After years of dominance, the solar industry hit a wall...

After years of dominance, the solar industry hit a wall...

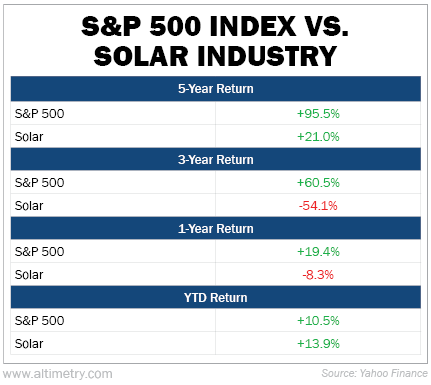

Investors who bet on green energy in 2021 were riding high... until the bottom fell out. Since their heyday, solar stocks have dropped more than 50%. Meanwhile, the S&P 500 has surged more than 60% in the past three years.

But deep in the options pits and short-interest data, something unusual is happening...

The same hedge funds that once loaded up on oil and shorted clean energy are now changing direction. Net short interest in the Invesco Solar Fund (TAN), which tracks a basket of solar stocks, has fallen to its lowest point since 2021.

At the same time, oil is looking increasingly shaky. And funds are starting to pile into short positions for the commodity.

In short, hedge-fund positioning suggests the worst may already be priced into solar. The smart money is starting to turn bullish on this fallen green-energy industry.

At first glance, solar's outlook looks bleak...

At first glance, solar's outlook looks bleak...

The Trump administration scaled back clean-energy tax incentives earlier this year, triggering a rush of project activity.

For a few months, it looked like the sector might bounce back. But that wave didn't last. More than $22 billion in solar projects have since been canceled or delayed. And sales momentum has collapsed.

This isn't just a one-time disruption. The industry is still reeling from high interest rates, permitting delays, and policy whiplash.

And yet... TAN is up more than 60% since the "Liberation Day" panic. Crude oil prices are flat in the same time period.

That move wasn't driven by retail traders. It's the result of a subtle but significant shift in hedge-fund positioning.

Hedge funds have been about 4% short solar, on average. But after years of riding a highly profitable long-oil, short-clean-energy trade... fund managers are backing away from the solar doubt.

They're now only about 3% short solar. Meanwhile, their long positions have risen above 2%.

Put simply, the gap is narrowing.

Even more telling, hedge funds are now net short oil stocks. That means they hold more short positions than long positions outright... a full reverse from their positioning in 2021 and 2022.

And this reversal isn't happening in a vacuum...

And this reversal isn't happening in a vacuum...

Two weeks ago, we wrote that China's solar industry is deteriorating... and explained why it might be an opportunity for the U.S. solar industry.

On the other hand, oil's fundamentals are weakening. OPEC is ramping up supply to maintain market share. But the U.S. and China – two of the world's biggest consumers – are showing signs of slowing oil demand.

China's demand for gasoline, jet fuel, and diesel peaked at 8.3 million barrels per day in 2021. Demand fell to 8.1 million barrels last year. It's only expected to be 8 million barrels this year.

In the U.S., oil demand fell by 0.4 million barrels per day as recently as July.

Trump's energy stance has tilted heavily toward fossil fuels. But he's facing hurdles from state-level regulations and barriers like grid constraints. Long-term planning is getting more and more difficult.

That growing uncertainty is pushing smart investors to reconsider what the next cycle might look like. And they're starting to rotate out of oil and back into solar.

The S&P 500 outperformed the U.S. solar industry over the past three years. But solar has started to catch up. It's actually outperforming the broad market in 2025.

Take a look...

The tide may be turning for the market's former punching bag...

The tide may be turning for the market's former punching bag...

Rising rates and inconsistent policy hammered solar margins for years. Even some of the industry's biggest players struggled to stay profitable... like SunPower and Sunnova, both of which went bankrupt in the past year or so.

But none of that has shaken long-term demand. Solar remains one of the most cost-effective and scalable energy sources in the world.

Hedge funds are throwing in the towel on their oil trades and turning to solar again. The setup is shifting.

Short interest is falling. Prices are rising. And policy clarity will finally bring some direction to the sector.

Solar isn't out of the woods yet.

But hedge funds aren't betting on more pain... They're positioning for a recovery.

Regards,

Joel Litman

September 11, 2025

P.S. Hedge funds are going all-in on solar. But in the broader market, the "fear of getting in" means folks are letting the bull run pass them by...

And that's a huge mistake.

I've been tracking a breakthrough market anomaly that's directly linked to hundreds of doubles in the past six months. If history is any precedent, it could lead to gains of 200%... 500%... even 800% by this time next year.

I'm going "live" with my findings on Wednesday, September 17 at 8 p.m. In the meantime, you can test this anomaly yourself for free... Click here for the details.

After years of dominance, the solar industry hit a wall...

After years of dominance, the solar industry hit a wall...