We're on the cusp of a revolution in U.S. infrastructure...

We're on the cusp of a revolution in U.S. infrastructure...

And three major trends are driving demand.

The first is the decarbonization of our energy system. Think tank Climate Analytics estimates we need to invest $8 trillion in renewable energy within the next six years to meet our climate goals.

The second is digitization. This one should be no surprise if you're paying attention to the stock market... trends like AI are driving tech investments way higher. And AI requires tons of physical infrastructure like data centers and fiber-optic cables.

The third trend is deglobalization. The U.S. is trying to reduce its reliance on China's supply chain. That requires building new transport facilities and factories.

These three trends combined are ushering in the next era of the "supply-chain supercycle"... the wave of U.S. infrastructure spending that has been underway for years.

As we'll explain, this demand ramp-up is only the start. And one underrated business in particular is positioned to benefit...

Infrastructure investment is up to nearly $1.3 trillion... almost five times what it was a decade ago.

Infrastructure investment is up to nearly $1.3 trillion... almost five times what it was a decade ago.

All that spending has been helped along by the Bipartisan Infrastructure Law, which President Joe Biden signed into law more than two years ago. It directs $1.2 trillion of federal funds for infrastructure projects.

Since the law passed, infrastructure investment is up 1.6% as a share of total spending... the largest increase since 1979. And in January, Biden announced nearly $5 billion more funding for transformational infrastructure projects.

With that level of booming demand, you can expect years of new projects. Construction and engineering (C&E) firms are set to benefit big time.

But investors are treating industry leader Fluor (FLR) like its glory days are long over...

Fluor was a great business about 15 years ago, when oil and gas were the dominant U.S. energy sources.

Most of its projects come from the energy sector. So Fluor booked years of consistent above-average returns.

Oil prices cratered in the second half of the 2010s... and Fluor's returns did, too. Investors all but gave up on the stock.

Since then, though, we're starting to see more investments in oil and natural gas. And Fluor has expanded its practice to focus on all kinds of energy – renewable energy included.

The market doesn't seem to understand that Fluor benefits from U.S. infrastructure demand...

The market doesn't seem to understand that Fluor benefits from U.S. infrastructure demand...

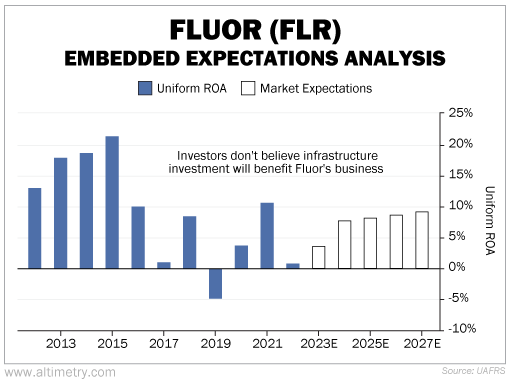

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Fluor did great during the boom times for oil and gas from 2013 to 2015... earning an average Uniform return on assets ("ROA") of almost 20%. That's well above the 12% corporate average.

Returns have dropped below average since then, even falling negative here and there. And as you can see, investors expect more of the same going forward...

Asset managers like BlackRock (BLK) expect years of U.S. infrastructure investment...

Asset managers like BlackRock (BLK) expect years of U.S. infrastructure investment...

And that should boost C&E leaders like Fluor. But investors only expect returns of 9% to 10% through 2027.

Said another way, investors don't expect Fluor to benefit from any of the energy investment going on in the U.S.

Infrastructure spending is at a 10-year high. It's projected to increase even more going forward. This trend should help boost Fluor's returns. And because the company also works with renewables, it should see more demand as decarbonization picks up.

That might just prove an opportunity for investors as well.

Regards,

Joel Litman

March 12, 2024

We're on the cusp of a revolution in U.S. infrastructure...

We're on the cusp of a revolution in U.S. infrastructure...