Investors have tunnel vision... and the pros are starting to worry.

Investors have tunnel vision... and the pros are starting to worry.

Much of the market has been chasing the hyped-up artificial-intelligence ("AI") boom. The S&P 500 is up 26% since its October 2022 low, with tech leading the way.

Yet today's booming market can't disguise the harsh truth... Earnings are on pace for a big decline this year.

Savvy analysts are beginning to see reality. They've raised concerns as high interest rates lead to less borrowing and cool off global growth.

These experts caution against chasing the trend. Investment bank Morgan Stanley (MS), for example, forecasts that the S&P 500's earnings per share ("EPS") will decline 16% to $185 in 2023.

Plus, March's banking crisis and tougher borrowing conditions make an economic slowdown likely.

Yet the market is going against conventional wisdom. It's still rallying, despite the threat of shrinking earnings. And as we'll discuss today, it's a recipe for pain.

When it comes to corporate earnings, companies have a lot of tools to 'game' their performance...

When it comes to corporate earnings, companies have a lot of tools to 'game' their performance...

For instance, when executive teams know earnings are going to be bad for a few quarters, they'll sometimes do everything in their power to make those quarters look as bad as possible.

This is called a "big bath." It basically makes earnings expectations look worse than they really are. That way, it's easier for the company to beat those expectations.

That's one of the reasons why it's good to be skeptical toward Wall Street's numbers. However, in this instance, the cleaned-up data supports analysts' concerns.

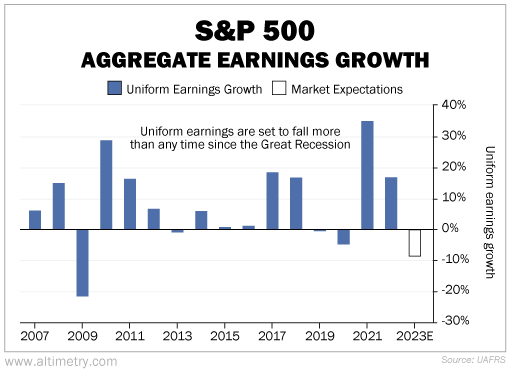

We multiply Uniform return on assets ("ROA") by Uniform assets to calculate earnings (or "cash flows"). When we do this in aggregate for the entire S&P 500, a concerning pattern emerges...

The last time Uniform earnings experienced a material year-over-year decline was in 2009 – during the financial crisis.

The following chart shows aggregate Uniform earnings growth for the S&P 500 since 2007. As you can see, Uniform earnings fell 22% in 2009.

Since then, they've grown pretty consistently – aside from blips in 2013 and 2019, and 5% earnings shrinkage in 2020.

However, 2023 is set for a worrying shift. It looks like it'll be the worst year for corporate earnings since the Great Recession.

Take a look...

Wall Street analysts are right to be worried... The Uniform data backs them up. Uniform earnings are expected to drop 9% this year. That's the largest fall in more than a decade.

The Federal Reserve's interest-rate hikes are working. They're slowing down corporate growth. And yet, investors are so caught up in the AI boom that they're ignoring what's going on around them.

This is the time to be discerning about your investments...

This is the time to be discerning about your investments...

While herd mentality can keep the AI hype train chugging along for a while, it can't prop the market up forever.

The tech sector, a key driver of AI growth, is already showing signs of weakness. It has laid off more than 200,000 workers this year... even as the U.S. economy added more than 1.6 million jobs.

The same stocks leading this year's rally, like Microsoft (MSFT) and Google parent Alphabet (GOOGL), sent the market lower last year.

This AI-driven rally is shortsighted... It's being driven by the fear of missing out, not by improving earnings.

We're still taking a cautious approach toward the rest of the year. The market tends to follow earnings. And when it blunders off that path, we're in for a rude awakening sometime soon.

Regards,

Joel Litman

July 17, 2023

Investors have tunnel vision... and the pros are starting to worry.

Investors have tunnel vision... and the pros are starting to worry.