The quality of as-reported numbers can lead to investment decisions that are no better than investing using your horoscope...

The quality of as-reported numbers can lead to investment decisions that are no better than investing using your horoscope...

We joke about the above, so imagine our surprise when someone came up with an actual app that recommends stocks to invest in, using astrology. Move aside, Robinhood... Bull & Moon might be the next popular app... for finding stocks "whose stars align with yours."

Of course, the app is meant to be tongue-in-cheek – please don't invest using it! But just remember, when you use as-reported accounting to make your investing decisions, you might as well use your astrological sign.

I'm on my way to our Manila offices this week...

I'm on my way to our Manila offices this week...

As I prepare to travel back, it has me thinking about packing... and e-commerce.

Our folks in Manila sometimes want things they can't easily get at a good price in the Philippines. So they use Amazon (AMZN) and order things to our offices in the U.S., or to my home. I transport everything back to Manila with me when I head east.

Oftentimes I'll end up heading to Asia with two bags pushing the maximum limits. I wonder if I'm a CEO or a Sherpa.

But the ability for my team to do this is impressive. It's a testament to what Amazon has created: A culture of e-commerce.

Think back to your Amazon shopping history. When is the last time you chose to shop online? Do you order more products online today than you did five years ago?

If you're like the majority of consumers, you probably answered, "within the last month" and "yes," respectively.

There's a number of benefits to shopping online. It's 24/7 convenience. You can compare prices instantly. AND most vendors even offer fast shipping nowadays, sometimes for free.

These are the reasons why 80% of consumers make at least one online purchase a month and why e-commerce now makes up more than 10% of all U.S. retail sales.

Clearly, the e-commerce trend is here to stay. And it's not slowing down, either... In 2018, e-commerce retail sales reached almost $3 trillion... That's "trillion" with a "t." This is expected to reach nearly $5 trillion by 2021, or 20% annual growth.

This has huge implications for a lot of companies, including some which might be less obvious.

We can start with the $900 billion elephant in the room: Amazon. Earlier this year, the company became the largest retailer in the world, with more than 90% of sales online (the company has a few physical bookstores and it owns supermarket chain Whole Foods).

But outside of Amazon, there are plenty of other tech companies that benefit from the e-commerce boom...

Alphabet (GOOGL) – the parent company for Google, the largest advertiser in the world – has seen demand for digital advertising skyrocket alongside the online sales trend.

If you've ever looked at an item online and later saw that same item as a banner ad on a different website, you can thank Google.

Social media giant Facebook (FB) has a surprising number of e-commerce tailwinds. While also benefitting from rising ad revenue, the company is also behind so-called "social commerce." If you're on Instagram – Facebook's photo- and video-sharing service – you might notice links to purchase products embedded directly in a post.

The lines between social networking and online shopping have never been blurrier.

But outside the world of big tech, there is yet another industry making a killing from e-commerce...

Packaging.

Whether or not you use free two-day shipping, your product is bound to arrive in the ubiquitous brown cardboard box.

And there's a good chance that cardboard box came from WestRock (WRK).

