Last week's headlines screamed 'economic trouble'...

Last week's headlines screamed 'economic trouble'...

The U.S. economy shrank for the first time in three years. In the first quarter of 2025, real GDP fell by 0.3%.

Markets didn't take it well. The S&P 500 dropped more than 2% within the first hour of trading that Wednesday. Investors assumed the long-feared recession had finally arrived.

But as we see so often... the market was only reacting to part of the story.

One economic quirk distorted the entire GDP reading. It dragged the whole number into the red.

Folks, the recent GDP contraction says more about short-term trade distortions than long-term economic health. This isn't a recession in the making.

The market is doing far better than most folks realize...

GDP is built from several moving pieces...

GDP is built from several moving pieces...

It looks at a lot more than just production or spending. And this time, one of the most volatile categories dominated the result...

I'm talking about imports.

In the first quarter, companies scrambled to front-load shipments ahead of the Trump administration's expected tariffs. Imports rose 41.3% – the biggest spike in five years.

Imports hurt GDP because they reflect dollars flowing out of the domestic economy. So the huge jump in imports took a big bite out of the final calculation.

Meanwhile, exports barely moved, with just 2% growth. Because of how GDP is calculated, that imbalance alone knocked nearly five percentage points off the headline GDP number.

First-quarter GDP data was just too skewed to be a good representation...

First-quarter GDP data was just too skewed to be a good representation...

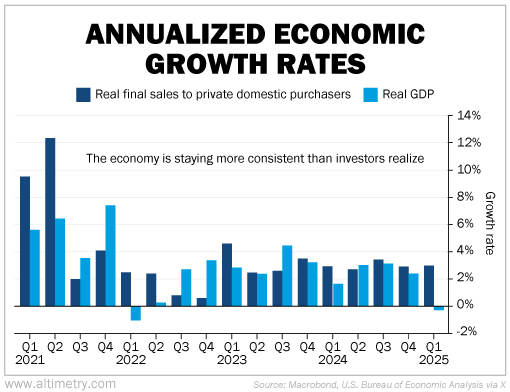

For a more accurate read on the economy, we can focus on core domestic activity through real final sales to private domestic purchasers.

This metric removes the noise of inventories, trade, and government outlays. Said another way, it represents how much an economy actually produces and buys.

Take a look at this chart from Nick Timiraos, chief economics correspondent for The Wall Street Journal. In the first quarter, real final sales to private domestic purchasers rose 3%.

That's consistent with how the economy has performed over the past several years.

Check it out...

When you take out the noise, the rest of the economy is chugging along.

Private investment surged nearly 22%, driven by business equipment investments. Consumer spending increased by a modest 2%.

These are the indicators of significant economic momentum.

The government component declined. Federal spending fell at a 5.1% annualized pace... reflecting early-term spending cuts from the new administration. That was the other major drag on the GDP total.

GDP is often treated as a temperature check on growth...

GDP is often treated as a temperature check on growth...

But this reading was skewed by temporary behaviors tied to policy. The adjusted data still supports growth.

The first quarter is rarely a great one... It comes right after the holiday season. And fiscal years tend to start out slow.

That said, when you remove the tariff noise, this year's first quarter was just fine.

Consumers and businesses – the underlying engine of the economy – haven't stalled. Companies are still investing. Households are still spending.

And there's no sign that credit markets or liquidity conditions are under stress.

Policy changes and trade friction can create noise in quarterly data. But we're seeing the results of trade distortions and government policy shifts... not an immediate recession risk.

Stay focused on the factors that actually drive growth, like consumer spending and corporate investment. If anything, these kinds of sell-offs are a buying opportunity.

Regards,

Joel Litman

May 5, 2025

Last week's headlines screamed 'economic trouble'...

Last week's headlines screamed 'economic trouble'...