Some folks say Americans don't know how to vacation...

Some folks say Americans don't know how to vacation...

Around the world, the U.S. is known for its "workaholic" mindset. It has garnered our labor force plenty of international criticism. And the pandemic made things even worse.

As we've written previously, "Parkinson's Law" was in full effect when the world shut down. That's the theory that "Work expands so as to fill the time available for its completion."

So when work-from-home became the norm, corporate America no longer just filled the hours of 9 to 5. The line between office life and home life blurred. Our work time expanded to fill all waking hours.

Sadly, while the world is opening back up, we haven't made much progress in fixing this overlap. Since the pandemic started, it has become easier than ever to work from anywhere.

Remote work is great for flexibility and autonomy. But U.S. employees have found themselves working more, even on their vacations.

In a recent study by Glassdoor, 54% of surveyed professionals admitted they never feel like they can truly "unplug."

In response, many companies are getting serious about taking time to recharge...

Some employers are even mandating vacations in the name of employee morale and efficiency.

Goldman Sachs (GS), notorious for its tough working conditions, now requires employees to take 15 days off per year. Five of those days need to be in a row.

And in May, accounting company PricewaterhouseCoopers announced the whole company would shut down for two separate weeks – once in July and once in December.

With increasing time off comes the need for proper management...

With increasing time off comes the need for proper management...

Because investing in your employees is becoming more and more important, businesses that facilitate this are in high demand.

Workday (WDAY) is one such company. It provides solutions and platforms for companies to manage human resources, spending, and finances.

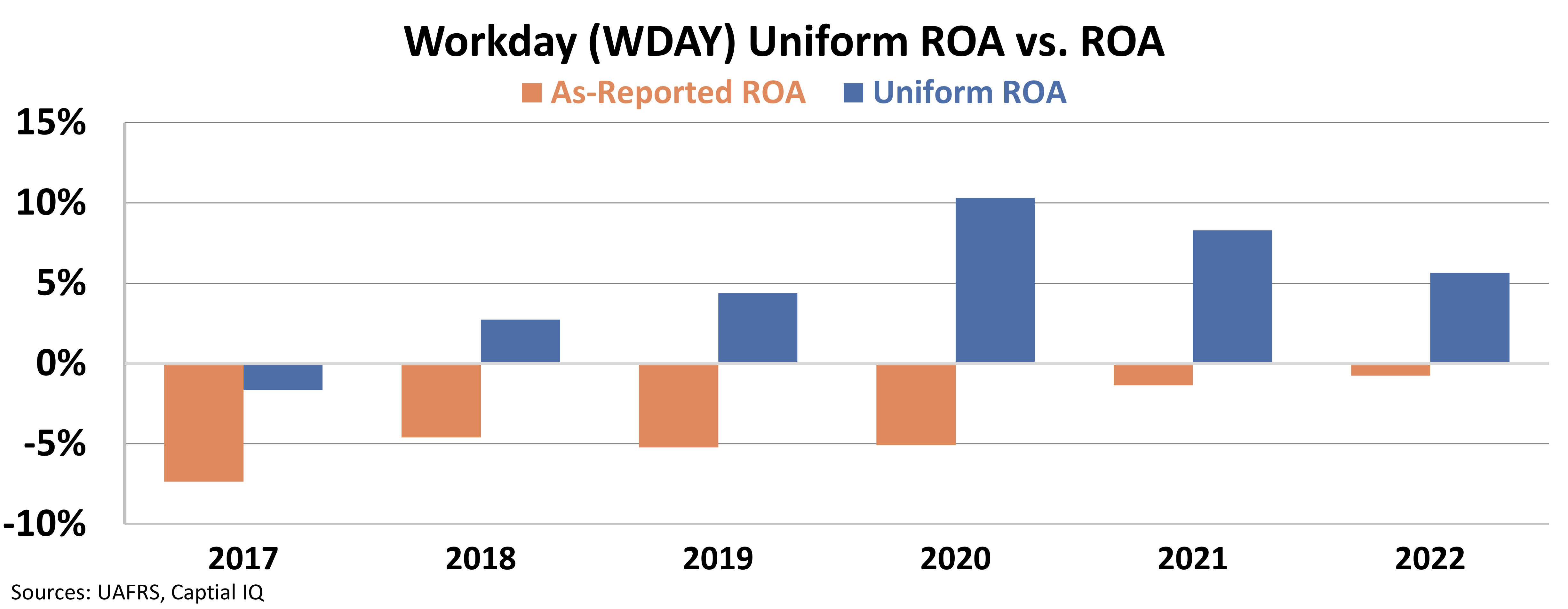

Wall Street would have you believe that Workday has never made money. Since its initial public offering in 2012, the company's as-reported return on assets ("ROA") has been consistently negative.

