Office owners faced two disasters in the wake of COVID-19...

Office owners faced two disasters in the wake of COVID-19...

With most folks locked down at home, companies wanted out of their expensive office leases. The longer the pandemic carried on, the more companies terminated their agreements while they figured out what to do.

That was the first disaster. Landlords couldn't wait for the pandemic to be over... and for companies to come back to their regular 9-to-5 schedules.

But it turns out, people liked staying home. It gave them more flexibility, more time with family, and less time wearing suits.

And that became the second disaster. Employees pushed back against the return to offices... and many of them won (or at least reached a compromise). Offices have stayed largely empty.

Workers who do go into the office only do so about three days per week, on average. And it's not only happening in the U.S... One study found that the overall average for the entire U.K. labor force has dropped to 1.5 in-office days per week.

Companies have been breaking their leases for years. It's finally showing up in office landlords' bottom lines. They're starting to default on their obligations.

Brookfield Asset Management, one of Canada's largest asset managers, recently defaulted on its debt for two office towers in Los Angeles. According to the Wall Street Journal, five to 10 office towers are reaching default risk territory every month.

Today, we'll dive deeper into one real estate investment trust ("REIT") that specializes in offices. Its business has been decimated, but investors don't seem to see the danger.

Vacant offices have already meant significant disruption for office REITs...

Vacant offices have already meant significant disruption for office REITs...

And things are only going to get worse from here. Office REITs own and manage the real estate used for offices. Most companies lease office space from office REITs rather than owning their own real estate.

Within that space, Vornado Realty Trust (VNO) is one of the biggest players in New York City. Shares are down more than 70% since February 2020.

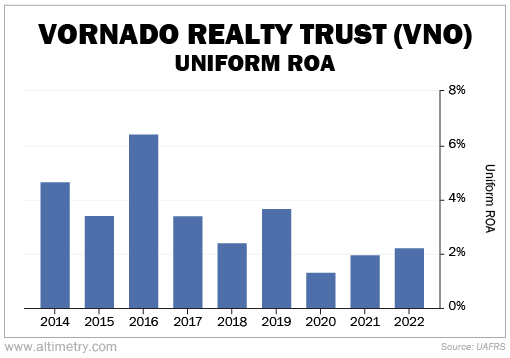

Before the pandemic, Vornado's Uniform return on assets ("ROA") already averaged just 4%. That's way below the 12% corporate average. As it lost tenants during COVID-19, its returns plummeted to just above 1% in 2020.

It hasn't done much better since.

As you can see in the following chart, returns improved a little over the past two years. But the company still hasn't recovered to normal levels. Uniform ROA was still only 2% last year...

Vornado's recovery has been weak. And the bad news is, the picture isn't improving all that fast. Uniform ROA is expected to drop to 1% again in 2023.

Investors don't seem to grasp how dire Vornado's situation really is...

Investors don't seem to grasp how dire Vornado's situation really is...

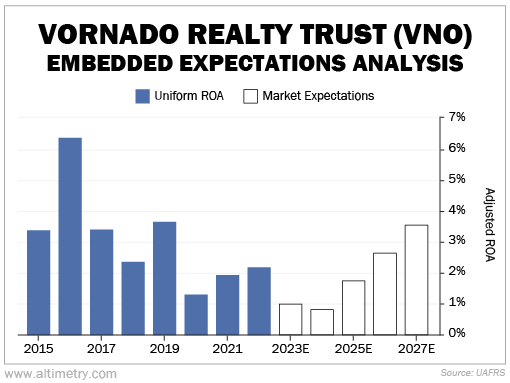

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA looks at a company's current stock price... and uses that to determine what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Vornado's EEA shows us that investors believe things are going to return to normal... everything is fine... and there's nothing to see here. They expect Uniform ROA to get back up to its long-term average of nearly 4% by 2027.

Take a look...

That is the best-case scenario for the stock. Some of these office REITs may end up going bankrupt... and many others will have lower returns for a long time.

Vornado is down more than 70% in the past three years. That doesn't mean it's cheap.

Its Uniform price-to-earnings (P/E) ratio – which measures the value of a company's stock price against its earnings – is 94 times today. That's almost five times the corporate average.

Be careful when trying to make sense of stock market movements. Vornado plunged dramatically. But that doesn't mean the market understands the risks with this stock.

If the company can salvage enough rent, the stock may turn out to be fairly valued... at best. But it could very well fall even further.

Regards,

Rob Spivey

March 9, 2023

Office owners faced two disasters in the wake of COVID-19...

Office owners faced two disasters in the wake of COVID-19...