I'm writing to you this week from Belgium...

I'm writing to you this week from Belgium...

Brussels, the country's capital, hosts the offices for most European Union ("EU") organizations. The city also shares the European Parliament with Strasbourg, France. It's the de facto headquarters and capital of the EU, even though it isn't officially named one.

Before I get to investing thoughts, I have to say that all the clichés about Belgian food are incredibly accurate and amazing.

Of course, I'm referring to Belgian beer, Belgian chocolate, Belgian waffles, and Belgian fries. All of which, unfortunately, I have probably overindulged in on this trip.

I say Belgian fries because it's been made clear that French fries are Belgian in origin, at least according to Belgian waiters.

As the story goes, American GIs snacked on these amazing treats during World War I when they arrived in Belgium. Because the Belgians they ordered from were speaking French, the Americans assumed they were French, and the fries were, too.

I wonder if the GIs had been just a bit further north in the Flanders area, would the world now call them "Dutch fries"?

Right now, Brussels is busy with a serious Russia-Ukraine crisis...

Right now, Brussels is busy with a serious Russia-Ukraine crisis...

With Russia's war on Ukraine, you can see a lot of activity here in Brussels. We're seeing lots of interviews and images on television and the Internet of European diplomats discussing the largest war in Europe since World War II. Many of those conversations are happening right here in this city.

Even in the hotel where I'm staying, I'm constantly aware of the NATO officials flowing in and out of meetings on the crisis. They even requested that the hotel's restaurant open an hour earlier than usual each morning to accommodate them before the day's meetings.

Meanwhile, my phone, texts, and e-mails have been quite busy with clients and friends asking me how to react.

One wealthy friend who has been using our research for more than a decade messaged me, concerned that a major European war would spell doom for the market. And so, he was asking me how much he should sell.

He's not the only one, though. As I said, I've had endless questions from friends and even institutional clients on if they should go to cash or at least unload some stocks or do something else aggressive to stave off another leg down.

It is an understandable yet knee-jerk reaction. Along with all the rest of us, he hears nothing but bad news from the financial media's echo chamber of sensationalizing emotions.

This contributes to people often making the mistake of selling into a panic without understanding the market's patterns and actual cycles around these periods.

It may feel counterintuitive when it comes to geopolitical conflicts anywhere in the world, but the data show you should buy the market into a panic like this... You don't sell into one!

Historically, conflicts show a quick recovery when panic sell-offs occur. If you were long in a downturn, the best decision is to continue to stay long. If you had lightened up on your exposure ahead of the meltdown, then these dips are the times to buy back in, not a time to panic even more.

This isn't just a hot take now that the market is lower to make you feel better, either. The data back it up.

Data show that sell-offs driven by geopolitical events are regularly a buying opportunity...

Data show that sell-offs driven by geopolitical events are regularly a buying opportunity...

The total days required for the market to recover from a panic sell-off are amazingly short.

We talked about this last Friday. In the last few days, I saw even more data on it, though, and that's given me even more confidence in our advice.

After Pearl Harbor, the bombing of Hawaii's military bases, and the entry of the U.S. into World War II, there was a panic sell-off. After all, that time, we weren't watching a war play out half a world away, we were jumping fully into a war ourselves.

But even in that terrible situation for the U.S., the market recovered to the levels before the initial dip in just 300 days.

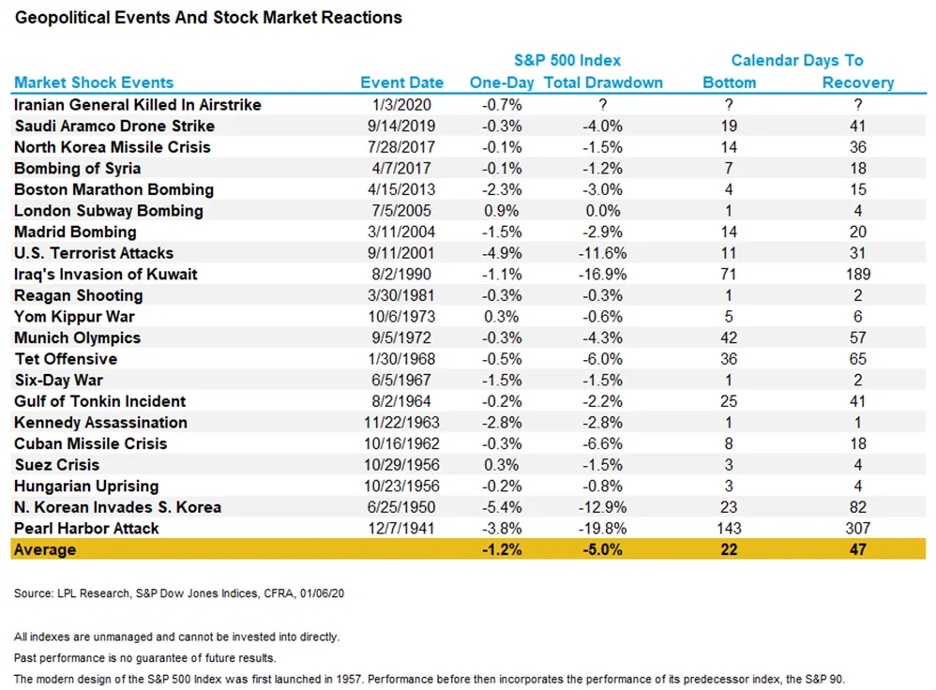

In every other major geopolitical conflict, the recovery from panic sell-off was relatively swift. It took 22 days on average for the market to bottom from the event and only took 47 days to recover fully.

I thought LPL Financial (LPLA) did a solid job of summarizing in a more granular way than the Ned Davis Research chart we showed last week. Below is a table of geopolitical events and the market's performance.

This conflict is terrible for Ukrainians for the senseless human loss and Ukrainian and Russian markets. Who knows how long that very troubling situation may continue...

But the S&P 500 Index, an index of the greatest companies in history, diversified into every sector and industry, has historically been incredibly resilient to these geopolitical situations.

History often repeats itself, and this time isn't any different...

History often repeats itself, and this time isn't any different...

Subscribers to The Altimeter get a monthly report which analyzes all of these patterns and cycles to help you understand how to position your portfolio, both in calm and stormy times.

And the one thing it tells us right now is, don't sell into a panic sell-off like this. The historic data and our current data show this is not a reason to run for the hills and go to cash. None of the data that are the bedrock of our macro analysis, like credit and earnings growth signals, give a reason for concern.

If you want to receive our monthly macro insights on how to position your portfolio and if you want to be in the know on which stocks you should be buying now and whenever there is a dip, sign up for access to The Altimeter right here.

In the meantime, seeing it from right here in Brussels, with all the activity of the EU and other world leaders surrounding the terrible situation in Ukraine, it's certainly important to put market concerns in a broader context as well.

Take a moment to have compassion and concern for Ukrainians under this military barrage. Their challenges go much further than what we see on TV. It also causes concern for the Russian people, who will experience severe economic maladies because of a war many have made clear they don't support.

As always, I wish everyone love, joy, and especially peace,

Joel

March 4, 2022