Alternative assets aren't so alternative anymore...

Alternative assets aren't so alternative anymore...

Pensions and endowments have been looking to break into the world's alternative assets for a long time. You can get a diverse stock portfolio by adding asset classes like private equity and real estate. And this helps big investment shops reduce correlations in their portfolios.

Alternative investment firms like Blackstone (BX) and KKR (KKR) have offered massive returns to investors. Managed funds have historically sought alternative assets to build more financial firepower.

This worked great for a while, but as more funds have flooded into these alternative investments, this strategy has become more mainstream.

Blackstone alone has more than $880 billion assets under management ("AUM"). To keep putting money to work, the investment firm must pursue less attractive investments, which are dragging down total returns closer to market averages. With so much money in the space, it's tough to find competitive deals.

In fact, one in three private equity deals were classified as a tech investment in 2021. With all the big shops going for the same investments and industries, it's hard to find a good deal that isn't overpriced...

But a small subset of private equity firms are trying to show they are more diversified by finding small corners of the market where the big guys can't play.

These firms avoid getting tied down with the more asset-intensive side of what much private equity has done, such as focusing on sectors like real estate, and they narrow in on niches like infrastructure.

Let's look at one company focusing on those smaller corners of the market...

Let's look at one company focusing on those smaller corners of the market...

One business that has seen success with this focus on under-analyzed industries is StepStone (STEP).

StepStone is a global private markets firm with portfolios across private equity, private debt, real estate, and infrastructure.

It's much smaller than shops like Blackstone, but that doesn't mean it's doing any worse.

We can use The Altimeter, which shows users easily digestible grades to rank stocks on their real financials, to see how StepStone is performing.

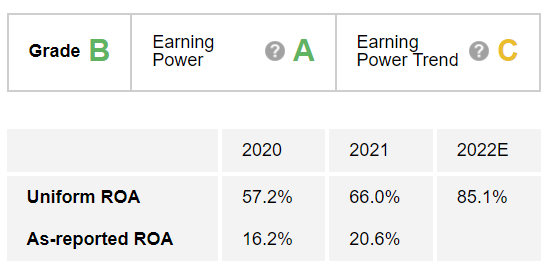

The Altimeter shows us that as-reported metrics make it appear StepStone only saw a 16% return on assets ("ROA") in 2020 and a 21% ROA in 2021.

These aren't bad returns, being slightly above corporate averages and better than the long-term stock returns. On the surface, it looks like the type of returns that you would get from any alternative asset class.

But Uniform Accounting tells us it generated a 57% ROA in 2020 and a 66% ROA in 2021. That number is forecast to rise even higher, jumping to 85% in 2022.

While the largest shops are struggling to find ways to be competitive, StepStone seems only to be going up since it can discover strong investments in those smallest corners of the market.

Because of its robust ROA, it earns an "A" for Earnings Power.

Earnings Power Trend tells us the ability of StepStone to grow its earnings year over year. While returns are growing, the returns aren't fast enough to earn a grade better than a "C" grade.

Even though its Earnings Power Trend isn't as impressive, it still earns an overall Performance grade of a "B."

While the big shops are struggling to find competitive deals and investments, StepStone is using its smaller size as an advantage to find those smaller corners of the market.

StepStone sees huge returns by focusing on specialist niches and being more asset-light than the big names.

Often, it's by going against popular sentiment where the best returns can be found. Sometimes it's looking at signals or trends that the market hasn't realized or kept up with...

And in this case, the market hasn't understood the "true" power of the returns that StepStone is generating...

Whatever story is known about a company will already be priced into its stock valuation...

Whatever story is known about a company will already be priced into its stock valuation...

If you can identify that change before the market does and value the magnitude of that change in the company's fortunes, you can be in line for significant gains.

Just like StepStone has been reaping strong gains from untapped niche industries, we discovered a niche market sector with a 96% win-rate in a recent backtest.

It's a niche market with just a few big players. And according to our backtest, the average gain among companies in this niche was 759%.

And here's where it gets interesting... One of these stocks is poised to skyrocket ahead of the rest at any moment – it could mean potentially 20x profits if you act soon.

Get all the details before it's too late in my recent presentation.

Watch it right here.

Regards,

Rob Spivey

March 17, 2022

Alternative assets aren't so alternative anymore...

Alternative assets aren't so alternative anymore...