A key part of American society that's mandated in the Constitution has come under pressure with the coronavirus pandemic...

A key part of American society that's mandated in the Constitution has come under pressure with the coronavirus pandemic...

In the midst of the crisis, the U.S. Postal Service ("USPS") has come into focus as a key tool to help people get what they need and stay connected.

And now, according to Bloomberg, the agency has never been more under threat.

While the coronavirus pandemic has disrupted what was already a declining business, it's worth noting that much of the USPS's profitability issues aren't a cash-based reality... they're yet another example of as-reported accounting "noise."

The problems aren't due to GAAP financials, though... Rather, they're caused by laws Congress has put in place to require the USPS to pre-fund future retiree benefits. These requirements are completely different from any other pension's required rate of funding.

The Postal Accountability and Enhancement Act ("PAEA") requires the USPS to create a fund to cover all its employees post-retirement health care expenses – also known as "other post-employment benefits" ("OPEBs") in the private sector – for 75 years into the future.

No other public or private entity is required to fund OPEB expenses in cash that far out. And this places an enormous burden on the USPS's cash flows and accounting profitability, especially in a period where revenues are in secular – and cyclical, due to the coronavirus pandemic – decline.

In fact, some argue that without this excessive burden, the USPS would have been profitable in recent years... even in the face of declining demand for mail.

This is just another example of how as-reported accounting can diverge so far from reality, and how changes in accounting rules can completely distort how an organization's performance appears.

History seems to be repeating itself...

History seems to be repeating itself...

We can't overstate the importance of understanding macroeconomic and financial history for being a successful investor.

We often talk about history when referring to our macro analysis, because understanding past economic cycles can help us avoid making common mistakes. Moreover, when we identify an ongoing pattern, we can make informed decisions about how to invest next.

You've probably heard investment advisers use the term "past performance doesn't indicate future results"... While that's basically true, it's really just an excuse to keep accountability at arm's length.

The truth is, most situations we've seen in the markets have a historical precedent – either a near-exact match or a close analogy.

The current coronavirus-driven disruption we're going through now has a lot of complexity... But when it's broken into components, we can easily draw historical parallels.

With respect to the outbreak itself, we've seen different outlets draw lessons from the SARS outbreak in 2003 and even the Spanish flu of 1918.

Economically, we don't have to look that far back for comparisons...

One of the main side effects of the outbreak is the recent pressure we've seen on the energy sector. Demand for oil and gas has declined sharply, and yet many of the global oil superpowers had been refraining from controlling their supplies until just this week.

We've seen oil prices jump around for the last month – and they officially registered their worst quarter in history as March came to a close.

This is the second time in the past decade we've seen widespread concern about oil prices and the energy sector. Nearly the exact same issue popped up in late 2014 – now dubbed the "oil glut."

A lot of oil companies went out of business at that time, but the majority survived and fully recovered... only to find themselves in the exact same position today.

In 2015, we conducted a thorough analysis of all the oil companies that were trading as if they were going bankrupt. At the time, more than 150 bonds yielded more than 10% – near-bankruptcy yields. Unsurprisingly, not all 150 bonds defaulted – only a fraction failed to rebound.

Using our credit analysis, we were able to identify which bonds and related equities were likely to recover as investors calmed down, with great results.

Today, we're in the same exact situation. Many of the largest oil companies in the world are trading as if they're going bankrupt tomorrow, but we don't see it the same way...

For example, look at ConocoPhillips (COP). It's one of the largest oil exploration and production (E&P) companies in the world.

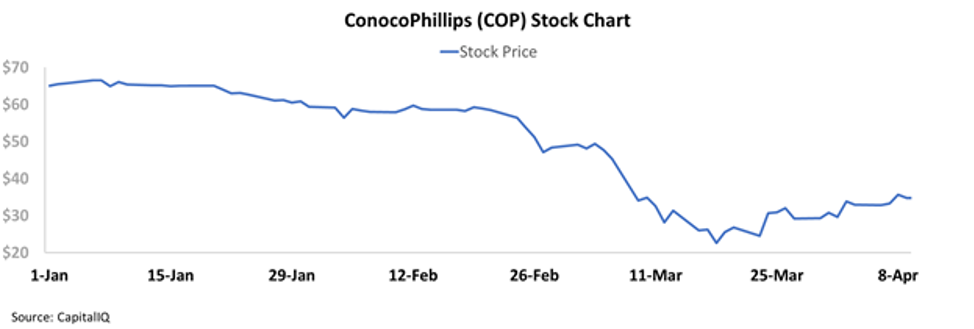

And yet, its stock price has roughly been cut in half since the beginning of the year...

