Until recently, data-analytics leader Palantir Technologies (PLTR) was untouchable...

Until recently, data-analytics leader Palantir Technologies (PLTR) was untouchable...

In the words of CEO Alex Karp, the company was "on fire." And much of that stemmed from its AI innovations...

The company builds large language models ("LLMs") that quickly and accurately interpret data. These tools help Palantir and its clients carry out advanced analysis and decision-making.

Fueled by this AI technology, the company posted extremely strong first-quarter results on May 5... Its revenue soared year over year ("YOY"), and its net income doubled.

Yet Palantir's stock plunged 12% the very next day. Analysts pointed to a sharp drop in international commercial revenue. Yet the more important issue is the steep valuation...

You see, the stock's recent fall is actually a small dip... Palantir is up nearly 500% over the past year.

At a certain point, even AI darlings get too expensive for their own good, making it hard to attract investors. And that's the case with Palantir today.

We'll break down why the company's sky-high valuation leaves no room for error... and why that could spell trouble for investors.

Growth headlines can't mask the company's deeper issues...

Growth headlines can't mask the company's deeper issues...

Palantir's overall revenue increased 39% YOY. But its international revenue fell 5%. The company blamed headwinds in Europe, saying that the region "doesn't quite get AI."

Palantir's LLMs help law enforcement investigate cybercrimes and biomedical clients analyze their data more efficiently. But the international market hasn't embraced this pioneering work.

The company also depends heavily on U.S. government contracts, particularly with the Department of Defense. So if budgets tighten, the company's future growth could take a hit.

For the time being, Palantir is a solid company... Its Uniform return on assets ("ROA") was 52% in 2021 – more than four times the corporate average (12%).

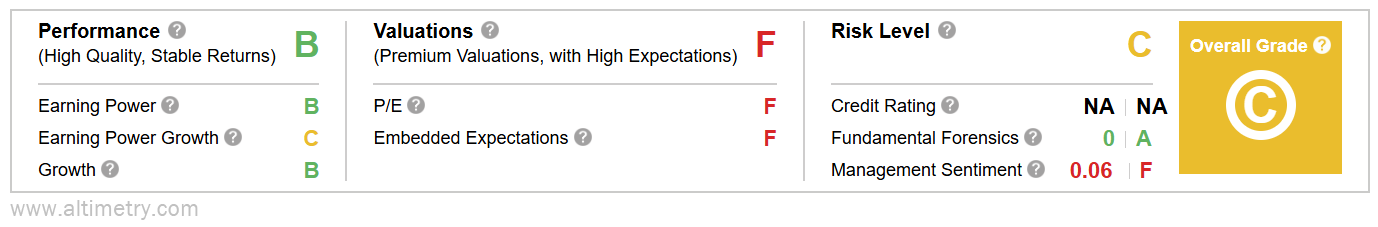

It fell to 20% in 2024, which is still decent. That earns it a "B" for Performance in the Altimeter.

The real concern is Palantir's astonishing valuation...

The real concern is Palantir's astonishing valuation...

The company's Uniform price-to-earnings (P/E) ratio jumped from 42 times in 2023 to a staggering 272 times in 2024. It's now an eye-popping 369 times.

The market average is roughly 20 times. So before PLTR took off last year, it was already twice as expensive as the average stock.

Now it's one of the most expensive companies in the S&P 500 Index. That's why Palantir gets an "F" for Valuations. Take a look...

To justify its valuation, Palantir would need to generate $14 billion in corporate earnings. That's unlikely, as only 24 public companies succeed in doing that today.

Palantir's stock price suggests that any slipup poses a major risk for investors...

Palantir's stock price suggests that any slipup poses a major risk for investors...

Despite its AI innovations, Palantir is vulnerable to patchy international traction and government spending cycles.

And right now, market expectations don't reflect reality... Palantir's core business remains solid. But its sky-high valuation signals mounting pressure.

This is creating a fragile setup. Investors aren't pricing in any market turbulence despite serious risks... Palantir's global business is weakening, and budget uncertainty looms large.

Until the company stabilizes and grows into its premium, there's no margin for error. That means investors should steer clear of the company for now.

Regards,

Rob Spivey

May 21, 2025

P.S. Frankly, a lot of tech stocks are overvalued right now.

That's why, today at 10 a.m. Eastern time, tens of thousands of people are tuning into one of the most original livestreams in the history of our industry.

After the worst sell-off since 2020, a new AI super chip 50 times faster than Nvidia's could soon transform the AI sector. It could create millionaires if you have the courage to buy NOW... beginning with just five little-known AI stocks. (They're all gushing cash right now.)

This story all centers around a tiny California company...

And our friend Jeff Brown – a Silicon Valley legend – predicts that this stock could generate 10 times your money if you position yourself well. I wouldn't bet against him... During his career, Jeff has secured 18 tech deals with 1,000%-plus returns.

This morning, Jeff has even agreed to risk his own life demonstrating next-generation AI technology.

If you have any interest in AI, be sure to watch the full livestream here today. It will be one heck of a show. (And it includes three free recommendations.)

Until recently, data-analytics leader Palantir Technologies (PLTR) was untouchable...

Until recently, data-analytics leader Palantir Technologies (PLTR) was untouchable...