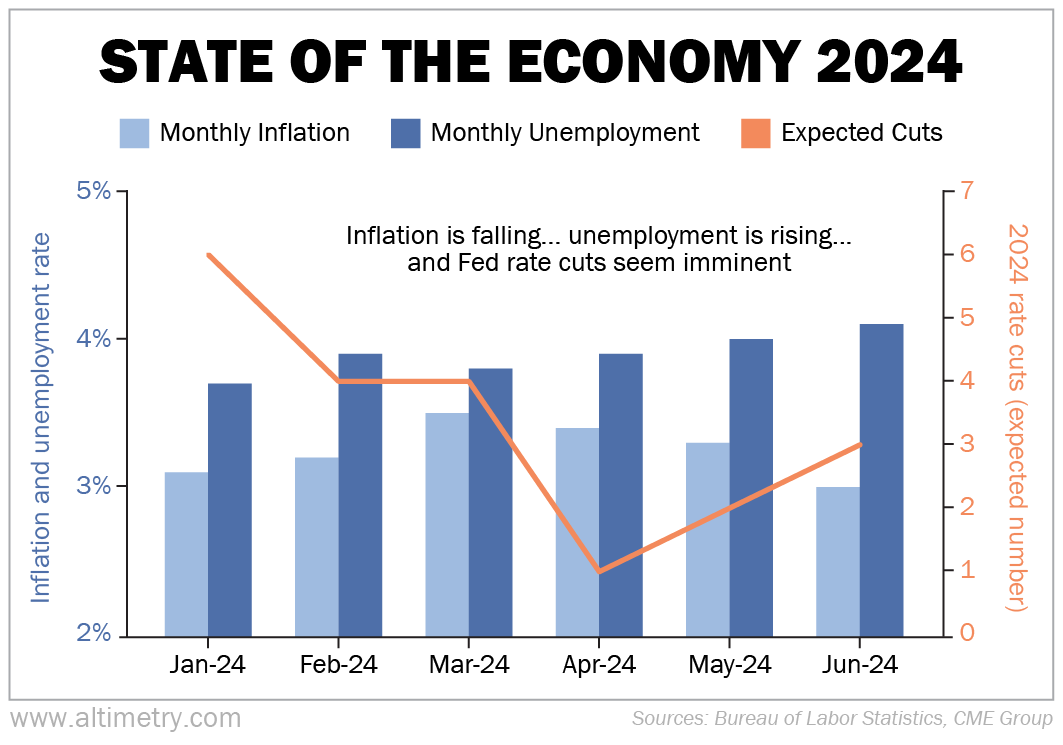

Back in January, investors expected six rate cuts this year. Quite frankly, we couldn't find a way to justify that many rate cuts... no matter how we looked at it.

Rate cuts help stimulate the economy. And earlier this year, our economy was doing plenty well on its own. It simply didn't need any help from the Federal Reserve.

Something had to give. As we explained in February...

According to the CME FedWatch Tool, which tracks sentiment in the futures market, [investors] are hoping for six rate cuts in 2024... a total of 1.5 percentage points...

You don't get six rate cuts in a healthy environment. The Fed only takes an approach that aggressive if it needs to revive an economy on life support.

Investors want to have their booming-economy cake... while feasting on recession-era interest-rate cuts. But they can't have it both ways.

Around that time, inflation actually started rising again. And the unemployment rate remained below 4% for 25 straight months... more than twice as long as the next-longest streak in the past 20 years.

Investors turned their focus to the stock market rally. They all but forgot about rate cuts. By April, expectations fell to just one rate cut for the year.

But now, they've been reminded all over again.

Longtime subscribers know the Fed follows a 'dual mandate'...

Longtime subscribers know the Fed follows a 'dual mandate'...

It aims to bring inflation down to 2%... and targets unemployment between 4% and 5%.

As recently as April, we weren't making much progress toward either of these goals. But since then, inflation – as measured by the consumer price index ("CPI") – fell to an even 3% for the first time since March 2021.

The unemployment rate rose to 4.1%. Not only is that within the Fed's mandate... it's also the highest unemployment rate since November 2021.

Until recently, investors were a lot quieter about their rate-cut expectations this time around. But they're now anticipating three by the end of the year.

And unlike back in January, we agree this time. This economy looks very different from the economy of early 2024.

Just take a look at how inflation, unemployment, and rate-cut expectations have changed this year...

Investors started 2024 far too excited about rate cuts. But today's expectations make a lot more sense.

As you can see, both unemployment and inflation are moving in the right directions to justify current predictions.

And cuts may be just what the consumer needs...

And cuts may be just what the consumer needs...

With unemployment and consumer credit delinquencies rising, two-thirds of U.S. GDP remains under stress. Rate cuts could pump some life into the parts of the market that haven't been held up by AI.

That being said, stay cautious. Potential cuts point to improvements in credit and earnings growth. But they won't send the market straight up.

There's a reason we also look at key metrics like investor sentiment for short-term market direction. And in the past month, as the market anticipated some of these developments, sentiment metrics started to reach euphoric levels.

It's no surprise we had a brief panic last week... followed by a strong recovery.

Whenever investors get stirred into a mania, even the smallest kernel of bad news could cause a pullback.

This could be just the beginning of a volatile stretch in the market.

Regards,

Rob Spivey

August 12, 2024

Something has changed in the past few months...

Something has changed in the past few months...