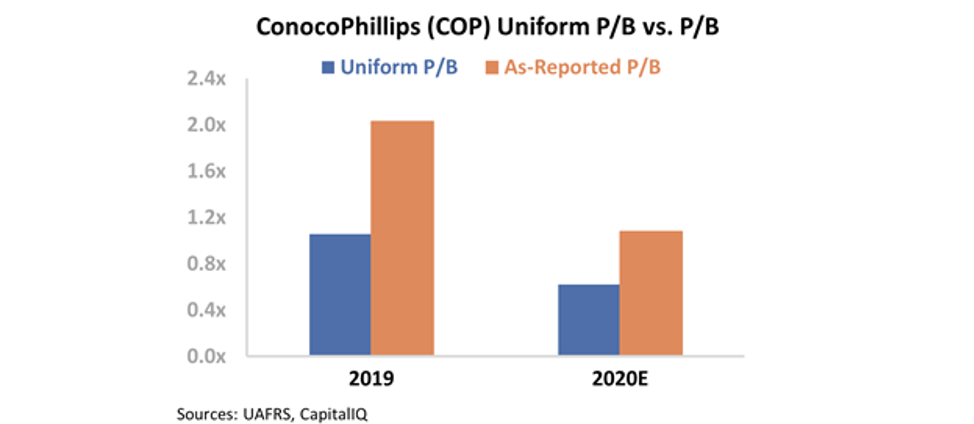

After taking such a big hit, ConocoPhillips' valuations have entered "imminent bankruptcy" territory.

For companies like ConocoPhillips that are likely to have weak returns for the next several quarters, traditional price-to-earnings (P/E) ratios don't have any real meaning or value.

Instead, we look at the value of the company in the market, its Uniform enterprise value ("EV"), versus the book value of its assets to see how investors value the business. This is our Uniform price-to-book (P/B) ratio, where any result below 1 means investors are discounting the value of the company relative to its asset base.

Many companies trade near their book values, but when this ratio starts falling well below 1, it's an indicator that investors are pricing the firm for bankruptcy.

On a Uniform Accounting basis, ConocoPhillips is currently trading at 0.6 times – meaning the company is comfortably in bankruptcy range.

We can perform the same type of credit analysis we did in 2015 to see if this is warranted.

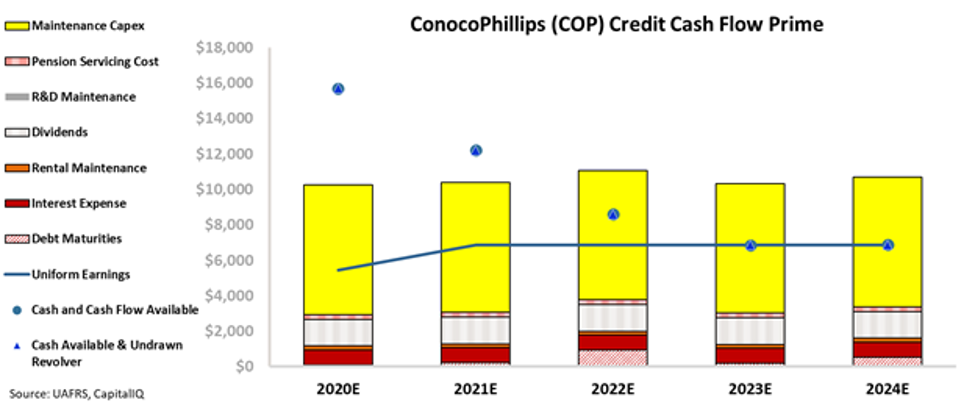

By looking at ConocoPhillips' real, Uniform earnings compared to its annual financial obligations, we can get a better sense of how much pressure the company is under.

We call this a "Credit Cash Flow Prime" analysis.

When looking at ConocoPhillips' Uniform earnings, we can see that it can comfortably service its most important obligations, including items like debt maturities, interest payments, and dividend payments. Take a look...

Additionally, ConocoPhillips has a substantial cash balance that it can use to service any short-term obligations it can't pay with its cash flows.

The potential reason for the market's concern is capital expenditures ("capex"). The only expense the company can't service with Uniform cash flows alone is maintenance capex, which is the most flexible type of expense on its schedule.

If ConocoPhillips doesn't reduce capex spending for a few years, the business will be in trouble. But the reality is that the company has already declared that it's reducing capex. This shows that ConocoPhillips has flexibility to manage this slowdown.

Considering how much buffer ConocoPhillips has over its important obligations, current valuations appear far too low.

Not only is the company's likelihood for bankruptcy low... but as the market begins to calm, COP shares could see upside ahead.

Regards,

Rob Spivey

April 16, 2020

A key part of American society that's mandated in the Constitution has come under pressure with the coronavirus pandemic...

A key part of American society that's mandated in the Constitution has come under pressure with the coronavirus pandemic...