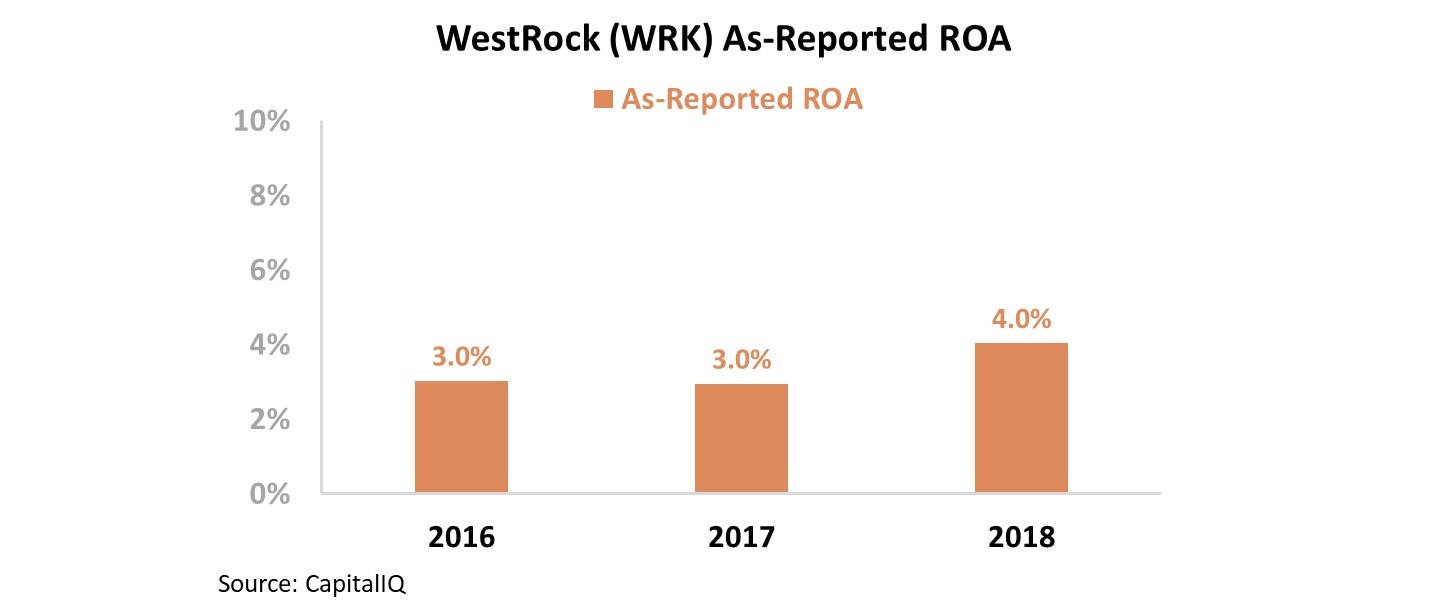

The packaging company has started seeing significant momentum as e-commerce continues to grow. This has driven its return on assets ("ROA") from 3% over the last several years to 4%. Take a look...

Not only does WestRock make cardboard boxes, but it also produces big rolls of brown paper known as "kraft paper." On top of seeing higher demand for boxes, many companies have switched from filling those cardboard boxes with Styrofoam peanuts and plastic bubble wrap to more environmentally friendly kraft paper.

But despite the two significant tailwinds, WestRock's stock has plummeted over the past few years...

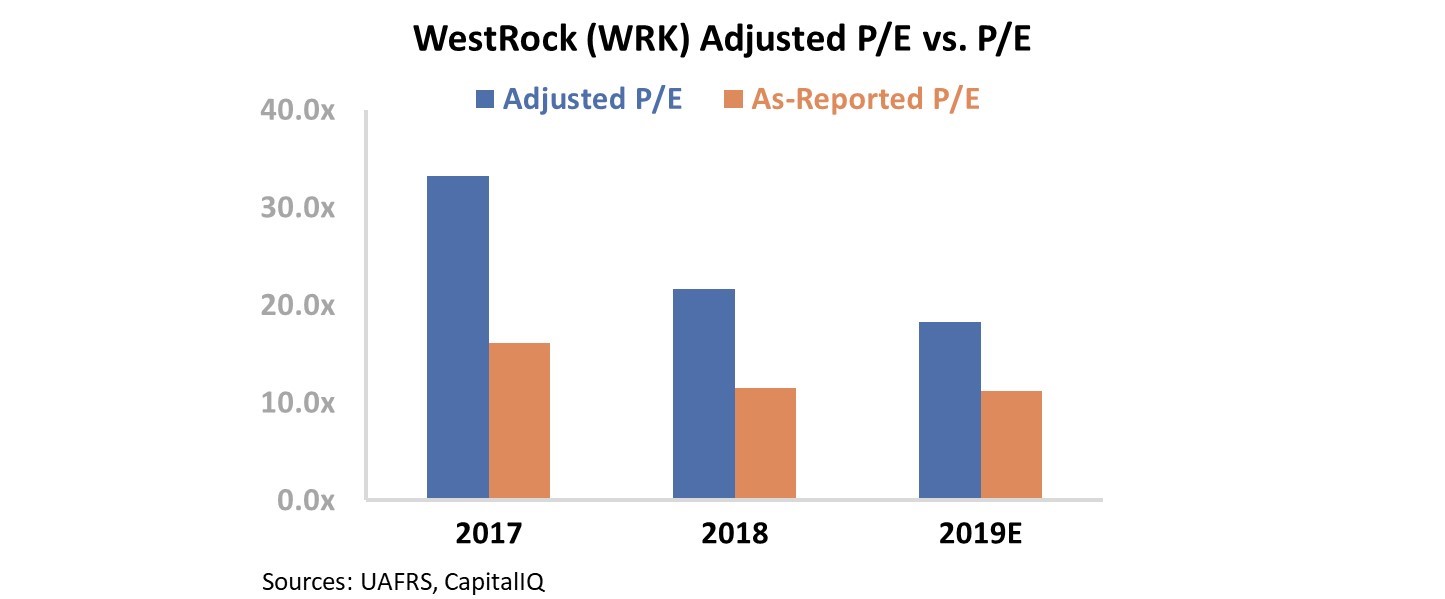

At first, this looks like a case where the market is missing something. WestRock currently trades at a price-to-earnings ("P/E") ratio of just 11, making it look incredibly cheap.

