Corporate America is struggling to keep up with the rate of the global recovery...

Corporate America is struggling to keep up with the rate of the global recovery...

Over the past few weeks, supply chain bottlenecks and raw material shortages for commodities like lumber have investors concerned about future growth. As Bloomberg recently explained, this may have a direct effect on economic growth and the U.S. Federal Reserve's market forecasts... but not in the way you might think.

The housing market is an example. Sales came in below expectations in April. That may set off alarm bells, but it wasn't because of a lack of demand. Instead, it was due to material shortages – leading to an inability to service the homebuying surge.

This same problem is also plaguing the auto industry, which is in dire need of semiconductors to sell new cars. Recently, used-car prices have been surging... while sales for new vehicles were disappointing only because manufacturers can't secure enough chips to get vehicles out the door fast enough. Car lots are empty.

This may mean that current economic forecasts will need to be revised for the second half of 2021. Inflation, supply chain kinks, and uneven reopenings across the globe all spell potentially slower-than-expected growth.

However, there's a silver lining to this glum news for investors.

Underlying demand is still strong. So once these issues are fully resolved next year, growth could end up not just being a short surge... but a long-burning period of rising spending and growth.

U.S. economic growth was an impressive 6.4% in the first quarter, and the second quarter is shaping up to be even stronger despite these building headwinds.

But growth in the third and fourth quarters may be sluggish as manufacturers can't fill orders fast enough and stimulus benefits run out. But this shouldn't be cause for panic... It will just serve to draw growth out rather than stop it dead in its tracks.

To understand why we see this bumpy period, let's turn to the numbers...

To understand why we see this bumpy period, let's turn to the numbers...

Over the past two decades, Corporate America has gotten older.

We're not talking about the age of the companies or the CEOs... but rather, the age of the machinery, buildings, and technology that companies use to manufacture their products. This can be grouped as the property, plant, and equipment (PP&E) costs for a business.

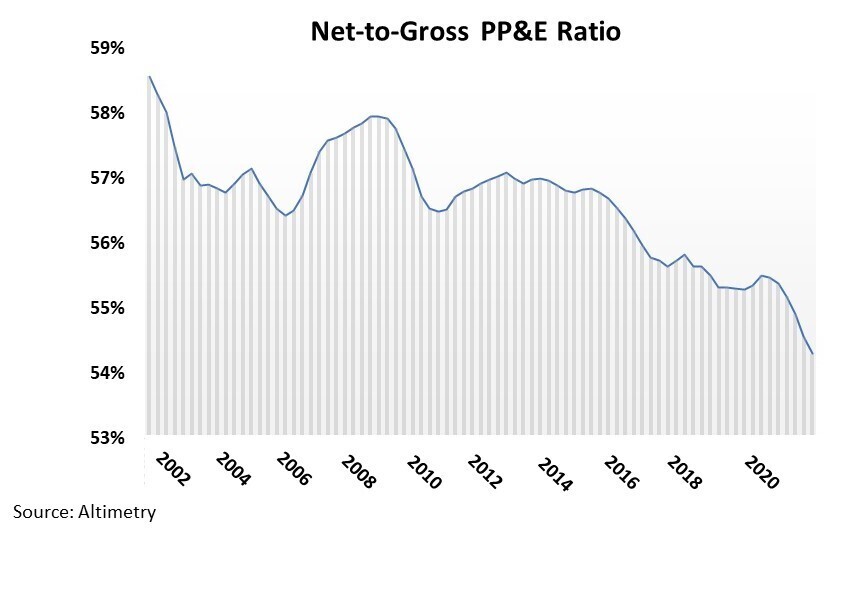

To measure the age of America's PP&E, we can use how much these assets have depreciated as a "dipstick" into when they need to be replaced. The gross PP&E is the original cost of the machinery and buildings when they were new. Meanwhile, the net PP&E is what those assets are worth today.

Since 2001, the net-to-gross PP&E ratio has consistently been trending down. This means assets are growing older and more depreciated. Due to a reluctance to spend in the aftermath of the Great Recession, management teams have let the net-to-gross PP&E ratio reach 20-year lows of 54.5%. Take a look...

Part of the reason why supply chains are so muddled today is that assets are at their all-time oldest levels. While companies have "spare capacity" on their books, they don't have available capacity. All their assets that aren't already working need a lot of investment to get up to snuff to ramp up.

It's part of the reason why capacity utilization has been trending down the past few decades, even when there's strong economic growth. So a lot of that "spare" capacity isn't real.

With no spare capacity, to meet current market demand, companies need to start ramping up their capital expenditures ("capex").

That will take a few quarters to unfold... But with demand strong, companies – just like the chipmakers that have been talking a lot about expanding capacity – are going to start to spend.

Until they do, growth may be subdued. But the powerful thing is, their spending alone will help power economic growth and amplify the virtuous cycle of recovery. As companies spend on capex, their suppliers will need to ramp capacity to support them, and their suppliers will need to ramp capacity to support that growth. And that means higher, longer economic growth.

So consumers may have delays... but the economy will keep chugging in the right direction – just slower at first, before heating up even faster than folks might currently expect.

Regards,

Joel Litman

June 21, 2021

P.S. We've found one of the companies that win in this type of recovery – one of the first capex-driven recoveries in the U.S. in decades – and we just recommended it in our Microcap Confidential newsletter.

It's a supplier to big automotive and construction machinery companies... But it's still not priced in for the huge tailwinds like its customers already are. Even better, this company is consolidating its market and transforming its business model to send returns soaring.

To find out how to gain instant access to this brand-new recommendation – and the full portfolio of 16 other microcaps we love – click here.

Corporate America is struggling to keep up with the rate of the global recovery...

Corporate America is struggling to keep up with the rate of the global recovery...