After a long stretch of corporate quiet, the dealmakers are busy again...

After a long stretch of corporate quiet, the dealmakers are busy again...

Boardrooms have stayed cautious with their deals for three years. High interest rates made it tough to justify borrowing to invest. Executives preferred to hoard cash instead.

But the tide has turned... and fast.

Since the Federal Reserve's September rate cut, the pace of dealmaking has picked up in earnest.

PNC Financial Services (PNC) announced a $4.1 billion purchase of FirstBank on September 8 – before the rate cut was even official. Just a month later, on October 6, Fifth Third Bancorp (FITB) announced a $10.9 billion acquisition of fellow regional bank Comerica.

Both deals are significant because they involve regional banks... a sector that typically pulls back when credit conditions are tight.

And that tells us more than you might expect about the current state of the economy...

Two midsized lenders are confident enough to pursue multibillion-dollar transactions...

Two midsized lenders are confident enough to pursue multibillion-dollar transactions...

For that to be true, it means credit risk is under control. And sentiment across the banking industry is improving.

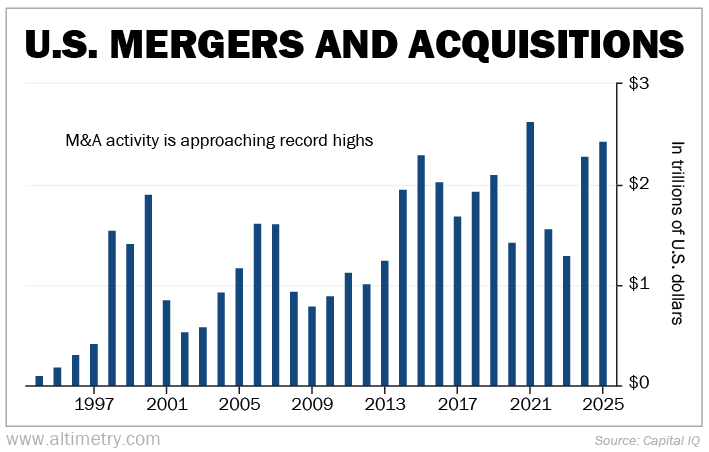

A broader flood of mergers and acquisitions (M&A) is sending a strong bullish signal to the market today. U.S. M&A has already topped $2.4 trillion this year.

That's more than all of last year. And it's within striking distance of 2021's record $2.6 trillion.

Take a look...

Deals like these don't happen in shaky economies. They happen when credit is available and financing costs are easing.

And conditions are easing even further. The Fed cut rates by another 0.25 percentage points last week. The market expects another cut this year... and two more in 2026.

With financing costs coming down at last, executives finally feel confident enough to put their balance sheets to work again.

We saw a similar pattern around 20 years ago, from 2003 through 2006...

We saw a similar pattern around 20 years ago, from 2003 through 2006...

Deal volumes spiked toward $1.6 trillion as the Fed wrapped up its early-2000s easing campaign and profits accelerated. The market surged about 66% through 2006.

It happened again starting in 2010. Mergers jumped 25% year over year as the post-financial-crisis expansion gained momentum.

And over the next five years, the market nearly doubled.

Each time, the return of dealmaking marked a transition from caution to optimism. Business leaders stopped waiting for the all-clear... and started building for the next cycle.

We consider four metrics when gauging the health of the market... credit, earnings growth, valuations, and sentiment.

Credit matters more than the other three combined. So the influx of M&A deals is a powerful signal.

Earnings are ramping up, helping rationalize today's expensive market. And credit conditions are finally easing thanks to the two recent rate cuts.

In short, credit has finally shifted from being a market stabilizer to a participant in the rally.

This change could very well lift the market in the coming months. The flood of new deals tells us it's time to be bullish.

Regards,

Rob Spivey

November 5, 2025

After a long stretch of corporate quiet, the dealmakers are busy again...

After a long stretch of corporate quiet, the dealmakers are busy again...