Dear reader,

I don't like buzzwords. As an investor, they signal for me that it's time to look elsewhere for ideas.

It's like the old expression about knowing it's time to sell your gold if even your cab driver is talking about buying it... when everyone is focused on something, it has likely hit its peak.

When I was teaching MBA students in late 2017, all anybody wanted to talk about was bitcoin and the blockchain. I knew it was a matter of time before bitcoin reversed.

When uninformed investors are trying to catch onto the latest fad, it's impossible to make a rational investment decision. There's just too much emotion in the market. Think about bitcoin right before Christmas 2017... after a massive-run up to nearly $20,000, the crypto crashed by roughly 45%.

Of course, what I aim to do with this e-letter is inform you, the reader, on how to think and act like a rational investor.

Today, I want to explain how a rational, well-informed investor can invest through a buzzword bubble.

Let's look at "cellular broadband." I know... it doesn't sound like a buzzword.

And that's intentional. Buzzwords aren't investible. If I said today's topic was the 5G revolution – the "fifth generation" of mobile Internet connectivity – you might have different expectations. You might be thinking about a fledgling tech company looking to make the fastest download speeds or which wireless carrier will have the best 5G coverage.

5G is a huge opportunity that will unlock a lot of value for consumers. However, since the technology is still in its infancy, it's risky to speculate on the future.

In reality, the best way to think about investing in wireless broadband is to look back in history – who were the biggest winners in 4G?

One of the biggest gainers since 4G (also known as "4G LTE") launched in 2010 is American Tower (AMT). The company owns and operates thousands of cell towers, antennas, and other telecommunication assets across the globe.

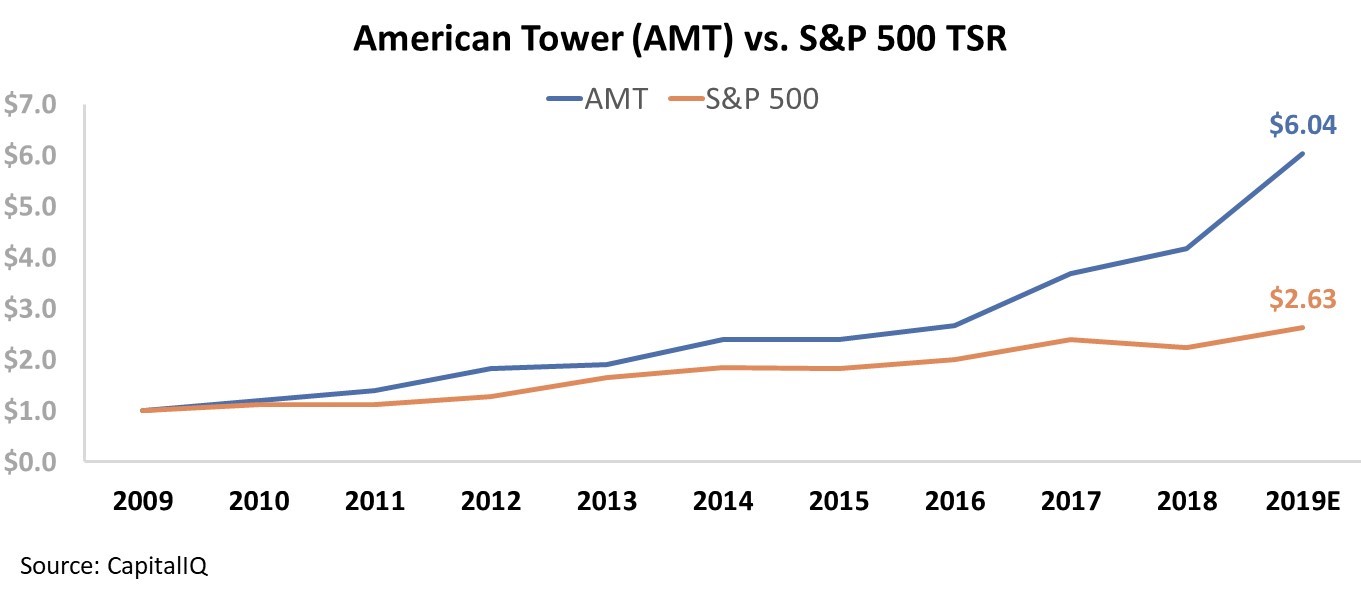

American Tower has significantly outperformed the market over the last decade thanks to the 4G boom. The chart below shows the total shareholder return – or "TSR," which is the total capital gains and dividend earnings an owner would generate by owning a company's stock – of American Tower and the S&P 500 since 2009. As you can see, American Tower's TSR has more than doubled that of the market...

