The 'most feared person in Silicon Valley' hasn't done her job...

The 'most feared person in Silicon Valley' hasn't done her job...

When Lina Khan became chair of the Federal Trade Commission ("FTC") in 2021, she was expected to rein in Big Tech.

For years, the largest tech companies had only gotten bigger and more concentrated. Folks were growing concerned about potential monopolies and anti-competitive business practices... and not much had been done to keep these companies in check.

Khan had made waves in 2017 when the Yale Law Journal published her article, "Amazon's Antitrust Paradox." She called for the breakup of Amazon (AMZN)... and for the U.S. to modernize its antitrust laws to include Big Tech.

A few years later, when she became chairwoman of the FTC, she made it her mission to take on the world's largest tech companies.

But so far, her efforts haven't been realized...

For example, late last year, the FTC tried to block Microsoft's (MSFT) acquisition of video-game publisher Activision Blizzard (ATVI), claiming that it would hurt competition in the gaming industry. This July, a federal judge ruled in favor of the merger, saying that the FTC was unable to prove it would lessen competition.

The FTC also tried block Meta Platforms' (META) acquisition of virtual-reality company Within Unlimited last year. Again, it lost. A district judge ruled that the FTC didn't have enough evidence to support its antitrust claims.

Regulators' inability to control Big Tech's mergers and acquisitions (M&A) has caught the attention of dealmakers. They're starting to feel more confident in taking risks on ambitious deals.

This benefits both tech companies and those orchestrating the deals – investment banks.

Today, we'll take a look at one investment bank that has struggled with the slowdown in M&A activity. As we'll explain, Big Tech's recent wins may signal a rebound in dealmaking. And that's fantastic news for this company...

The FTC's failures are a sign that things may be looking up...

The FTC's failures are a sign that things may be looking up...

It's no secret that deal flow has been down. M&A announcements fell 30% in 2022.

Tightening credit standards, rising borrowing costs, and increasing valuations make it difficult for companies to find acquisition opportunities.

However, deal flow isn't completely drying up. It's only down about 4% through the first half of 2023.

And the tech sector might have more room to keep making deals, as the FTC hasn't made any regulatory progress.

That's good news for an investment bank like Lazard (LAZ)...

The company focuses on two areas: M&A advisory and asset management. These can be massively profitable businesses. But lower M&A activity over the past year-plus has seriously weighed on profits...

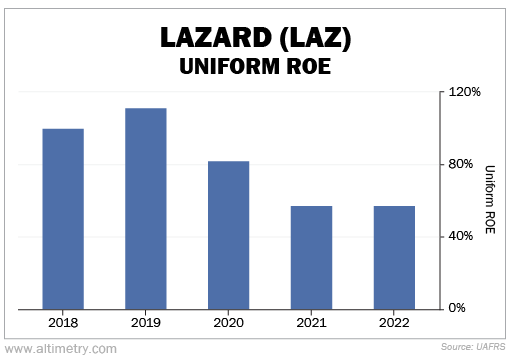

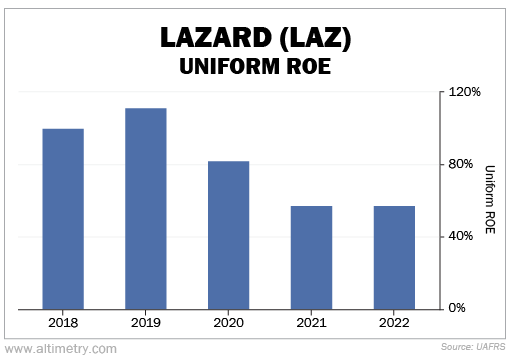

Before the pandemic, Lazard's Uniform return on equity ("ROE") was incredibly high – at around 100%. As of last year, it has plummeted all the way down to 57%.

Take a look...

That's a huge drop. However, with the FTC's recent shortcomings, Big Tech might not be so concerned about reining in M&A activity. That means Lazard's returns may not drop much more...

But the market isn't giving Lazard enough credit...

But the market isn't giving Lazard enough credit...

It's not pricing in the company's ability to keep generating high returns if more tech M&A is on the horizon.

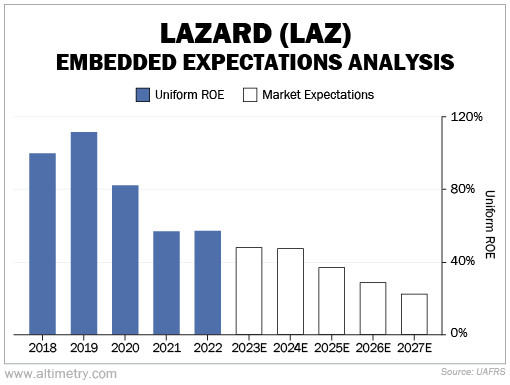

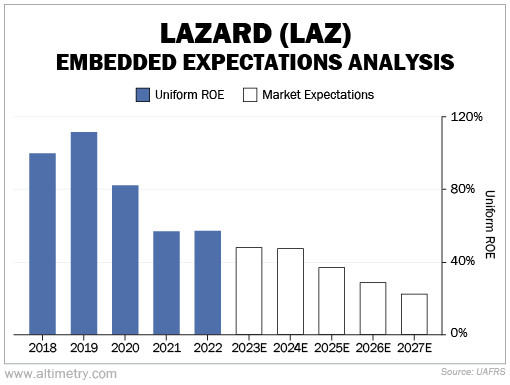

We can see this through our Embedded Expectations Analysis ("EEA") framework...

We begin by looking at a company's current stock price and calculate what the market expects from the company's future cash flows. We then compare that figure with our own cash-flow projections.

In short, the EEA tells us how well a company has to perform in the future to justify what the market is paying for it today.

At the current market price, the market expects Lazard's business to collapse further. In fact, it's pricing Uniform ROE to be cut by more than half.

Check it out...

Lazard has managed to keep its returns high even when deal flow has slowed down in the past. The company's Uniform ROE has never been below 50%. That's more than four times the 12% corporate average.

Today's expectations seem too negative. Investors are pricing in M&A activity falling to all-time lows, when it seems like there's reason to believe deal volume will keep up just fine.

Unless Lina Khan finally reins in Big Tech, Lazard has nothing to worry about...

Unless Lina Khan finally reins in Big Tech, Lazard has nothing to worry about...

Investors appear to be expecting the slowdown in dealmaking we've seen since late 2022 to continue.

And while high interest rates and a potential recession are certainly reasons to think there may be some slowdown... the FTC's push to break up Big Tech probably isn't another.

M&A activity in the tech industry is likely to rise as more acquirers are encouraged by regulators' inability to regulate. That benefits the banking industry – and companies like Lazard.

And the market's pessimism toward Lazard might just give investors an opportunity if M&A activity stabilizes from here...

Regards,

Rob Spivey

August 16, 2023

The 'most feared person in Silicon Valley' hasn't done her job...

The 'most feared person in Silicon Valley' hasn't done her job...