Tech is driving the market this year...

Tech is driving the market this year...

The Nasdaq 100 just recorded its best first half of the year ever. The index, which tracks 100-plus nonfinancial companies – including many of the biggest tech players – rose 40%. It even beat its first-half performance during the dot-com bubble.

But here's the issue... Only six companies were responsible for much of this rally.

Google parent Alphabet (GOOGL), software giants Microsoft (MSFT) and Nvidia (NVDA), tech titan Apple (AAPL), e-commerce leader Amazon (AMZN), and electric-vehicle innovator Tesla (TSLA) led the Nasdaq 100 higher.

After the first half of the year, these six companies accounted for more than 50% of the Nasdaq 100's weight. So when investors bought into the Nasdaq 100, they were essentially investing in these six companies.

The other 94 were pretty much afterthoughts.

Three weeks ago, Nasdaq decided to do something about this concentration. It executed a special rebalance... meaning it cut those six stocks' collective weight from roughly 51% to just 40%.

The market is more concentrated than ever before. Today, we'll explain why that's a huge problem for investors. And we'll discuss why increasing market concentration will lead to more pain down the road.

Investors are getting more bullish by the day...

Investors are getting more bullish by the day...

And that's a big reason why the market has rallied this year.

Equity exposure surpassed 100% in July... which is only possible when investors use leverage. That's a clear sign these folks are concentrating their bets and trying to make the most of the rally.

It's not just a matter of where bets are placed. It's also about how these bets are influencing the overall market. The market can become skewed when a lot of money is flowing into just a few stocks.

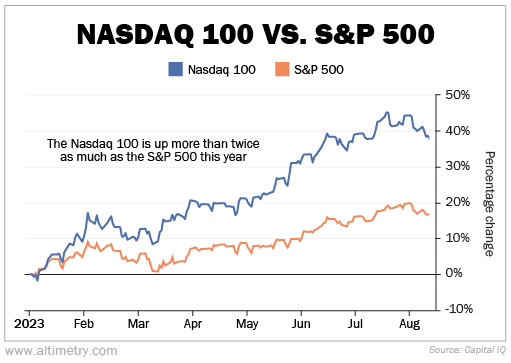

That's why the Nasdaq's rebalancing was a much-needed change. The Nasdaq 100 has significantly outperformed the rest of the market this year, thanks to those "Big Six" stocks. It's still up more than 37%, compared with 16% for the S&P 500.

Take a look...

Like the Nasdaq 100, the S&P 500 also weights its holdings based on market cap. It also has excessive exposure to those Big Six companies. But because it has five times as many constituents, it's way more diversified.

The situation looks even worse when you look at the S&P Equal Weight Index. This index essentially levels the playing field... It weights all S&P 500 constituents equally, so each represents roughly 0.2% of the portfolio.

The S&P Equal Weight Index has far underperformed both the Nasdaq 100 and the traditional S&P 500... It's only up 7% this year.

No wonder plenty of investors have struggled to keep up with the market. If you were exposed to nothing but the Big Six, you'd be doing great.

But everything else... not so much.

Nasdaq's latest decree has the potential to slow down this concentration cycle...

Nasdaq's latest decree has the potential to slow down this concentration cycle...

And that could lead to a lot of pain for a lot of people.

Six stocks are keeping the market alive this year. If they lose momentum, investor sentiment could flip fast.

If more indexes follow Nasdaq's lead and cut the Big Six's influence, a lot of money could flow out of those stocks. Equity allocations could plunge as folks pull their cash out of the market.

Expect more volatility on the horizon. As an investor, you ought to keep your sights set on the long term. Stay diversified... and keep an eye out for announcements that could cause downside in the near future.

Regards,

Rob Spivey

August 15, 2023

Tech is driving the market this year...

Tech is driving the market this year...