This 30-year-old tech firm is quietly outperforming some of AI's flashiest names...

This 30-year-old tech firm is quietly outperforming some of AI's flashiest names...

Big Tech giants like Amazon (AMZN) and Microsoft (MSFT) have captured much of the market's attention. Both companies have raked in billions of dollars in revenue thanks to their impressive AI offerings.

But while these industry titans are grabbing the headlines, a surprising competitor has quietly outperformed both...

EBay (EBAY) might be one of e-commerce's key players, but it's hardly the first name most folks think of when they hear "AI."

And yet, the stock is up 32% year to date... versus 17% for Microsoft. Amazon is flat since the start of 2025.

EBay's outperformance has nothing to do with growing operations or flashy deals. Instead, CEO Jamie Iannone has paired eBay's decades of data with cutting-edge AI tools.

As we'll explain, his innovation has led to a promising, overlooked AI story...

Before Iannone took the reins in 2020, eBay was lagging its chief rival...

Before Iannone took the reins in 2020, eBay was lagging its chief rival...

Revenue hovered around just $7 billion in 2019, paling in comparison to Amazon's $280 billion.

Iannone had actually worked at eBay from 2001 to 2009. He then went on to run Barnes & Noble's e-book business... and later Walmart's e-commerce unit. So he was no stranger to the evolving e-commerce landscape.

Once he was appointed CEO, Iannone turned eBay's attention back to some of its original strengths. Instead of trying to outgrow its competitors, it focused on used and refurbished items – a great market to be in when money is tight for consumers.

By 2021, revenue had improved to $10.4 billion.

But the real game-changer came last year... when eBay went "all in" on AI.

The company deployed proprietary large language models ("LLMs") that specialize in tasks like writing item descriptions and predicting prices.

Then, it gave similar AI tools to sellers. They could even generate photos for their items from minimal input.

These tools have helped roughly 10 million sellers post more than 200 million item listings to date.

The company is also using AI to identify products trending on social media – from vintage Oasis merchandise to Taylor Swift engagement-dress lookalikes. And its tools are helping improve email campaigns, leading to 40% more engagement from customers.

But the market couldn't care less about eBay's AI usage...

But the market couldn't care less about eBay's AI usage...

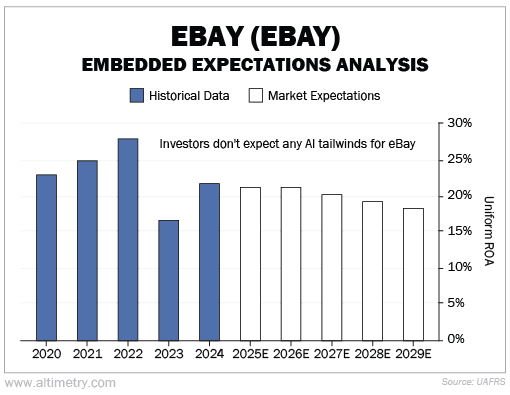

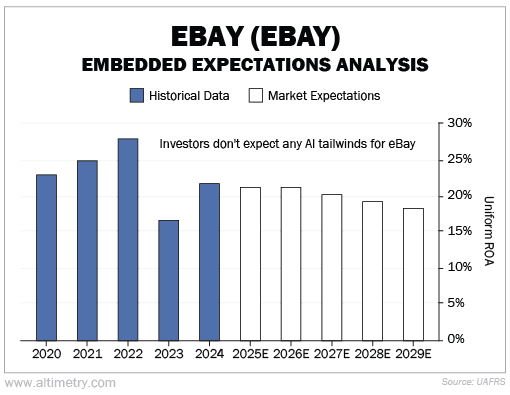

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

EBay's Uniform return on assets ("ROA") jumped from 17% in 2023 to 22% last year – almost double the 12% corporate average.

But at current prices, investors think returns will fall from here... to just 18% by 2029.

Take a look...

This isn't the trend of an e-commerce giant that's making moves in AI. The market isn't giving eBay enough credit for its new tools.

Sure, eBay's stock is outperforming Big Tech giants Microsoft and Amazon...

Sure, eBay's stock is outperforming Big Tech giants Microsoft and Amazon...

So the market must have some clue that it's embracing AI – and that its efforts are paying off.

But folks aren't seeing the full story. EBay's AI tools are giving the business a significant boost.

Returns should rise from here. And when they do, investors are in for a big surprise to the upside.

Regards,

Joel Litman

November 20, 2025

This 30-year-old tech firm is quietly outperforming some of AI's flashiest names...

This 30-year-old tech firm is quietly outperforming some of AI's flashiest names...