The outlook isn't great for a lot of industries right now...

The outlook isn't great for a lot of industries right now...

Last week, the Institute for Supply Management ("ISM") announced its Purchasing Managers' Index ("PMI") rating for March. The index measures how strong manufacturing activity is in the U.S.

A PMI rating below 50 indicates economic activity is shrinking. March's rating was 46.3... one of the worst values since 2009. Even worse, it was below economists' expectations of 47.5.

Along with the data, ISM releases some of the most relevant quotes from purchasing managers. Last month's comments didn't exactly bode well for economic growth...

Sales a bit down, and budgets being cut with a greater emphasis on savings.

Business is still slow overall. Customers have not yet picked up orders at pre-pandemic levels.

Demand appears to be slowing. And companies are beginning to react. They're producing less... and some are even cutting their workforces.

The surprise PMI drop is only the latest in a string of economic difficulties...

Businesses are already feeling the pressure of rising interest rates. The possibility of a recession is increasing by the day. The bank panic in the middle of March didn't help matters.

As we'll explain today, PMI isn't the only sign that economic growth is slowing down. Another key data point is flashing red today...

Corporate investment is one of the most important economic health indicators...

Corporate investment is one of the most important economic health indicators...

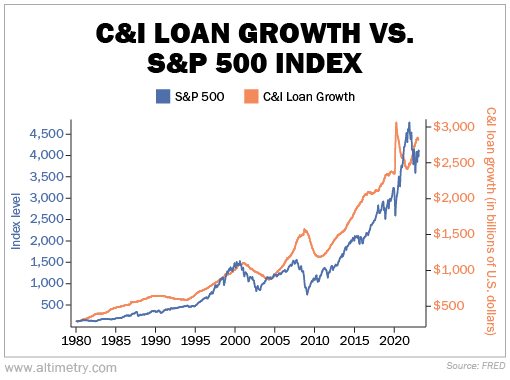

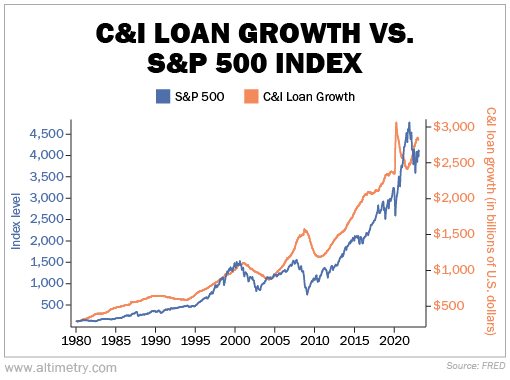

To track this metric, we look at something called commercial and industrial (C&I) loan growth.

Companies use C&I loans to fund capital projects instead of relying on cash flows. So C&I loan growth can tell us a lot about corporate investment and the corporate outlook.

At its heart, economic growth is powered by credit cycles. When credit availability is improving and anyone who needs a loan can get one, it's easy for companies to refinance and borrow for growth. That leads to strong gross domestic product ("GDP") growth and a bull market.

On the other hand, when credit availability is tight and demand is declining, the economy contracts.

C&I loans can be a driver of economic activity. The market often tends to follow it closely. That's what happened in every major bear market over the past 30 years.

In 1990, 2000, 2008, and 2020, C&I loans declined. And in each of those years, we saw recessions at the exact same time. Declining loans had ripple effects across the economy.

Take a look...

As you can see, the S&P 500 closely tracks C&I loan growth activity.

And it goes both ways... When C&I loan shrinkage bottoms out, it's an equally important signal. That's when the economy goes from a consolidating bear market back to a bull market. We saw this in 1994, 2003, 2010 to 2011, and in early 2021.

Current C&I loan growth is sending negative signals...

Current C&I loan growth is sending negative signals...

Right now, C&I loan growth is rolling over again for the first time since early 2020.

In the past three months, C&I credit contracted a little less than 1%. Loan shrinkage has only been that bad (or worse) about once every six years for the past two decades... about as frequently as you see a recession. In the middle of last year, loan growth reached 4% per quarter.

In short, companies are no longer looking to invest. That's why we don't think the recent PMI data is a one-off. It's part of a bigger story... Economic activity is slowing down.

Until credit availability improves, those PMI trends aren't likely to rebound. Production levels will stay lower until corporations regain confidence and banks make it easier to access credit again.

Inventories will continue to dwindle. Employment in sectors that rely on manufacturing may suffer. And that's a good reason to remain cautious and tactical in this range-bound market.

Regards,

Joel Litman

April 10, 2023

The outlook isn't great for a lot of industries right now...

The outlook isn't great for a lot of industries right now...