When Howard Marks talks, even the 'Oracle of Omaha' stops to listen...

When Howard Marks talks, even the 'Oracle of Omaha' stops to listen...

Marks is a co-founder of Oaktree Capital Management, one of the largest institutional investors in distressed debt and other securities. It has more than $170 billion in assets under management ("AUM").

Legendary investor Warren Buffett has said he reads Marks' letters before anything else because he always learns something new. So when Marks recently said that it's "crunch time" for the private-credit market, savvy investors knew to pay attention.

Private-credit funding has been steadily rising since 2008. It really picked up in 2020 and 2021. Asset managers were throwing all their spare cash at private-equity companies because interest rates were cheap.

Lenders were also quick to give out money to anyone who wanted it. Plenty of private-equity firms were able to buy companies with cheap debt.

However, it may be starting to backfire...

Marks commented that the boom in private credit – meaning credit lent outside of the traditional banking system – is hitting a crucial stress test. Businesses are facing more pressure as the Federal Reserve raises interest rates. It's becoming harder to get loans.

This could be setting up for a big problem in private credit. As we'll explain today, the data backs up Marks' warnings... And the market isn't acknowledging it yet.

A few weeks ago, seven large private companies defaulted in one weekend...

A few weeks ago, seven large private companies defaulted in one weekend...

Each of these companies carried more than $50 million in liabilities. The list included plenty of names you might recognize, like Vice Media and Envision Healthcare.

It was the highest rate of defaults in one weekend since 2008. History tells us we're not even close to the worst of it. And yet, as Marks pointed out, the credit market hasn't even blinked.

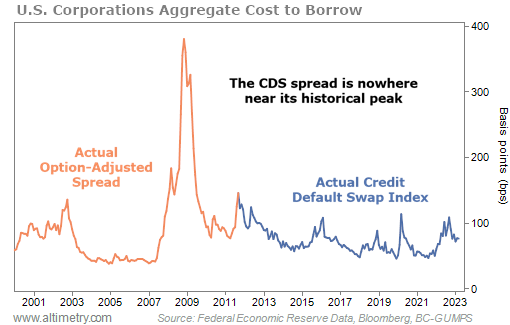

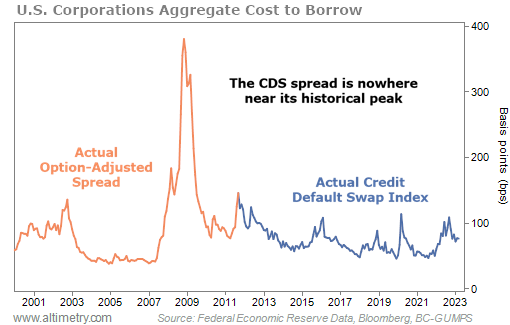

For the first decade of the 2000s, the option-adjusted spread was one of the main ways to measure risk in the credit market. Some bonds carried extra options for investors, like the right to early repayment.

The value of these options rises if the underlying bond is riskier... so we can use the spread to measure risk. The higher the spread, the riskier a company's bonds are.

Another measure, called credit-default swaps ("CDS"), became more popular by the 2010s. CDS are insurance on bonds. When their values rise, it means borrowers are more likely to default... and their bonds are riskier.

The Credit Default Swap Index ("CDX") tracks CDS spreads. When we look at these two metrics in tandem since the turn of the century, we can see how the credit market is faring today.

Take a look...

The cost to borrow for U.S. corporations remains slightly elevated compared with the past 10 years. However, that cost is nowhere near the levels we saw during the Great Recession.

Right now, the market is pricing in a bit more risk than it has on average in the past decade. That said, investors are betting that any credit crunch will be far milder than it was during the last major recession.

Investors don't see a ton of corporate credit risk yet...

Investors don't see a ton of corporate credit risk yet...

They're not prepared for bank and corporate credit to continue tightening... and for private credit to get worse. That's what Marks is warning could happen. And if it does, things could get bad.

A spike in corporate borrowing costs would cause a domino effect. It could cascade into more defaults and a recession. We still believe a downturn could hit in the back half of this year.

Keep an eye on the credit market. As we await a potential credit crisis, it's important to stay disciplined and patient with your investments.

Regards,

Joel Litman

May 30, 2023

When Howard Marks talks, even the 'Oracle of Omaha' stops to listen...

When Howard Marks talks, even the 'Oracle of Omaha' stops to listen...