American Tower rents tower space to wireless providers like Verizon Communications (VZ) and AT&T (T). With each new generation of broadband (3G, 4G, 5G), the range from any given tower gets shorter. In order to maintain the same level of coverage, wireless companies need to rent space on more towers.

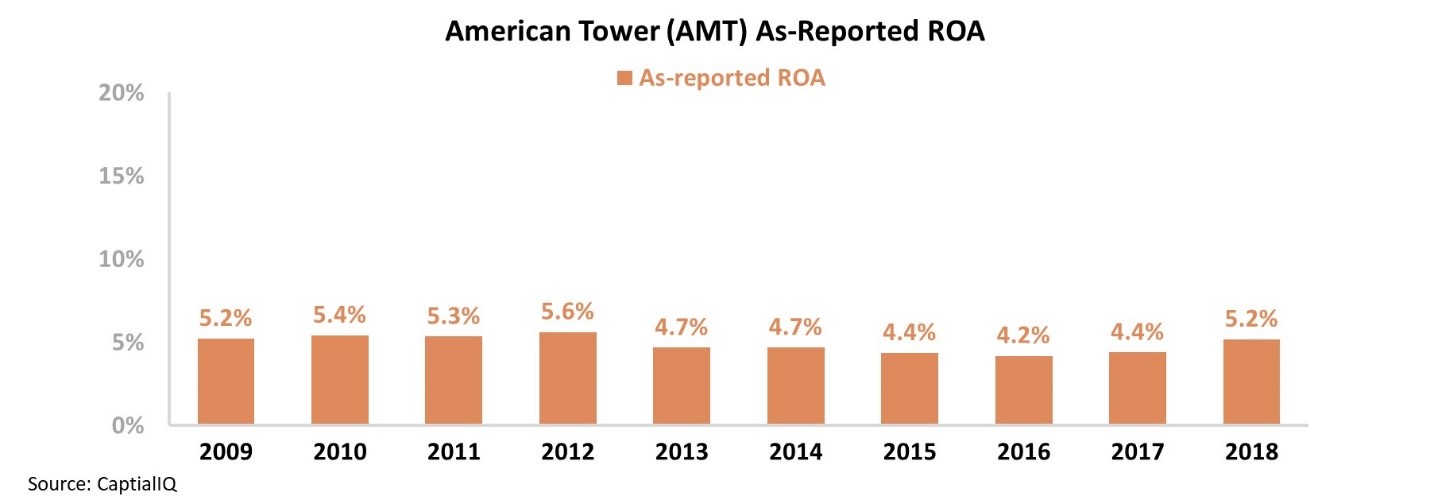

This, in turn, drives higher efficiency for American Tower. However, looking at the as-reported financial data, you might miss out on this trend... Since 4G launched in 2010, American Tower's as-reported return on assets ("ROA") looks flat, remaining in the 4% to 6% range since 2009.

This does not line up with the company's recent stock performance and valuations. With long-term average ROAs in the 6% range and no momentum over the past decade, the company's stock should really be trading at or below corporate-average valuations.

In the chart below, you can see that American Tower currently looks expensive based on its price-to-earnings ("P/E") ratio, even after we apply our Uniform Accounting metrics. The company trades for a P/E ratio around 36, well above corporate averages of a P/E ratio around 20.

However, once we apply Uniform Accounting to the company's performance metrics, we can see why investors are willing to pay for this company. When we adjust for accounting distortions – including the treatment of goodwill and operating lease capitalization versus expensing – you can see how American Tower benefitted from the massive uptick in data demand with the better coverage and faster service under 4G.

Looking at American Tower's adjusted ROA, the company has consistently improved its profitability every year since 4G launched. American Tower currently generates a 15% ROA, which is well above corporate averages. This is up from less than 10% in 2009.

With this ROA trend, market valuations start to make a lot more sense – it's clear that the market has caught on to the real winners of the wireless broadband revolution. Given the similarities between the infrastructure needed to grow 4G and 5G, American Tower looks poised to repeat what it has done over the past decade. If the company can do this, its stock will continue to justify current premium P/E ratios. A sustained high P/E ratio and earnings growth translate to stock gains.

These are the kinds of signals you might miss if you're just chasing buzzwords. The truth is, if you're waiting to hear about the latest investing craze from your relatives this holiday season, it's likely too late. Worse yet, without Uniform Accounting, you might be receiving the wrong signals altogether.

Regards,

Joel Litman

October 23, 2019