U.S. gross domestic product ('GDP') grew a healthy 2.5% in 2023...

U.S. gross domestic product ('GDP') grew a healthy 2.5% in 2023...

Employers added 2.7 million new jobs in the year...

And inflation dropped from almost 10% in June 2022 to just 3.4% this past December.

The economy appears to have survived the Federal Reserve's aggressive rate-hike cycle. At a glance, it looks like the U.S. is on very strong economic footing.

The stock market seems to back up this trend.

The S&P 500 rallied 24% last year... and is now back to an all-time high. The Dow Jones Industrial Average rose 5% in December. It also recently hit an all-time high. And the Nasdaq closed at its highest level in years last week. It returned an impressive 43% in 2023.

Investors are convinced the smooth sailing we've seen thus far can continue. That's one big reason for the recent rally.

The other reason – especially when it comes to November and December – can be explained by hope. But as we'll explain, positive sentiment alone can't support this market forever...

Investors expect far too much this year...

Investors expect far too much this year...

According to the CME FedWatch Tool, which tracks sentiment in the futures market, these folks are hoping for six rate cuts in 2024... a total of 1.5 percentage points.

A rate-cutting spree of that size would be like sending a few thousand volts through the economy...

You don't get six rate cuts in a healthy environment. The Fed only takes an approach that aggressive if it needs to revive an economy on life support.

Investors want to have their booming-economy cake... while feasting on recession-era interest-rate cuts. But they can't have it both ways.

There are plenty of clues as to which hopes will soon be shattered. Corporate bankruptcies are already piling up. Credit availability has been tightening for more than a year. Many companies slowed their investment last year, even in the face of that healthy GDP.

And the market seems to have forgotten about one other surefire recession signal...

And the market seems to have forgotten about one other surefire recession signal...

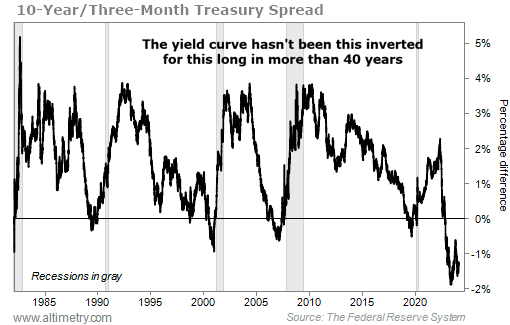

We're talking about 10-year/three-month yield curve.

The most liquid market in the world isn't stocks. It's U.S. Treasurys. And for that reason, it tends to be the best market for pricing in risk.

Usually, longer-term Treasurys have higher yields than short-term Treasurys. Investors expect to be paid more to compensate for the uncertainty of loaning out their money for longer... and missing other potential investment opportunities.

But when a recession is on the horizon, short-term Treasurys will have higher yields than long-term Treasurys. It tells us investors think growth and overall investment opportunities will be better far in the future than in the next three months.

The yield curve inverted back in October 2022. Every time this indicator has flashed, we've fallen into a recession within six to 24 months.

It has now been 16 months. We're running out of time.

Not only that, the yield curve still hasn't flipped back. This is both the most it has been inverted and the longest it has remained inverted since 1982.

Take a look...

Three-month Treasurys currently yield about 1.5 percentage points more than 10-year Treasurys. Treasury investors know we've had it good for the past six quarters... and they don't think it can last much longer.

Investors are probably making the right bet on interest-rate cuts – but for the wrong reasons. A recession is coming, likely in the next few quarters. The Fed will have to offer some relief when it hits.

Once investors realize that, their expectations will change... and stocks will fall.

It's only a matter of time.

Regards,

Rob Spivey

February 13, 2024

U.S. gross domestic product ('GDP') grew a healthy 2.5% in 2023...

U.S. gross domestic product ('GDP') grew a healthy 2.5% in 2023...