Once again, the 'Oracle of Omaha' is listening to this legendary investor...

Once again, the 'Oracle of Omaha' is listening to this legendary investor...

We're talking about the "Oracle's Oracle" Howard Marks.

Back in May, we mentioned just how fond Warren Buffett is of the Oaktree Capital Management co-founder... Buffett reads Marks' letters before anything else because he always learns something new.

And he was probably among the first to read Marks' recent thought piece in the Financial Times...

In that article, he discussed why investors should "exploit the differences between how things are supposed to work and how they actually [work]."

The reason is simple... We tend to rely on business fundamentals to determine how stocks should perform... And while that is a vital part of smart investment decisions, there is another piece of the puzzle... investor sentiment.

You can analyze a company to death, understand everything about it, and still lose money... if you don't take into account how other investors think.

Contrarians like Marks know that real investment success comes from market dislocations… That’s where fundamentals and prevailing investor sentiment diverge.

Despite an unpredictable market, we can still capitalize on these conditions to reap financial rewards while avoiding big losses.

Today, we'll explain how Marks' investing framework can help us identify, and navigate, market dislocations within the current economic environment...

Investor sentiment often dictates key market moves...

Investor sentiment often dictates key market moves...

To understand market dislocations, you have to be able to recognize market patterns...

Marks has more than 50 years of investing experience. And the more market history he covers, the easier it is for him to recognize historical patterns in today's market.

One pattern that repeats time and time again involves investor sentiment... Markets will often correct due to extreme investor sentiment in either direction.

To identify upcoming market corrections, we need to do three things: (1) pinpoint the source of irrational investor behavior, (2) identify market movements based on investor sentiment, and (3) determine the extent of the bearish or bullish sentiment... and then figure out the divergence between sentiment and reality.

In order to make real money, we need to keep our finger on the pulse of investor sentiment, resist the temptation to follow the "herd," and keep our emotions in check.

Simply put, when the market is bearish, you need to be bullish. And vice versa.

To get the most out of Marks' investment approach, though, we need to consider the broader market outlook...

Several macro signals are pointing to an 'irrational' market...

Several macro signals are pointing to an 'irrational' market...

In our monthly newsletter Timetable Investor, we summarize macro market signals and explain how they can help position investors for the next three to 24 months.

Two of those key signals involve credit and corporate investments...

Credit has us worried right now because it is continuing to tighten, and that could lead to a credit crunch by early next year.

Corporate investments show us whether companies are putting capital to work and help us project future earnings. Right now, earnings are forecast to shrink this year... and that's not great for the overall economy.

Knowing this context, we can use Marks' framework to figure out if investors are currently too bullish or too bearish and adjust our investment strategy accordingly...

With these two negative macro signals in play, it would make sense for investors to have a bearish outlook.

Yet, that does not reflect reality... Instead, investors are excessively bullish right now, and that creates a clear market dislocation.

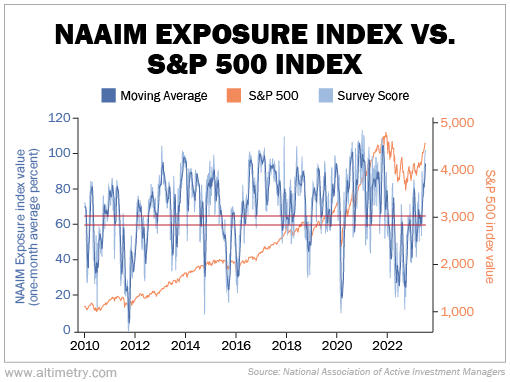

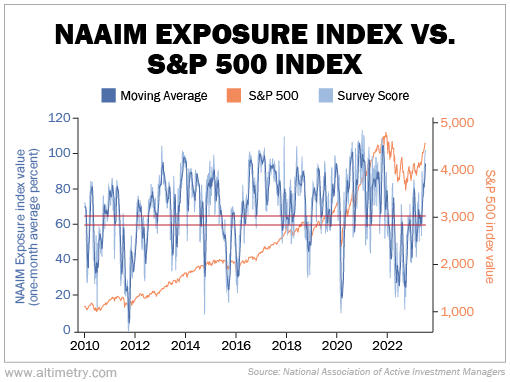

We can illustrate this point by using the National Association of Active Investment Managers ("NAAIM") Exposure Index...

This index draws data from a weekly survey that tracks the proportion of assets members invest in equities. Results tend to fall between 0% and 100%... They can be lower than 0% if investors are shorting stocks or higher than 100% if investors are using leverage to buy assets.

The long-term average allocation falls between 60% and 65%. That means active investors in an average market have 60% to 65% of their assets in stocks.

When allocations rise, investors are bullish, leading them to pour a lot of money into the stock market.

Right now, investors are getting bullish... and fast.

Total equity exposure reached 83% at the beginning of July before rising to 102%. That's way above the long-term average, marked with the red lines below...

This high equity exposure is a clear sign of a strong bullish sentiment despite worsening macro factors like credit and earnings.

Today's unpredictable market presents a unique opportunity for contrarians...

Today's unpredictable market presents a unique opportunity for contrarians...

Howard Marks would call this trend "irrational."

After all, investors seem overly optimistic at a time when key fundamental markers give us reasons to be more pessimistic.

Marks' framework also suggests that today's overall market is "irrational," meaning there's a clear dislocation between fundamentals and investor sentiment.

And when the market gets overly bullish, that means a negative correction could be coming soon. (We still think we’re heading for a sideways market.)

That's exactly where we can apply Marks' contrarian approach... We can profit from current market conditions by going against the grain and getting bearish.

With a flat, unpredictable market on the horizon, though, we recommend a cautious investment approach over the next few months.

Regards,

Joel Litman

July 31, 2023

Once again, the 'Oracle of Omaha' is listening to this legendary investor...

Once again, the 'Oracle of Omaha' is listening to this legendary investor...