Foreign investors are getting into India as fast as they can...

Foreign investors are getting into India as fast as they can...

The value of India's stock market has surged to roughly $5 trillion... putting it in line with more popular international markets such as Hong Kong.

International pension managers and wealth funds that like emerging markets have even started preferring India to China.

India has a lot of the qualities China used to have. Its economy grew 9% in 2021 and 7% in 2022... ahead of China's alleged growth. And the country is set on keeping growth high through foreign direct investment.

Indian Prime Minister Narendra Modi is a big reason for that growth. Modi has done a lot to help India's economy become one of the fastest growing in the world. He welcomed a lot of new foreign investors over the past few years.

Modi was just reelected for a rare third term. Indian citizens are clearly happy with how the past decade has gone.

And as we'll discuss today, Wall Street is finally starting to recognize India as a future powerhouse.

Since the pandemic, outsourcing has shifted away from China...

Since the pandemic, outsourcing has shifted away from China...

A lot of Chinese factories shut down for long periods during the pandemic... which led to severe supply-chain shortages worldwide.

Plus, relations between the U.S. and China have deteriorated. The two countries have escalated the tariff war that started under former President Donald Trump.

All of this led corporations to rethink where they're making goods. While much of production is coming closer to U.S. shores, many companies are also moving to India.

Tech giant Apple (AAPL), for instance, started ramping up iPhone production in India. It made 14% of iPhones there in the past year. And it hopes to ramp that up to 25% by 2028.

India is leaning into its new position in the foreign markets. The country's commerce ministry is using a joint venture called "Invest India" to attract more foreign investment... with a goal of $100 billion per year over the next five years.

And while foreign investment was "only" $28 billion last year... companies are still in the process of setting up shop. Two hundred U.S. corporations are reportedly moving their international manufacturing from China to India.

India's Nifty 50 Index has doubled in the past five years...

India's Nifty 50 Index has doubled in the past five years...

The Nifty 50 tracks the country's 50 biggest public companies. It's like their version of the S&P 500. And based on that performance, Indian corporations have been doing well.

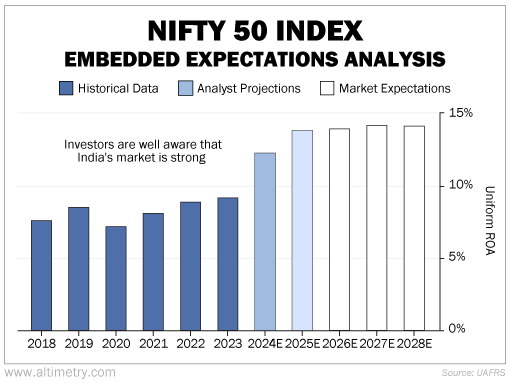

That said, foreign investors may be getting a bit ahead of themselves. We can see this through our aggregate Embedded Expectations Analysis ("EEA") framework...

Our aggregate EEA starts with the average stock price of all Nifty 50 companies. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well India's largest companies have to perform in the future to be worth what the market is paying for them today.

As you can see, profitability has been rising since 2018. Uniform return on assets ("ROA") was only about 8% back then, and it rose to 9% last year.

Wall Street analysts expect a big shift in the next two years... with Uniform ROA reaching 14%.

And yet, investors have already priced in that entire rise in profitability. Take a look...

U.S. public companies returned 11% last year. Investors expect them to return about 12% through 2028.

So they expect India to outperform the U.S.

With so much investment surging into the Indian economy, it's entirely possible that its biggest companies could become more profitable.

However, investors getting in today may be disappointed if they're looking for massive gains. Much of the upside is already priced into Indian stocks.

Regards,

Joel Litman

June 24, 2024

P.S. Our director of research, Rob Spivey, was recently a guest on Chuck Jaffe's "Money Life" podcast.

Rob and Chuck spoke about Uniform Accounting research... some of today's biggest macro trends... and Rob's and my take on a handful of today's most popular stocks and best opportunities.

The full episode is available for free on the "Money Life" website. You can listen right here.

Foreign investors are getting into India as fast as they can...

Foreign investors are getting into India as fast as they can...