Canada's second-largest pension-fund manager has seen enough...

Canada's second-largest pension-fund manager has seen enough...

Charles Emond is the CEO of Caisse de dépôt et placement du Québec ("CDPQ"). The firm has roughly $300 billion in assets under management... 12% of which is invested in real estate. And within that area, CDPQ is running as far as it can from offices.

Office spaces used to be its single largest holding in the real estate sector, at about 28%. As of 2022, that number was down to 18%.

It looks like the fund is trimming those positions even further. As Emond said in a recent interview with Bloomberg News, "There's going to be a bloodbath in some areas."

Emond is far from alone. Pension funds are turning their backs on office real estate investment trusts ("REITs")... and for good reason.

Remote work has led many companies to rethink their office leases. After all, why hold on to office space if no one is coming into work?

Office buildings have gotten progressively emptier as a result. Vacancy rates were about 11% at the end of 2019. As of the first quarter of 2023, they've climbed to 17%.

With such low demand for office space, office REITs have started defaulting on debt and attempting to escape properties.

Today, we'll take a look at one office REIT that illustrates why these funds are so worried. As you'll see, there's a big reason to avoid this space...

Nobody wants to lend to office real estate...

Nobody wants to lend to office real estate...

Normally, REITs have little problem refinancing their debt. Since their businesses are backed by real estate assets, lenders are willing to keep financing them. They can always collect the assets as collateral.

With occupancy rates continuing to fall, the value of those assets is less certain. And for lenders, that means real estate investors are more likely to mail in the keys.

Douglas Emmett (DEI) is a great example of what lenders are trying to avoid.

The office REIT holds property mostly in Los Angeles, with some in Honolulu. That poses a big problem for the company, given the current climate of remote work...

Tech companies have a large presence within the Los Angeles region. And they're typically very flexible with remote work... which means demand for office space in the city is significantly decreasing. Office vacancy rates in LA are at a record 30%.

If this trend continues, Douglas Emmett can expect even more vacancies. Unfortunately, these high rates are already weighing on the values of its properties...

For the past 15 years, the company's Uniform return on assets ("ROA") remained around 3%.

Then, as remote work took off during the pandemic, its Uniform ROA dropped to 1%. And it has stayed around that level over the past two years. So its cash flows are clearly falling.

And to make matters worse, its debt is mounting...

And to make matters worse, its debt is mounting...

Douglas Emmett's current credit risk outlook doesn't look great. It shows the company is likely to struggle to pay its obligations going forward.

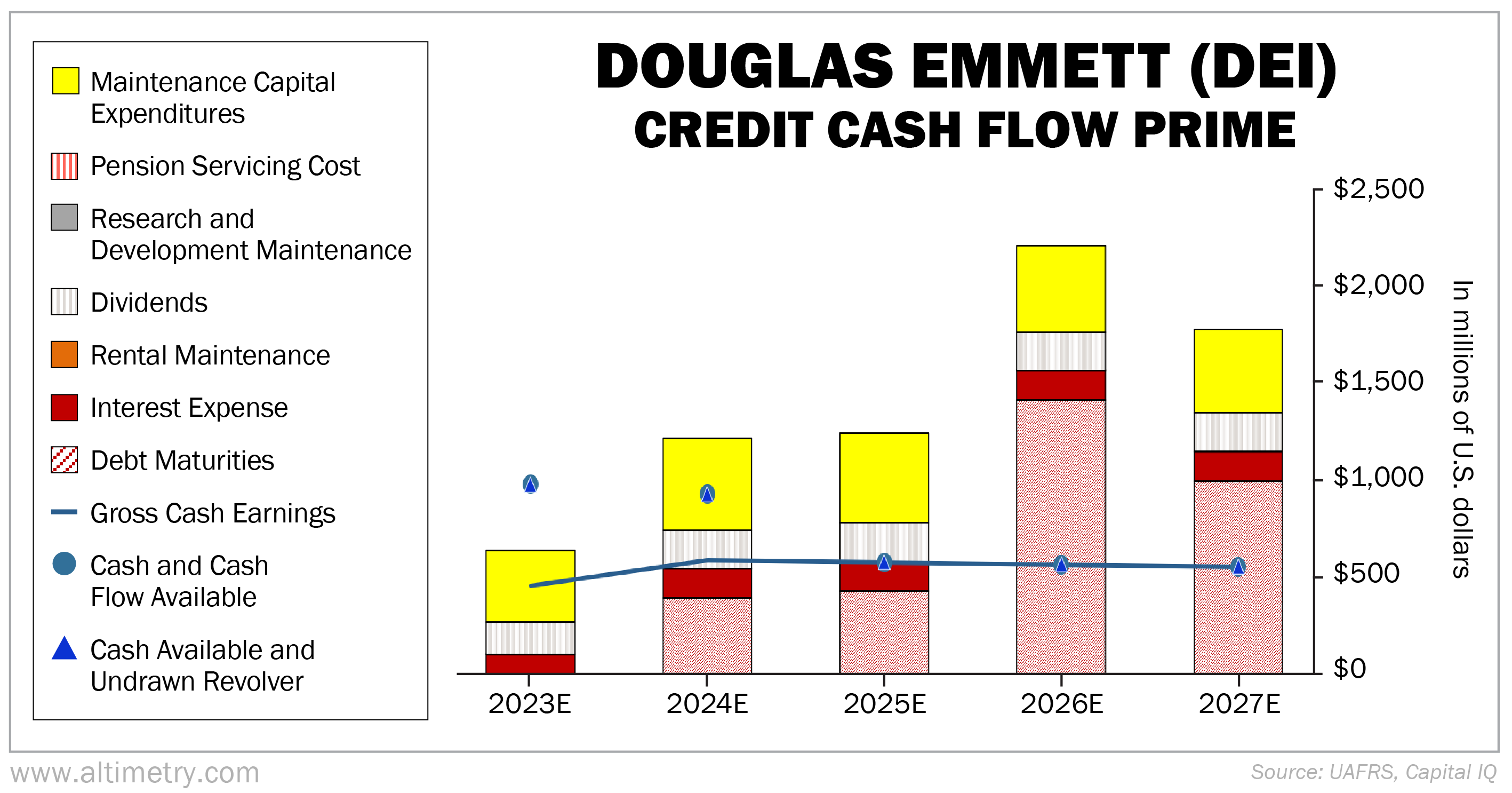

We can use our Credit Cash Flow Prime ("CCFP") analysis to see if there's a real risk of Douglas Emmett not being able to meet its future payments. The CCFP helps us compare a company's obligations with its cash position and expected cash earnings.

In the chart below, the stacked bars represent Douglas Emmett's obligations each year for the next five years, including this year. We then compare these obligations with the company's cash flow (the blue line) as well as its cash on hand at the beginning of each period (the blue dots).

The CCFP shows the company is going to have some difficulty meeting its obligations starting next year.

Take a look...

As you can see, Douglas Emmett's cash flows won't cover its current obligations. Plus, it has consistent debt maturities going forward.

These obligations are also based on today's interest rates. With variable-rate loans, the situation could worsen if interest rates rise further.

Given its current credit situation, the company will need to start considering different financing options as soon as next year. Something will need to budge.

While Douglas Emmett may be able to resolve its credit issues in the near future... that's the best-case scenario. The risk of default is not far-fetched.

For now, we think it's best to follow CDPQ's lead and steer clear from the overall office REIT space.

Regards,

Joel Litman

July 13, 2023

Canada's second-largest pension-fund manager has seen enough...

Canada's second-largest pension-fund manager has seen enough...