Take a look...

But Uniform Accounting clears up all these distortions. Workday's ROA actually went positive in 2018, hitting 3%. That number peaked at 10% in 2020.

It turns out that Workday is a more profitable business than the market thinks...

It turns out that Workday is a more profitable business than the market thinks...

But that doesn't mean it's a good buy today.

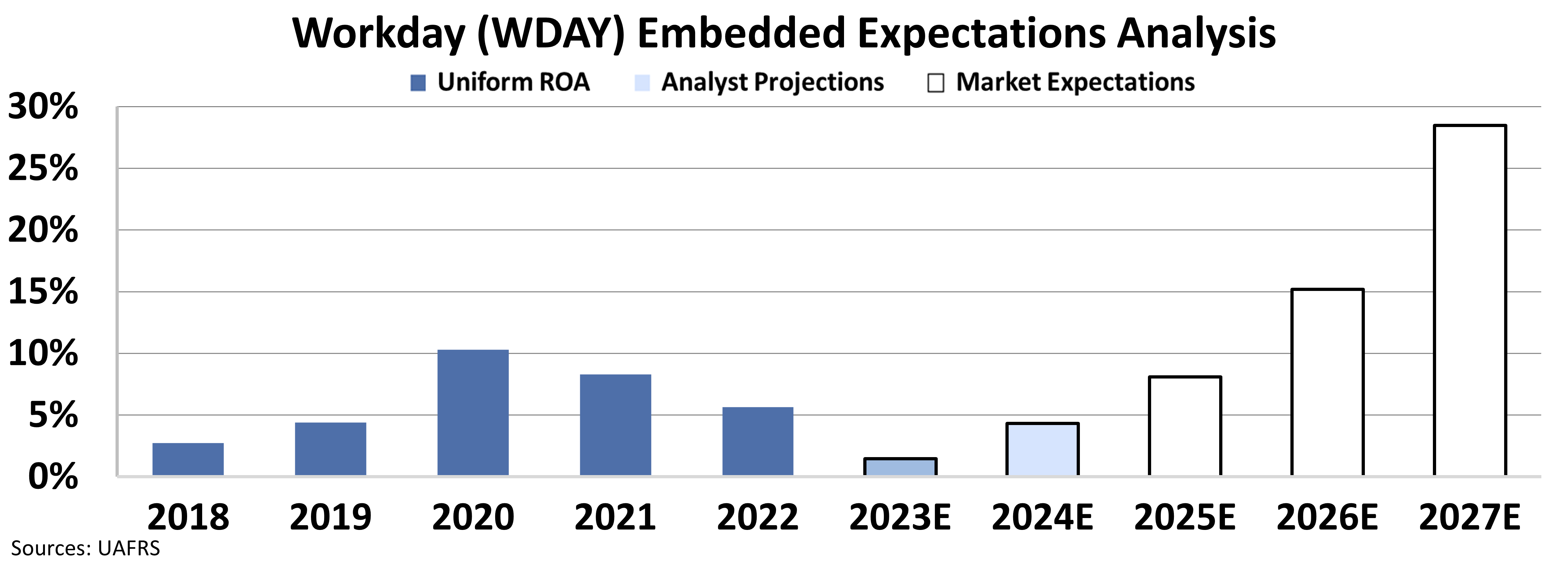

As we mentioned, investors know that companies are using Workday to help manage their employees. To understand how the market is valuing Workday, we need to look at our Embedded Expectations Analysis ("EEA") framework.

The market traditionally uses a discounted cash flow ("DCF") valuation model. DCF models take assumptions about future performance to calculate what a company's stock should be worth.

EEA, on the other hand, starts with a stock's current stock price... so we understand what the market is currently expecting. Then, we can assess whether investors are acting irrationally.

Here's how it looks for Workday...

The market is already pricing in a huge change for Workday's returns. Investors seem to understand that the company's services are in high demand.

At current stock prices, the market thinks Workday's Uniform ROA will climb to 28% by 2027. But in its best year so far, it has returned 10%.

Workday is in a great place to help other businesses manage their employees as they take more time for themselves. The market already seems to understand its potential, though.

In fact, investors predict the best-case scenario for this company. Few businesses actually generate consistent 28% returns... so Workday might struggle to meet expectations.

There's a difference between a good company and a good stock. While Workday has higher returns than as-reported metrics suggest, investors may be getting ahead of themselves.

Regards,

Rob Spivey

September 1, 2022

Some folks say Americans don't know how to vacation...

Some folks say Americans don't know how to vacation...