GDP headlines may be flashing red, but the 'real' economy is heating up...

GDP headlines may be flashing red, but the 'real' economy is heating up...

U.S. GDP growth went negative for the first time in three years, contracting 0.3% in the first quarter of 2025.

And the financial media ran with it. It warned that the long-feared recession had arrived. But these headlines mask the real story. Core demand metrics show that the economy, in fact, grew...

Real final sales to private U.S. buyers – the cleanest measure of core demand – rose a solid 3% this past quarter. (It represents how much an economy actually produces and buys.) Private investment surged nearly 22%, driven by business-equipment investments.

Yet one other industry led the charge: data centers.

According to asset-management company Apollo, data centers alone – a key part of AI infrastructure – added a full percentage point to GDP growth. That's a rare feat for any single category of spending.

This kind of momentum reshapes capital cycles. And today, we'll look at how that underappreciated shift is creating major tailwinds for the companies building AI from the ground up.

The numbers behind the chip surge are staggering...

The numbers behind the chip surge are staggering...

Hyperscalers like Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL) are set to spend $300 billion this year alone on AI-ready infrastructure.

McKinsey forecasts $5.2 trillion in global data-center investments by 2030. Of that, $3.1 trillion would flow directly into the semiconductor supply chain.

Every modern AI model – from ChatGPT to Gemini – runs on chips, which go into data centers. They require cutting-edge graphics processing units. And, of course, those specialized chips don't make themselves...

Lam Research (LRCX) creates the tools that help chipmakers build the most advanced semiconductors. These chips are essential for training and running AI models. And they're getting more complex by the day.

As AI adoption explodes, chip demand is soaring... and so is capital spending. Lam's customers – including Taiwan Semiconductor Manufacturing (TSM), Samsung, and Intel (INTC) – are racing to install more advanced tools to meet orders for AI accelerators, high-bandwidth memory, and application-specific integrated circuits.

Despite these trends, investors don't understand where we are in Lam's profitability cycle...

Despite these trends, investors don't understand where we are in Lam's profitability cycle...

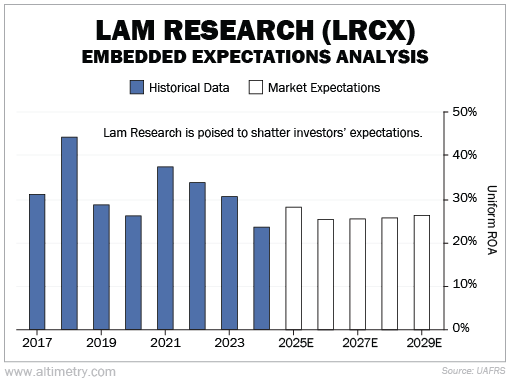

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

When there's a huge demand for chips, like we're seeing today, Lam's Uniform return on assets ("ROA") explodes. Back in 2018, its Uniform ROA reached an impressive 44%. It was still a solid 37% three years later.

But Lam's Uniform ROA tumbled in 2024, reaching just 24%. And investors don't expect much of a rebound. Right now, they're pricing in just 26% by 2029. Take a look...

That tells us the market is underestimating the strength of today's data-center investments.

A new kind of chip cycle is taking shape, and Lam is ready for it...

A new kind of chip cycle is taking shape, and Lam is ready for it...

This company is building the backbone of the next semiconductor boom.

Lam is a key supplier to the chipmakers that power advanced AI models. And that puts it squarely at the center of the global AI build-out.

The market views this as a weak phase in the business cycle, but the data points to something much bigger. Global capital spending on AI infrastructure (including data centers) is ramping up, not peaking.

In reality, Lam is crushing the market so far this year. It's already up 15%... and counting. And that's just the beginning for this company and other stakeholders in the AI build-out.

Regards,

Joel Litman

June 4, 2025

GDP headlines may be flashing red, but the 'real' economy is heating up...

GDP headlines may be flashing red, but the 'real' economy is heating up...