But once we make the proper adjustments to misleading as-reported financial statements, we can see that as-reported metrics are lagging reality... and the market knows.

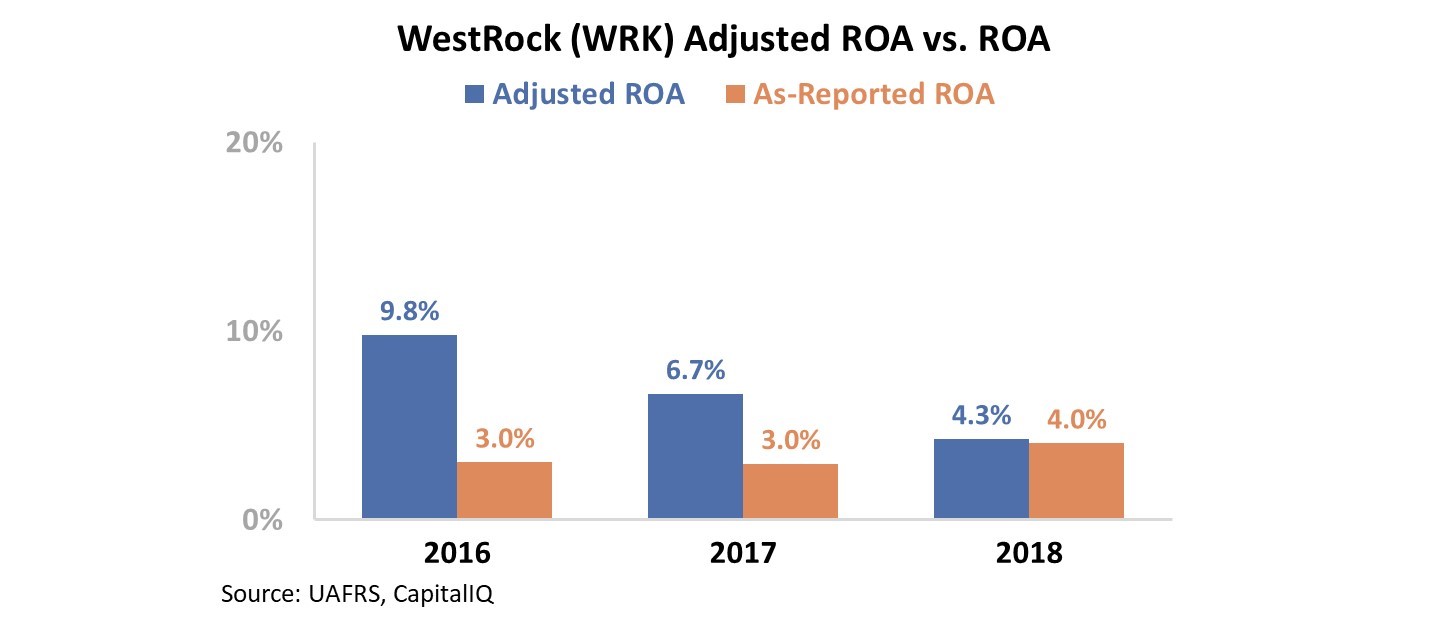

WestRock has significant distortions impacting its financial statements, including misleading treatment of items like operating leases, goodwill, and income taxes. After making the proper adjustments, it is clear that most investors are getting signals nearly two years late.

As you can see in the chart below, WestRock's real ROA was at solid 10% levels in 2016, as the company was taking advantage of growing packaging demand and cheap input prices. However, over the last two years, trade disputes with China have driven the cost of producing paper much higher. As a result, WestRock's ROA has fallen by more than half...

Furthermore, at current stock prices, the company is not as cheap as traditional accounting metrics would have you believe. In reality, WestRock is still trading at a P/E ratio of 18, which is near market averages.

WestRock did indeed benefit from the e-commerce revolution two years ago... But it hasn't been able to sustain the benefits from that wave.

When looking at the numbers using Uniform Accounting, it would have been possible to take advantage of the relationship between e-commerce and shipping in real-time, instead of getting stale signals just when things are turning in the opposite direction.

Regards,

Joel Litman

November 21, 2019

The quality of as-reported numbers can lead to investment decisions that are no better than investing using your horoscope...

The quality of as-reported numbers can lead to investment decisions that are no better than investing using your horoscope...