Former New Jersey Governor Chris Christie is raking in thousands of dollars per year from mouthwash...

Former New Jersey Governor Chris Christie is raking in thousands of dollars per year from mouthwash...

Most investors are familiar with the mechanics of dividends and stock-price appreciation. But there's another cash stream that the world has all but forgotten about – royalties.

Royalties give investors a recurring payment stream that's tied directly to a company's ability to sell a certain product. While they used to be a common form of investment, royalties are almost extinct in today's investing landscape.

One of the last examples comes from Listerine.

The mouthwash brand pays out upwards of $24 million in royalties each year to colleges... nonprofits... churches... and yes, even individuals like Chris Christie. This is due to an agreement that was signed in the 19th century.

Dr. Joseph Joshua Lawrence created Listerine in the 1860s as an antiseptic. But the product wasn't very popular. So when a pharmacist offered to buy the formula from him 20 years later, he agreed.

But Lawrence made sure to secure future payments – not only for himself, but for his children and grandchildren – in case his creation took off. The royalty deal stated that for every 144 bottles of Listerine sold, he'd get $6.

That meant Lawrence and his heirs got a portion of Listerine sales without having to do any work. And he could sell the rights to interested parties.

This was already a great deal. But it gets better...

The kicker is that the agreement was signed in perpetuity. As long as Listerine remains on store shelves, someone will be receiving royalty payments.

When Lawrence died, the rights to the royalties were split among his children. These rights were then passed down to further generations or sold to opportunistic investors.

These days, investors who want a slice of the pie will have to dig deep – a royalty interest recently sold for $1.8 million. More than 140 years after the initial agreement was penned, people are still lining up to bid on Listerine royalties.

But at first glance, it looks like Listerine's parent company Johnson & Johnson (JNJ) leaves plenty to be desired...

But at first glance, it looks like Listerine's parent company Johnson & Johnson (JNJ) leaves plenty to be desired...

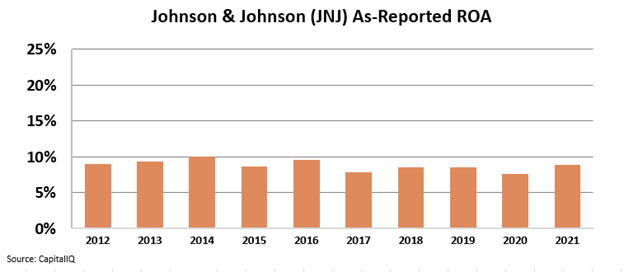

As-reported financials show that over the past 10 years, the company's return on assets ("ROA") hovered in a pedestrian range of 8% to 10%. Compared to the corporate average of 12%, it looks like Johnson & Johnson has been missing the mark.

Johnson & Johnson counts everything from Tylenol to Splenda among its brands. You'd hope that such a successful company would be more efficient.

But at Altimetry, we know better than to jump to conclusions. As-reported generally accepted accounting principles ("GAAP") metrics are full of inconsistencies. They offer little help to investors at face value.

Uniform Accounting shows us exactly why Johnson & Johnson remains a force in the pharmaceuticals sector...

Uniform Accounting shows us exactly why Johnson & Johnson remains a force in the pharmaceuticals sector...

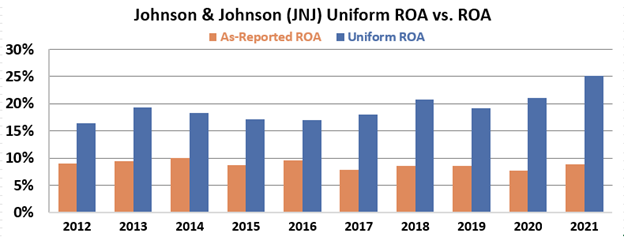

Once we make the necessary adjustments to the company's financials and remove GAAP discrepancies, the true story becomes clear.

It turns out, Johnson & Johnson is a very efficient company. In the past 12 years, the company has consistently posted returns of at least 16% – comfortably beating the corporate average.

And not only that, but its returns are rising. Johnson & Johnson is getting even better at what it does. Take a look...

Johnson & Johnson might be paying out millions of dollars in Listerine royalties every year, but that clearly isn't slowing the company down.

Despite what as-reported figures suggest, its true earnings have reached an all-time high. The future certainly looks bright for this consumer-staples giant.

Regards,

Joel Litman

August 17, 2022

Former New Jersey Governor Chris Christie is raking in thousands of dollars per year from mouthwash...

Former New Jersey Governor Chris Christie is raking in thousands of dollars per year from mouthwash...