U.S. housing turnover has collapsed to a generational low...

U.S. housing turnover has collapsed to a generational low...

According to data from Redfin, between January and September of this year, only about 28 out of every 1,000 U.S. homes changed hands.

That's the lowest home-turnover rate since at least the 1990s – and a sign that Americans are staying put.

Part of this is because folks are worried about the economy slowing down... But mostly, it's because interest rates are just too high.

If you were to sell your house today and look to buy another, you're likely giving up a mortgage rate that's much lower than what you'd get now.

The average mortgage rate today is roughly 6.3%. That's one of the highest levels since 2008... and it means many folks would be losing money by taking out a new mortgage.

This kind of freeze doesn't stay contained within housing, either. When people stop moving, spending slows across furniture, appliances, renovations, and home-improvement services.

Homebuilders are worried. They're stuck in the middle of this logjam. And instead of waiting for the Federal Reserve to fix it, they're trying to blast through it themselves.

As we'll explain today, homebuilders are now offering ultra-cheap financing to jump-start demand... and it signals far more stress in the housing market than headline prices suggest.

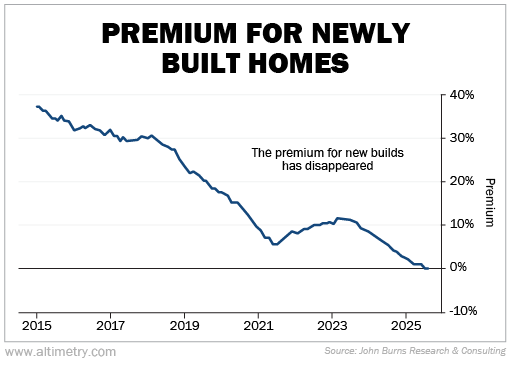

For decades, new homes reliably sold at a premium to existing ones...

For decades, new homes reliably sold at a premium to existing ones...

Buyers paid more for new builds because of benefits like modern layouts, customization options, and smart home technology.

Plus, as everything was new, buyers wouldn't have to deal with big, costly repairs or expensive maintenance that come from years of wear and tear.

The premium folks paid wasn't small... Over the past decade, new homes have sold for as much as 37% more than comparable existing homes. Over the longer term, going back to the 1970s, the average premium for a new home has been around 16%.

That relationship has now collapsed...

According to Bloomberg, new homes have recently sold for less than existing homes.

In July and August – for the first time ever – the typical price of a newly built home was cheaper than that of an existing home.

But again, current homeowners are effectively locked in. Millions refinanced or bought homes in 2020 and 2021 when mortgage rates were near historic lows. Selling today would mean swapping a 3% mortgage rate for something closer to 6%.

That keeps resale supply constrained... and supports higher prices for existing homes.

Homebuilders don't have the option to stay put. Unsold homes keep capital tied up and make it harder for these companies to move on to new developments.

So builders are now meeting buyers where they are...

So builders are now meeting buyers where they are...

Rather than wait for further rate cuts from the Fed, homebuilders are subsidizing mortgages directly.

Companies like homebuilding goliath D.R. Horton (DHI) have started offering mortgage rates as low as 1% for the first year and a fixed 4% long term.

On average, builders are spending roughly 7.5% of a home's sale price on incentives (such as mortgage-rate buydowns). That's a big jump from the just 4.8% they spent in May 2024.

Some giants like Lennar (LEN) are spending as much as 14% of revenue per home on incentives just to close deals.

Put simply, builders are bringing down borrowing costs themselves to stimulate activity.

And while this may look like a win if it spurs more home sales... we're not so sure.

Incentives don't equal strength...

Incentives don't equal strength...

Aggressive financing may pull demand forward, but it doesn't create higher profitability. When sales depend on subsidized rates and giveaways, margins are going to take a hit.

More important, this behavior could make it tough for homebuilders to raise prices in the near future. Buyers anchored to 3% mortgages and large concessions may become resistant to higher prices later.

In other words, homebuilders are backing themselves into a corner. They're risking lower margins today... and risking locking those margins in even as interest rates come down.

Right now, it's clear that homebuilders are getting desperate – and at the exact wrong time.

For investors, don't assume housing profits will snap back just because interest rates are expected to come down. Even if homebuilder sales volumes start ticking up, it's not necessarily a sign of strength.

Regards,

Joel Litman

December 18, 2025

U.S. housing turnover has collapsed to a generational low...

U.S. housing turnover has collapsed to a generational low...