For nearly a century, the Bell Telephone Company and its successor AT&T (T) reigned supreme over the North American telecom industry...

For nearly a century, the Bell Telephone Company and its successor AT&T (T) reigned supreme over the North American telecom industry...

But by the 1970s, the U.S. government had enough. The Justice Department brought a lawsuit against AT&T for its monopolistic behavior, which culminated in the 1984 breakup of the company's Bell System into seven different regional businesses known as "Baby Bells."

While most have been acquired or have folded, two stood the test of time and came to dominate the market...

In 1997, Bell Atlantic merged with another Baby Bell called NYNEX. The entity created a joint venture with U.K.-based Vodafone... and the Verizon (VZ) monolith emerged.

AT&T itself didn't vanish, either. It largely kept control over the long-distance market until it was acquired by one of the prior Baby Bells, Southwestern Bell, in 2005. The combined company rebranded itself as AT&T. And after acquiring Cingular the next year, it became a giant wireless brand in its own right.

Over the past 20 years, Verizon and AT&T – the last of the Baby Bells – have dominated the wireless communications market. T-Mobile (TMUS) and Sprint became accustomed to trailing the industry leaders at a distant third and fourth in market share.

However, T-Mobile has gained ground after its historic merger with Sprint last year. And now, the combined telecom giant has the strongest portfolio of spectrum services within the industry.

T-Mobile has also led the charge in investing heavily in the race to roll out the new, ultra-fast 5G network. Its head start in building out the necessary infrastructure and services for the next generation of connectivity has AT&T and Verizon scrambling to catch up.

Verizon and AT&T can't afford to fall too far behind. They'll need to assess their balance sheets to figure out how to source the billions needed to spend on the rollout. This is the primary reason both companies scrambled last month to issue piles of new debt... Verizon issued $30 billion, while AT&T issued nearly $15 billion.

To see which of these two companies is best positioned to catch up, we need to look beyond their stocks...

To see which of these two companies is best positioned to catch up, we need to look beyond their stocks...

To operate successfully in the telecom industry, network providers must invest in huge capital expenditure ("capex") to keep up with technology advancements. They also have to maintain the expensive and high-turnover infrastructure needed for calls, data, and more.

Verizon and AT&T have both already begun to spend big, as we can see through recent actions in spectrum auctions in their attempt to take back a prominent position in the coming 5G telecom industry.

Thus, identifying which telecom companies have the ability to ramp up capex is crucial to determine which will be winners as consumers look for faster 5G speeds.

While many equity experts have weighed in on the future of the industry, we'll focus on credit investors' knowledge instead...

While many equity experts have weighed in on the future of the industry, we'll focus on credit investors' knowledge instead...

Credit investors bring expertise on the potential effect and funding of big investments like the 5G rollout. To understand the debt profile of a telcom company like Verizon or AT&T, we need to break down the company's capex capacity over the next few years.

Credit investors need to be sure the companies they invest in can meet the upcoming operating obligations with cash flow or cash on hand.

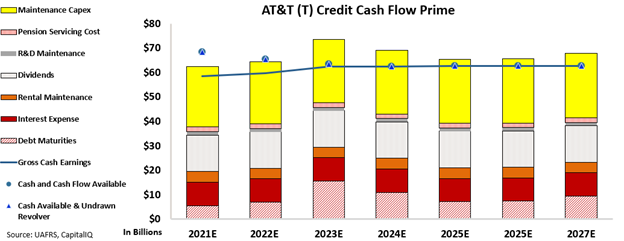

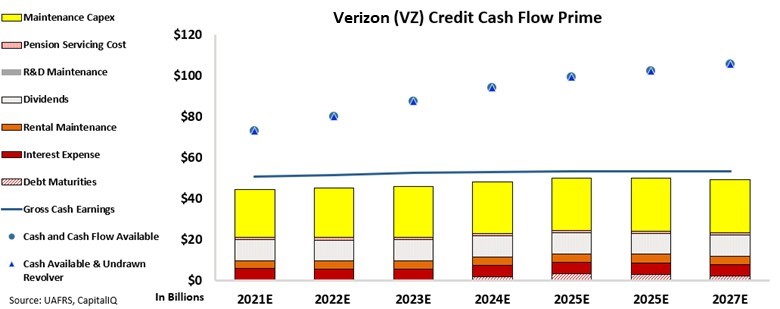

As such, let's take a look at AT&T and Verizon's credit profiles through the lens of Uniform Accounting with our Credit Cash Flow Prime ("CCFP") analysis.

By removing the accounting distortions, we can see the real story for a company's debt. In this specific case, we can also identify Verizon and AT&T's respective positions in their big surge in capex investments.

In the charts below, the stacked bars represent the company's obligations each year for the next five years. We compare these obligations to cash flow (blue line), cash on hand at the beginning of each period (blue dots), and the undrawn credit revolver (blue triangles).

As you can see in the first chart, AT&T's cash flows already are running into maintenance capex. This means the company will struggle to heavily invest into new technology.

Meanwhile, Verizon is in a much better position...

While AT&T is struggling to cover its capex, Verizon's cash flows alone cover all of its obligations. Furthermore, the company's large cash on hand means it can easily afford to invest for the future.

Thanks to Uniform Accounting and a closer look at credit, we can see that the future looks far brighter for Verizon than AT&T in the race to win in the 5G rollout.

Regards,

Rob Spivey

April 13, 2021

For nearly a century, the Bell Telephone Company and its successor AT&T (T) reigned supreme over the North American telecom industry...

For nearly a century, the Bell Telephone Company and its successor AT&T (T) reigned supreme over the North American telecom industry...