One big institutional investor is leading the charge in crypto...

One big institutional investor is leading the charge in crypto...

For years, investors have increased diversification through the ownership of exchange-traded funds ("ETFs"). They've helped investors access a wide array of asset types – from commodities to bonds.

ETFs are great because investors can buy exposure to assets without needing direct ownership. Yet one space that has been widely neglected is cryptocurrency... specifically bitcoin.

There are more than $10 trillion worth of ETFs, making them one of the biggest asset classes. So a bitcoin ETF has the potential to bring cryptocurrency even more mainstream.

And yet, the U.S. Securities and Exchange Commission ("SEC") has resisted the launch of a bitcoin ETF. It continues to grapple with fraud in the cryptocurrency market... and wasn't sure when the right time was to give the asset class more exposure.

Until now...

One of the biggest names in finance is leveraging its reputation and market power to get a bitcoin ETF off the ground. And we think it actually has a chance.

As we'll explain today, if it's successful, this plan wouldn't only benefit the crypto market... The institution behind the fund would also reap the rewards.

If anyone can start a bitcoin ETF, it's BlackRock (BLK)...

If anyone can start a bitcoin ETF, it's BlackRock (BLK)...

BlackRock is a global leader in the ETF space. It tops the industry with a 34% market share over all ETF providers.

This is a great place to be, considering the market is transitioning to more passive investments like ETFs. At one point in March, investors funneled about $130 billion into these funds – in a single week.

By market power alone, BlackRock is positioned to capture a large majority of the money during this transition period.

BlackRock's president, Rob Kapito, says it perfectly himself...

There are trillions... that are ready, when people feel rates have peaked, to flood the market, and we need to position ourselves to capture that.

And in June, the company decided to expand its reach into the world of crypto. It filed to launch a bitcoin ETF that will track the spot price of the asset.

Reputation holds strong weight. Market power holds a heavy influence. BlackRock holds both.

That's what makes it one of the best marketing machines in the financial world.

In most market conditions, BlackRock will have several drivers producing returns. The company understands how to market its funds. If it's the first to launch a bitcoin ETF, that's yet another avenue BlackRock would be set up to dominate early.

Despite a first-of-its-kind potential offering from BlackRock, investors don't expect much...

Despite a first-of-its-kind potential offering from BlackRock, investors don't expect much...

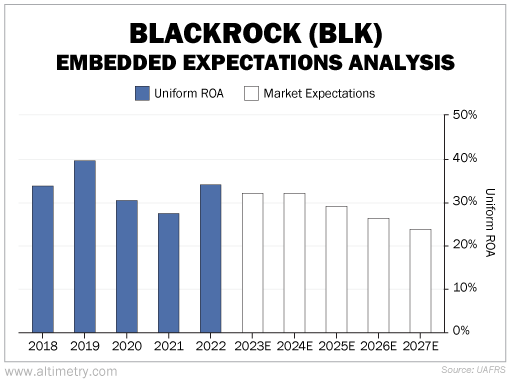

They're pricing its returns to gradually decrease below the company average.

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet. We use the current share price for companies across the insurance industry to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the industry) has to perform to justify the market's "bet" (the current price).

At current valuations, the market expects BlackRock's Uniform return on assets ("ROA") to diminish to 24% by 2027... lower than it has been in years. Folks are missing how powerful and influential BlackRock is.

See for yourself...

This is a high-quality, high-return business. BlackRock's Uniform ROA has only been below 30% once in the past five years. It has stayed above 27% since the Great Recession.

The market is seriously underestimating BlackRock's future performance... even without potential first-mover advantage from a crypto fund. It's already the dominant player in ETFs, and its investment strategies are on the cutting edge.

Yet, for some reason, the market hasn't caught on.

There's no reason to suspect Blackrock's ETF market share will take a hit. If anything, it could get even bigger if the bitcoin ETF gets off the ground. The market has a chance to be pleasantly surprised.

Regards,

Joel Litman

July 26, 2023

One big institutional investor is leading the charge in crypto...

One big institutional investor is leading the charge in crypto...