The metal bathtub looked enormous in the middle of the ruined street...

The metal bathtub looked enormous in the middle of the ruined street...

Thomas Peterffy joined seven other children to drag it from one bombed-out road to the next.

Hungary lost most of its metal mines after World War I. So it bought whatever it could salvage. Signs were scattered all throughout Budapest, offering money in exchange for scrap metal.

The work took Peterffy and the other kids all afternoon. But it was worth it. Those bits of metal meant they'd have a meal at the end of the day.

Peterffy grew up during Hungary's early communist era. Food shortages and constant political pressure meant little to no stability.

So he looked for structure wherever he could find it...

Soon enough, another war ravaged the country...

Soon enough, another war ravaged the country...

More than 80% of Budapest's buildings suffered damage during World War II. But Peterffy's grandmother's library survived in full.

He read several French classics that taught him about life outside of a communist regime. He learned there was an entire world outside of his war-torn bubble. And he sought out some of the order he read about in those books.

When Peterffy reached America in his 20s, he had almost no money and limited English. But he carried those survival skills from his childhood in communist Budapest.

He had already taught himself basic programming on early desktop machines... which gave him a path forward in a fast-paced society. Soon, Peterffy found his opening through another Hungarian immigrant named Janos Aranyi.

Aranyi introduced him to finance companies that needed help using computers...

Aranyi introduced him to finance companies that needed help using computers...

They wanted to speed up the way their investments worked.

Commodities traders had to enter all their data by hand. Every process depended on human memory. Traders made decisions based on habits and instincts. Their tools were too slow to support anything else.

But Peterffy changed that, one database at a time. He compiled information using basic punch cards... and turned the whole mess of data into a simple report.

Before long, other businesses heard of Peterffy's innovation. They asked him to analyze commodities and currencies alike.

And each new project revealed the same problem...

Markets relied on intuition, because nothing better existed – yet...

Markets relied on intuition, because nothing better existed – yet...

Peterffy realized the solution was to control the entire process himself. He set up his own small trading company so he could run every trade through the programs he wrote.

The system pulled in live prices, checked them against his models, and produced a precise order to buy or sell.

He upgraded the technology again and again. The system became faster, more accurate, and far less dependent on human judgment.

And all the while, Peterffy kept his technology-based edge at the forefront of his business.

Peterffy's small trading company still exists today...

Peterffy's small trading company still exists today...

Only it's not so small anymore. Interactive Brokers (IBKR) is one of the biggest trading platforms in the world.

Peterffy's expertise lies in tech. And that's the lifeblood of Interactive Brokers...

For most banks and brokerages, tech is an afterthought. The user interface is harder to navigate. Bugs crop up, or the system gets glitchy. On and on it goes.

That's not the case for Interactive Brokers... because it's a financial super-app.

Peterffy built his reputation on leveraging technology better than anyone else on Wall Street. And thanks to his obsession with technology and innovation, Interactive Brokers is also one of the most efficient brokerages in the world.

The company has grown from fewer than 1.5 million clients at the start of 2021 to 4.3 million today. Revenue is up from $2.8 billion in 2021 to $6 billion over the past 12 months.

But the rest of the market doesn't see it.

Investors are too fixated on as-reported accounting...

Investors are too fixated on as-reported accounting...

Based on generally accepted accounting principles ("GAAP"), Interactive Brokers looks nothing like an industry disruptor.

In fact, it looks like it's struggling to stay in business.

