Venture capital ('VC') is following the footsteps of the 'Your Home, Your Castle' movement...

Venture capital ('VC') is following the footsteps of the 'Your Home, Your Castle' movement...

Market-research firm CB Insights just released its State of Consumer Products Q1 2020 report, which shows VC investment trends for the quarter.

Unsurprisingly, VC dollars are heading towards areas like fitness technology, gaming, and esports – things people can do at home.

VC companies are seeing the same trend that we discussed in this month's edition of our Altimetry's Hidden Alpha newsletter... People are spending more time at home.

The coronavirus crisis has energized the trend of people investing in their homes, and this is likely to continue to stay strong long after the pandemic recedes. This includes investing so you can work from home, play at home, and supply yourself at home.

VC companies are voting with their wallets that these trends are going to remain strong.

To find out more about the companies that are likely to be the big winners from these trends – and gain instant access to the seven recommendations from our Your Home, Your Castle theme – subscribe to Hidden Alpha right here.

The importance of the value of education continues to grow...

The importance of the value of education continues to grow...

It's particularly important when it comes to social mobility. There's a strong link between quality of education and career outcomes.

Even for people who grew up with tougher circumstances, those who take education seriously and are able to apply their experiences typically end up benefiting from it.

It's no coincidence that higher education is growing more in demand each school year...

Even at the undergraduate level, the level of competition for getting into a top-tier program is nearly unbelievable.

You essentially need perfect grades, perfect test scores, and a five page CV of extracurriculars to be considered "average" at one of the top 50 schools in the country.

It doesn't get any easier after that either – we teach at several MBA programs around the country, and it's clear the competition for access across the board is increasing.

We're not the only ones seeing this... The best companies around the world have giant recruiting programs to cater to these programs.

While the top-tier, Ivy League schools are still considered "target" schools, we've seen an uptick in non-Ivy schools being targeted by the big investment banks and consulting firms... including schools like my alma mater Northeastern University – where we've also recruited several Altimetry employees – through its high-quality co-op program.

However, the crazy demand and competition for education doesn't mean the "market" is fully efficient.

You see, with increasing demand for higher ed, tuition costs have gone through the roof. Not everybody can afford a "name brand" program, even if they deserve to be there.

Some great students turn to community colleges, but recruiters for top firms don't seem to care.

That said, community college graduates aren't completely ignored. Some companies have started recognizing that there's great talent out there, but they just have to go find it.

As an added benefit, these students really are "undervalued" – they can have equal or greater potential to students from higher-ranked programs. But their ego and expectations aren't in quite the same rarified air.

One firm that has made it a mission to target students from community colleges is Paychex (PAYX). The company provides external payroll and HR solutions for small and medium-sized businesses.

Its philosophy has always been to hire hard-working, high-potential students, specifically from community colleges around the country. It's a much less crowded recruiting field, and it's a great place to find undervalued talent.

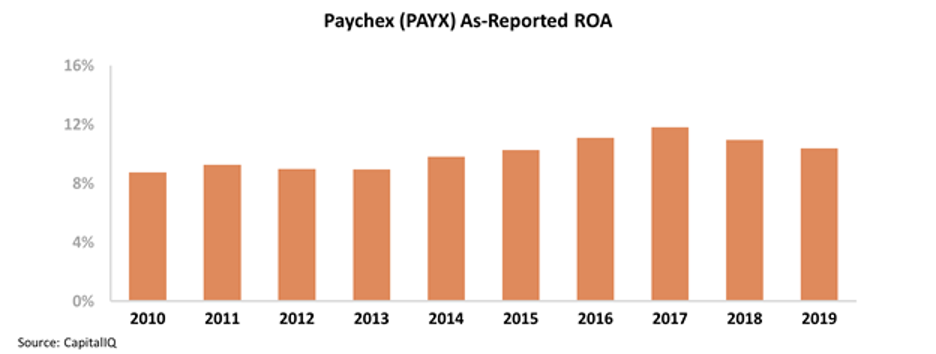

Looking at the company's financial performance, it's difficult to tell whether its unorthodox recruiting strategy of being a "value buyer" has worked.

Over the past decade, Paychex's as-reported return on assets ("ROA") has improved marginally, from 9% to a high of 12% in 2017. That's above corporate averages, but not by much.

With profitability like this, it's easy to wonder if a completely different recruiting strategy could lead to returns more like those of consulting firms and investment banks.

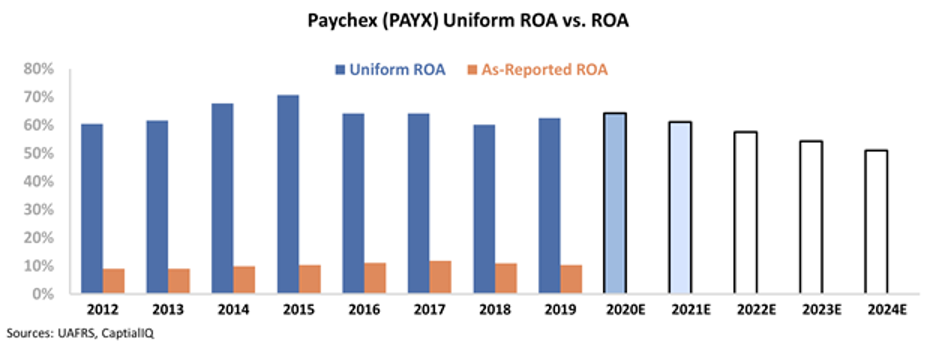

However, when we look at the Uniform Accounting metrics, we can see that Paychex already has returns in line with these businesses... but the market doesn't seem to see it. It's as underappreciated as some of the high-quality employees it has recruited.

Once we remove distortions that confuse traditional accounting statements – such as the impact of goodwill, excess cash, and non-cash stock option expenses – we can see that Paychex is a massively profitable business partly supported by its fleet of valuable employees.

The chart below highlights Paychex's historical profitability trends in terms of Uniform ROA (dark blue bars) compared to analyst estimates for the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, Paychex has maintained a massive 60%-plus Uniform ROA since 2012.

That said, the market doesn't seem to understand just how profitable Paychex is. Currently, expectations are for Uniform ROA to fade to 51% by 2024, which is lower than the company's post-recession profitability.

At these levels, investors are discounting Paychex's performance, much like most recruiters discounted the company's workforce.

All it takes is a slight shift in mindset to recognize that this company has a lot of undervalued assets that are due for some recognition, as well as upside potential ahead for its stock.

Regards,

Rob Spivey

May 27, 2020

Venture capital ('VC') is following the footsteps of the 'Your Home, Your Castle' movement...

Venture capital ('VC') is following the footsteps of the 'Your Home, Your Castle' movement...