Major money centers aren't the only big winners of the banking crisis...

Major money centers aren't the only big winners of the banking crisis...

Since Silicon Valley Bank ("SVB") and Silvergate Capital (SI) collapsed in early March, a lot of ink has been spilled over the fallout.

Rattled depositors are fleeing regional banks for big, "safe" institutions like Bank of America (BAC), Citigroup (C), JPMorgan Chase (JPM), and Wells Fargo (WFC). They've received tens of billions of dollars in deposits since the banking crisis.

And yet, with all eyes on these industry giants, the market is missing another bank-collapse beneficiary.

I'm talking about money-market funds.

Even before the collapses, money-market funds had been slowly draining deposits from banks for several quarters.

Banks have been slow to raise interest rates on their savings accounts alongside the Federal Reserve's rate hikes. So clients who wanted a higher yield moved their deposits to money-market funds... in order to get something closer to real interest rates.

Now, large depositors aren't just chasing yield. They're worried about keeping a lot of money in regional banks. What had been a steady drip has become a money-market deluge.

Like big banks, investors see these as a safe place to store their cash. After all, the 2008 financial crisis proved that the Fed won't let money-market funds go down. It's a sure bet they have the government's backing, just like they did back then.

However, this flood of deposits into money-market funds is a bad sign for the economy. As I'll explain today, that rush of funds out of banks is leading to a lot fewer loans. And investors should exercise caution.

Bank lending is about to fall off a cliff...

Bank lending is about to fall off a cliff...

We warned you last week, that commercial and industrial (C&I) loan growth is rolling over for the first time since 2020. It had already turned negative before the bank failures.

Remember, these loans aren't given to individuals. They are given to companies so they can invest and grow. That makes C&I loan activity an incredibly important metric to gauge the economy's overall health.

When C&I loans are dropping – like they are today – it means companies have less cash on hand. And that could lead to a slowdown in economic activity.

To get the full picture, though, we have to take it a step further... and understand why C&I loans are declining.

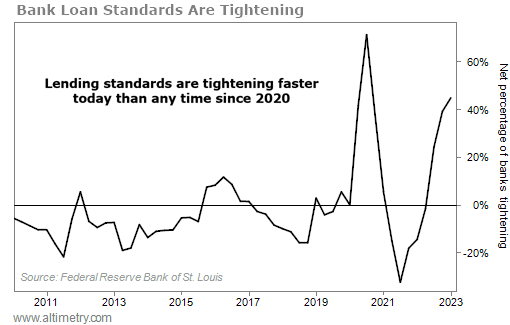

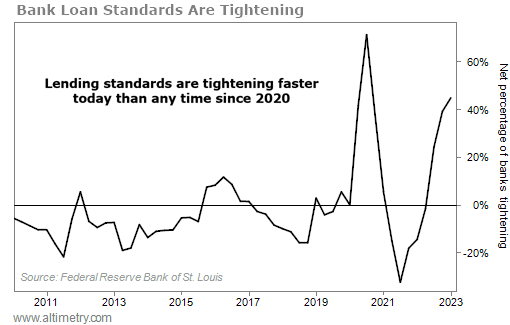

We can see this through the Senior Loan Officer Opinion Survey ("SLOOS").

The SLOOS is a poll conducted every quarter by Federal Reserve regulators. It asks loan officers if their lending standards have tightened, loosened, or stayed the same over the past three months.

Said another way, it tells us how willing banks are to make loans... and how easy or difficult it is for corporations and consumers to access credit.

According to the SLOOS, banks were already aggressively tightening lending standards way before SVB collapsed.

The chart below shows the percentage of domestic banks that tightened standards for C&I loans to large- and middle-market firms. As you can see, the number has been increasing pretty quickly since July 2021...

In the first quarter of 2023, 45% of banks tightened lending standards. And that's on top of the 39% that tightened at the end of last year.

They charged higher premiums on riskier loans, increased the spreads over the cost of funds, and tightened covenants and collateralization requirements.

Again, that started before Silicon Valley Bank collapsed... and before there was a run on deposits at many regional banks.

Regional banks are a vital part of the lending ecosystem...

Regional banks are a vital part of the lending ecosystem...

Much more than big banks and money-market funds, they create mortgages and lend to both local businesses and commercial real estate.

The rush to money-market funds is going to make today's lending freeze much worse. After all, money markets only fund very short-term borrowing for corporations – nothing long enough to allow for lasting investment.

Unfortunately, with regional bank deposits shrinking, it limits the amount of loans these banks can make. They're going to get more and more selective about which loans they underwrite.

The problem isn't that lending got slightly tighter in the past three months. It's that a lot of banks tightened even more than they had before.

In the past decade, banks have only tightened faster than this one other time... in in the third quarter of 2020, in the midst of the pandemic. Everyone was still terrified that we'd get a flood of companies going under.

As we've talked about time and time again, credit cycles lead economic cycles. So if credit is getting harder to come by for corporations and consumers, it's going to push us further and further toward a recession. And it will likely happen at a faster rate than many expect.

All the more reason to stay cautious with your investments right now. Don't let the recent strength in the stock market fool you. We're not in a new bull run.

Until credit starts to flow more easily, we'll continue to be in a choppy, sideways market... and you need to be tactical to keep your head above water.

Regards,

Joel Litman

April 17, 2023

Major money centers aren't the only big winners of the banking crisis...

Major money centers aren't the only big winners of the banking crisis...