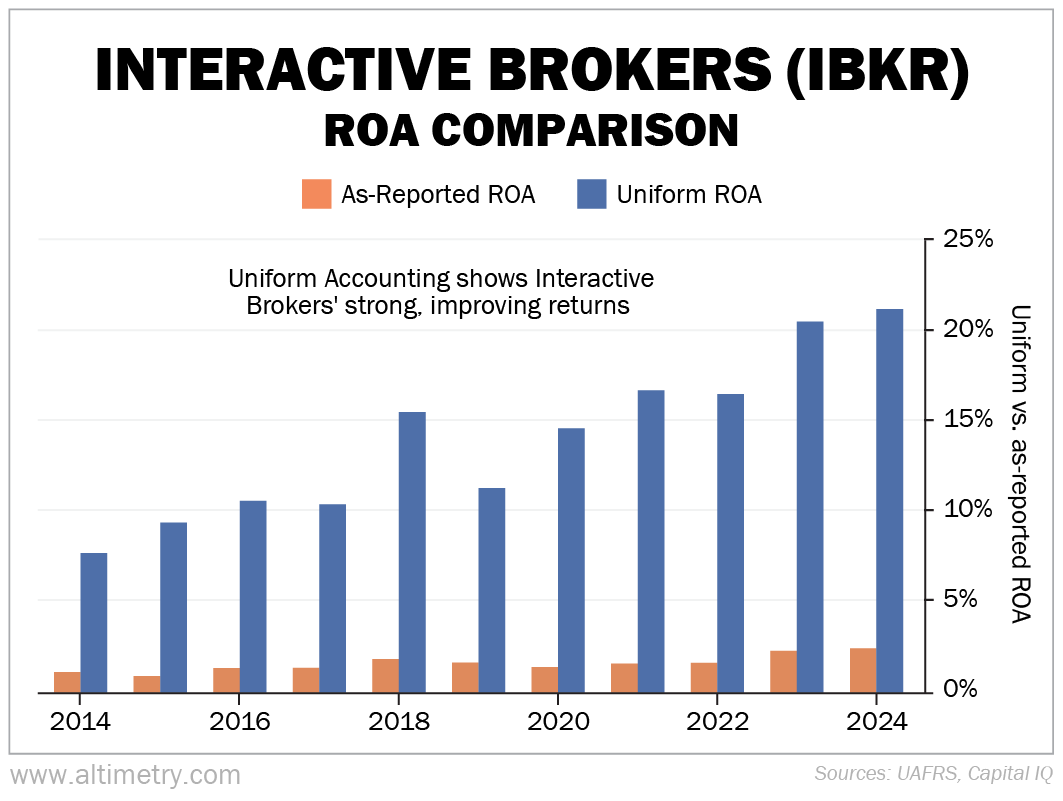

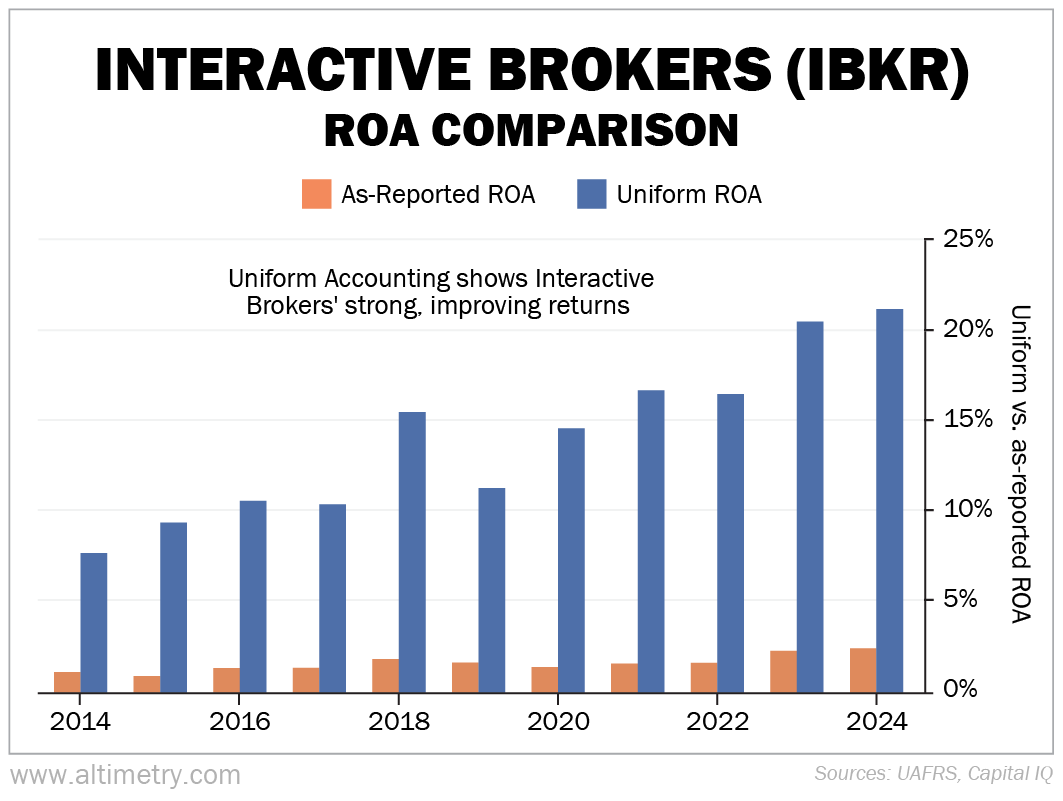

As-reported return on assets ("ROA") was 1% in 2014. It has barely improved in the past decade, to a little more than 2% last year.

But Uniform Accounting shows us a more accurate picture. When my team cleaned up the GAAP financials, the real story became clear...

Interactive Brokers is far more profitable than investors realize. Uniform ROA has been above breakeven for the past decade.

And returns have topped the 12% corporate average every year since 2020...

Most businesses struggle to become more profitable as they grow. But Interactive Brokers isn't most businesses.

Back in 2014, the company generated just $1 billion in revenue. Its Uniform ROA was an unimpressive 8%. Since then, revenue has climbed to more than $5 billion. And returns have climbed above 20%.

The secret lies in its tech-heavy platform...

The secret lies in its tech-heavy platform...

Building a platform like this is expensive. But once it's built, adding new users costs next to nothing.

As this company continues to add users to its platform, we expect profitability to keep soaring.

And thanks to misleading GAAP financials, the rest of the market hasn't figured out what it's missing... yet.

Regards,

Joel Litman

December 17, 2025

P.S. Uniform Accounting is the lifeblood of Altimetry. And today at 12 p.m. Eastern time, my colleague Rob Spivey is "pulling back the curtain" for our final Master Class of 2025...

In this live session, Rob will walk you through how our research team uses the Altimeter Pro every day. He'll explain how our Credit Analyzer and ETF Analyzer fit into the process. And he'll close with an extended live Q&A.

This Master Class is built for investors who want to see the markets the way the pros do – through real data, not just hype. It's the perfect session to round out your 2025 and set yourself up for the new year.

Our Master Class series is free for existing Altimeter Pro subscribers. You should have received your invitation via e-mail on December 12.

For everyone else, we're offering a 30-day free trial of the Altimeter Pro... including all 16 recorded Master Classes (and access to today's session). Full details here.

The metal bathtub looked enormous in the middle of the ruined street...

The metal bathtub looked enormous in the middle of the ruined street...